LATEST VIDEO: Three Lithium Stocks in the Buy Zone

Weekly videos with expert insights on investing, economics, and finance for Australian investors. Subscribe to our YouTube channel

Three Lithium Stocks in the Buy Zone

Lithium stocks jumped this week, so Murray and Callum discuss whether this could be the beginning of the second boom in lithium stocks. They also discuss a fund manager that is recovering and looking cheap

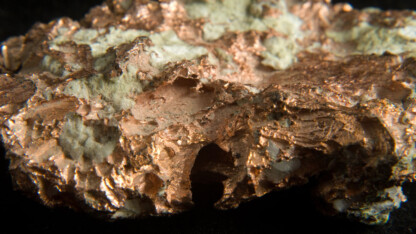

Commodities

Copper: on the precipice of a historical breakout

The only thing that matters in commodity markets right now is the price action of copper. Are you watching? And are you positioned for a potential break higher?

Investment ideas from the Edge of the Bell Curve to your inbox

Technology

Nvidia’s Comeback Signals AI’s Next Chapter

The future is here, it’s just unevenly distributed.

Investment ideas from the Edge of the Bell Curve to your inbox

Enter your email address in the box below and you’ll get Fat Tail Daily every day…absolutely free.