Australia’s first peer-to-peer online brokerage platform, SelfWealth Ltd [ASX:SWF] has been making significant waves in the fintech world over the past few months. Now in a trading halt, SelfWealth’s share price last closed at 15 cents.

The $26 million company is looking to raise $3 million through a placement priced at 14 cents a share.

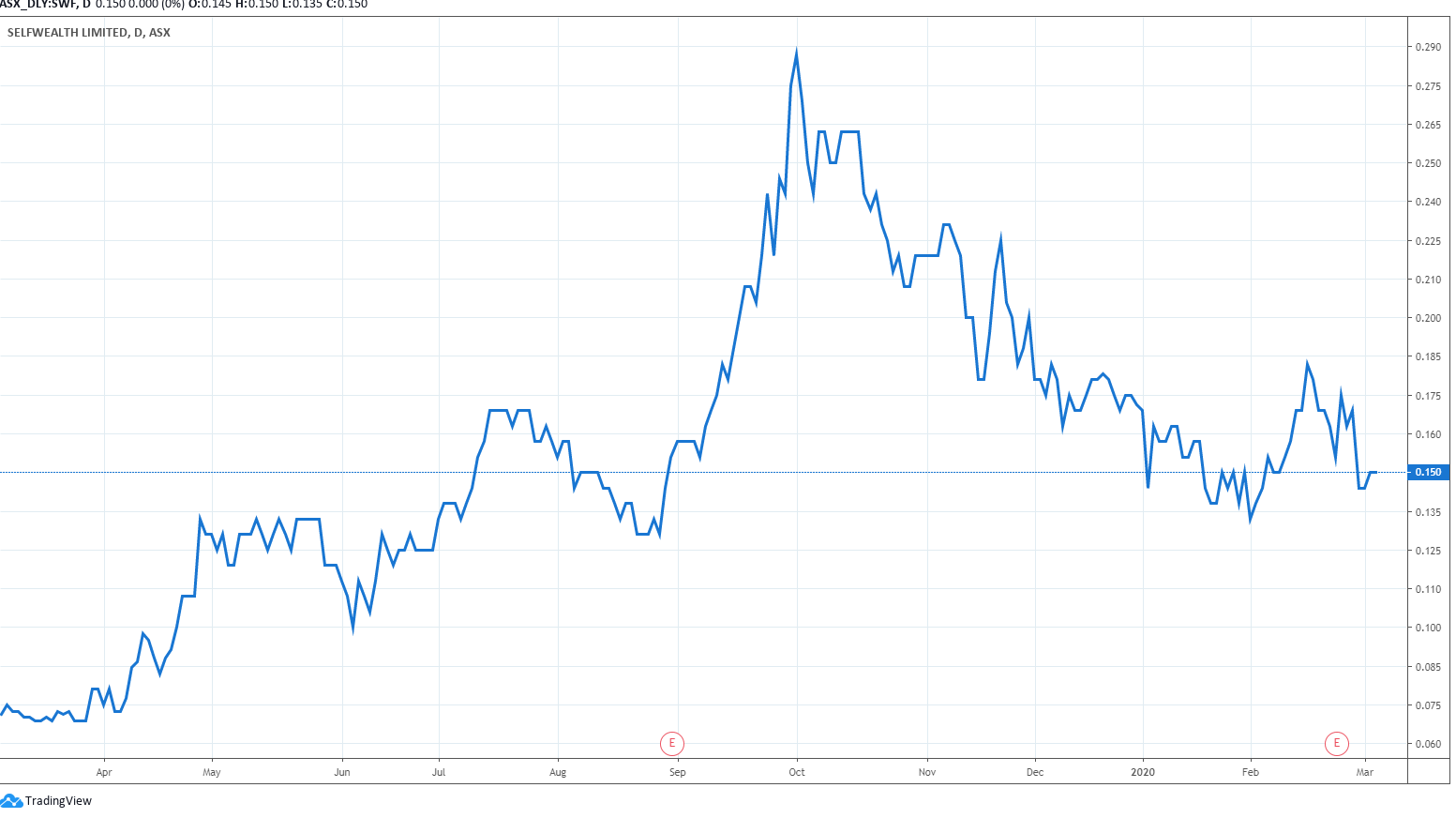

Source: Tradingview

SWF’s share price has performed strongly over the past 12 months, climbing a solid 105.48%. Though the share price has sputtered a bit since October 2019, we may see the share price lift on the back of a cap raise and today’s announcement.

Global fears not worrying SelfWealth traders

One day after entering a trading halt, SWF today announced some serious growth figures over the month of February.

The online trading platform recorded 2,581 new active traders in February, representing an 11% growth in overall active traders and a 51.3% growth in the monthly acquisition rate.

These new members join a further 26,000-plus community of active traders. Collectively, the cash balances of SWF’s traders grew to $217.22 million at the end of February, up 33.3% month-over-month.

SWF announced that the number of trades on their platform has increased 28.7% from January, totalling 42,396. Which represents approximately 1.63 trades per user.

While these figures certainly represent some positive news for SWF — and could be a telling sign of things to come for the broker market — they alone do not represent SelfWealth’s potential.

More people getting pushed into equities could benefit SelfWealth

With interest rates in the country inching ever lower, pushing more people into the Australian equities market, SWF’s pool of potential customers could grow accordingly.

Currently, there are approximately 760,000 online investors in the country with around 30,000 switching brokers annually. Though the market is still dominated by CommSec, accounting for about 50% of the market, SWF has managed to double its market share to an estimated 4%.

SelfWealth projects it will acquire 15,000-plus new active traders in year 2020. A figure representing about 25% of new and switching investors.

These strong growth trends have also cut the company’s cash burn by more than half. From FY18 June to FY19 June, SWF has cut cash burn from ~$1.75 million per quarter to ~$0.75 million per quarter.

During the same period, their number of active traders trebled, up from just under 5,000 to ~15,000.

We’ve seen this before — a small fintech carving out a niche by doing one thing well. The three fintech picks in this free report each have their own strengths — one in particular is up 25% and works in similar field to SelfWealth.

Regards,

Lachlann Tierney,

For Money Morning