‘Virus fatigue’ is its own type of malady.

I think I speak for most when I say people are sick of the news, sick of the market turmoil, sick of isolation…sick of all the endless loops, really.

But there is a glimmer of hope now.

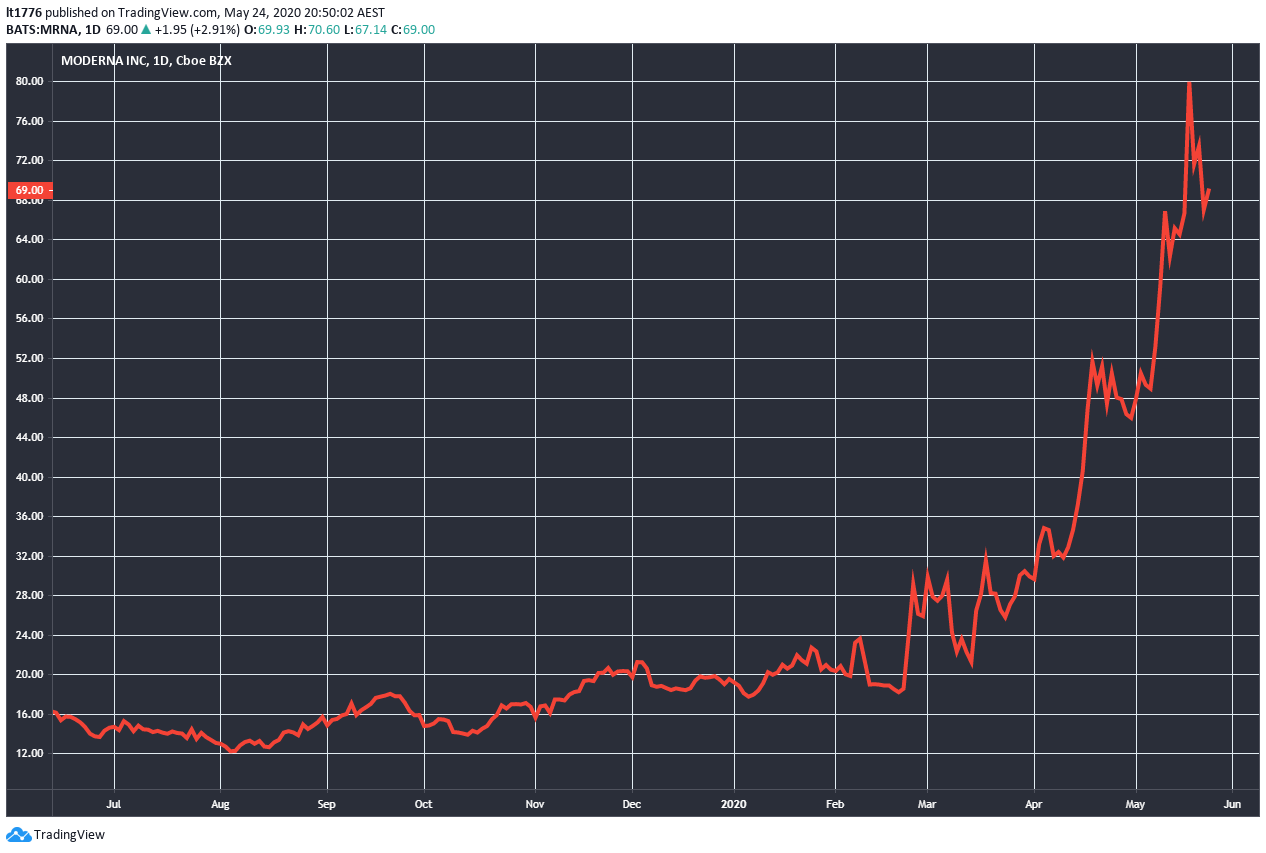

The US market rallied on Friday due to positive vaccine news from Moderna Inc [NASDAQ:MRNA], which is on a strong run up the charts despite not having a single marketable product:

|

|

|

Source: Tradingview.com |

MRNA is now a US$25 billion company and is up over 300% in a 12-month window.

It just goes to show how desperate the world is for this to end — panic buys placed on any stock that is even close to the solution.

However, today’s piece isn’t going to go into the tortured market psychology, or which flavour of the month company is winning the race to a vaccine.

Introducing the next exponential trend in finance…

No, today I want to introduce you to something you probably haven’t heard of before.

It’s called synthetic biology, or synbio for short.

And it could hold the keys to unlocking the cure to this horrible disease we call COVID-19.

Perhaps even more importantly, its emergence could be the dawn of a new era in medicine and health.

Novel drugs, extended life spans, new materials, and advancements in food.

This is a brief definition of what synbio is:

‘Synthetic biology is a new interdisciplinary area that involves the application of engineering principles to biology. It aims at the (re-)design and fabrication of biological components and systems that do not already exist in the natural world. Synthetic biology combines chemical synthesis of DNA with growing knowledge of genomics to enable researchers to quickly manufacture catalogued DNA sequences and assemble them into new genomes.’

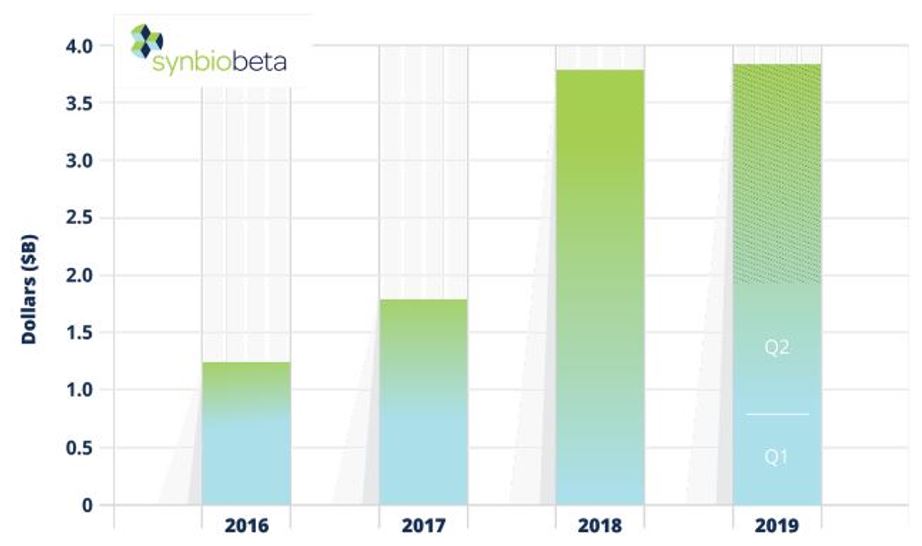

It’s a revolutionary new field that is growing rapidly.

Investment is pouring in as you can see below:

|

|

|

Source: Synbiobeta |

And the investors are the who’s who of the pharmaceutical/financial world…

Moderna is in there, but it also includes Impossible Foods Inc (fake meat company), Bayer, Novartis, Softbank, and DCVC.

ExxonMobil has even invested in a company called Synthetic Genomics Inc, to explore biofuel applications.

Synthetic Genomics also specialises in next-gen vaccines…

Which leads me to my next point.

This could be the end of pandemics

Pandemics became a feature of human life over the millennia as civilisation brought us closer to each other.

The problem is though, we are using centuries-old tools to fight these diseases.

It started in earnest with Edward Jenner’s smallpox vaccine in 1796 and accelerated with Louis Pasteur’s rabies vaccine 1885.

By the 1930s, vaccines for diphtheria, tetanus, anthrax, cholera, plague, typhoid, and tuberculosis came about.

This was followed by vaccines for measles, mumps, and rubella by the mid-20th century.

If you don’t recognise the names of some of these diseases, it’s because the treatment was so successful.

But without a COVID-19 vaccine, we are essentially fighting it with pre-historic medicine.

Largely by staying away from people.

Synbio could be crucial here.

By using computer modelling of the human genome, synbio has the potential to speed up the drug discovery process.

A programmable humanity.

Not just any computers will be set to work on humanity’s problems either.

Increasingly, AI could be behind the latest breakthroughs.

For instance, this little snippet of news from Thursday:

‘Nanome, Inc., a virtual reality (VR) startup whose signature product is a computational chemistry software platform, has co-authored a paper describing 10 potential small molecule inhibitors targeting the SARS-CoV-2 main protease that were generated by artificial intelligence (AI).’

Despite the technical language, AI-generated medicine is the punchline.

[conversion type=”in_post”]

Technology the only option

As a result, synbio stands at the intersection of some major exponential trends.

In addition to being its own exponential trend.

It sounds dangerous and could have ethical ramifications, but it looks like it is the future we will soon be living in.

Personally, I generally have a dim view of human nature.

I think the world’s problems are unlikely to be solved simply by increasing the amount of moral fibre in our daily diet of media, politics, and the like.

Technology can be a panacea here. A literal panacea.

Not because it’s the most desirable option, but because it’s the only one available.

In the coming weeks you will hear more from us on the themes discussed today. We hope you stick around.

Regards,

Lachlann Tierney,

For Money Morning

PS: We believe these rapid fire market opportunities are a fantastic way to grow your wealth. Which is why you’ll find us talking about the big trends that can uncover them. If that is something up your investment alley, then click here to learn more.