Market darling Afterpay Ltd [ASX:APT] continues to come under pressure with three brokers now downgrading the stock.

UBS downgraded the stock to a sell, as it believes that the Afterpay share price does not reflect the risks posed by the COVID-19 pandemic. This comes in conjunction with downgrades from both Citi and Goldman Sachs.

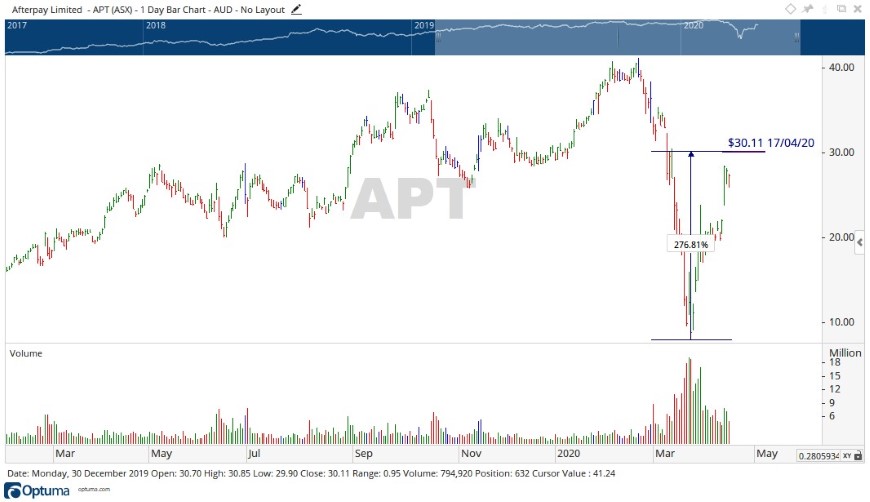

Afterpay exploded in price from its low in March, rising over 270% to $30.11 earlier today. Now though, it looks that reality is setting in for the buy now, pay later provider.

Despite tacking on an additional 9.8% today, looking at volumes, the Afterpay share price surge could be running out of steam.

Source: Optuma

COVID-19 and Afterpay

The pandemic has brought economies to a standstill and most people are now abiding by lockdown regulations. With increased time at home naturally shopping online would follow, but Australia is now into the second month of the crisis and the loss of jobs and income is in full swing.

This will heavily impact online spending as people become forced to tighten the purse strings.

Citi said this of the company:

‘While Afterpay has not seen a material deterioration in leading credit indicators, we expect bad debts to increase going forward.

‘We assume a decline in spending over the next 6 months, with an improvement later this year.’

Millennials and Afterpay

Millennials are the biggest users of Afterpay, and a very hard-hit demographic in the COVID-19 pandemic.

These are the type of people that work jobs in the gig economy.

But with flexibility, comes a lack of security.

I noticed this on a trip to the local shopping centre. When I entered the large complex to find the vast majority of retailers closed.

Outside you could find a few hopeful delivery riders looking glumly into their phones hoping for a job.

Scenes like this are now common in Australia, and it could only be a matter of time before this shows up in the figures of Afterpay’s earnings.

Regardless of how much stimulus is thrown at the problem.

Source: Optuma

Potential support levels for the Afterpay share price

Since the low in March, price has pumped up. Looking at the chart this has been on increasingly lower daily volume, indicating the run-up is losing its strength. Price is also around a historical resistance level of $28.56.

Coupling the technical analysis and the downgrading, should Afterpay fall, historical support levels of around $23, $20, and $16.29 may come into play.

If you are looking to protect your money during the ‘corona crisis’, check out this free report by our Money Morning analyst, in it he reveals a two-pronged plan to help you deal with the financial implications of COVID-19. Download your free report here.

Regards,

Carl Wittkopp,

For Money Morning