Jobs can de destroyed…and created too!

Macroeconomic News: Insights into Economic Trends and Developments

It’s Time to Make Gold Great Again!

Discover the secrets of gold to help build your wealth

Tech Roars to Life

Are Apple’s best days behind it?

Yen Rescued from the Precipice

Can the Bank of Japan stop the yen from collapsing?

I See a Boom Coming for This Aussie Asset

Ask yourself this when currencies crash

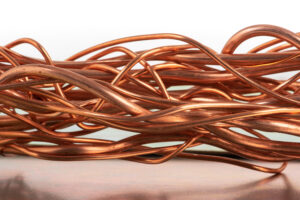

Aluminium…the Copper Grid Alternative

Base metals set to rumble in copper’s wake