New Zealand-based The a2 Milk Company Ltd [ASX:A2M] shares are among a select few that have risen during the coronavirus pandemic.

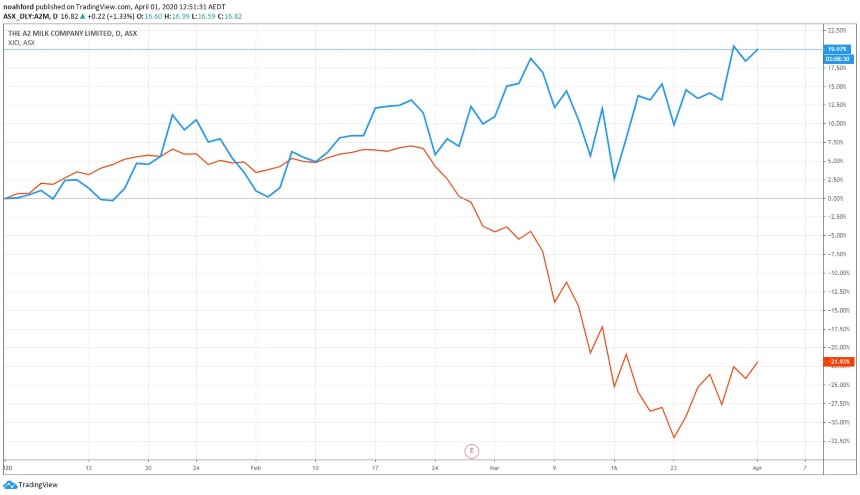

Since the beginning of the year shares in the milk producer are up nearly by 20%, while the ASX 200 has reversed 21% over the same period.

Source: Trading View

A2M has the luxury of selling what some investors consider essential consumer staples.

Which is why, I suspect, the price has held up so well under the current economic conditions.

There is an insatiable demand for baby formula from a Chinese market — so much so there are now limits on how much you can purchase at a time.

There is also appeal to defensive-minded investors, since their business is non-cyclical, A2M enjoys strong demand year-round.

But that could be about to change…

COVID-19 catching up with dairy demand, implications for the A2M share price

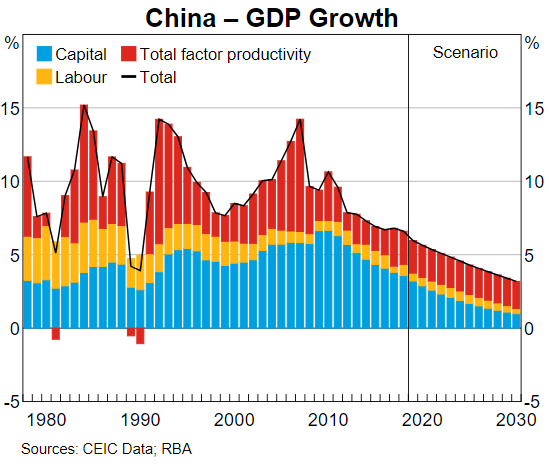

Even before this pandemic gripped the world, China’s economy was beginning to cool.

The RBA warned that exports to China could be impacted by a negative shock to growth in China.

China’s consumption growth has also slowed down.

And the RBA warns that if recent trends continue, it is possible that GDP growth could halve from current rates by 2030.

Source: RBA

We could be beginning to see come early signs of China’s economic cooling.

Today Fonterra Co-operative Group Ltd [NZE:FCG], another NZ-based dairy producer, announced milk exports in February fell 6.1% compared to last year.

FCG cited the decline was primarily driven by decreased demand for butter from Iran and for fluid milk products from China.

Where does this leave a2 Milk?

A2M recorded strong half-year financial results ending 31 December 2019.

Revenue was up a big 32%, totalling NZ$806.7 million, while earnings was up a jumped by 21%, reaching NZ$263.2 million.

By far the biggest contributor to sales revenue was infant nutrition with NZ$659.2 million, up 33%.

The company’s infant nutrition products in China saw sales double in 1H20, totalling NZ$146.7 million.

In total, China and other Asia regions segment revenue accounted for NZ$317.2 million in 1H20, easily making it the company’s largest segment.

China is obviously critical for A2M’s revenue grow and the company is no doubt monitoring the current situation closely.

The notable difference between Fonterra’s and a2 Milk’s segments in China is that Fonterra’s fluid milk is more of a luxury than a2’s infant formula.

Chinese consumers are more likely to give up milk than they are infant formula and risk the lives of their children.

A2M seems to share this sentiment too, ‘given the essential nature of our products for many Chinese families, demand is strong, particularly through online and reseller channels.’

So far, A2M has reported that revenue for the first two months of 2H20 was above expectations, but it’s difficult to tell if this is because of panic buying and stockpiling.

If a2 Milk shares begin to feel the pinch of the downturn, consider ‘The Coronavirus Portfolio’ to shield yourself from the fickle market. It’s a free download, and well worth a read. You can get that here.

Regards,

Lachlann Tierney,

For Money Morning