In the current climate of COVID-19, businesses like Flight Centre Travel Group Ltd [ASX:FLT] have been ravaged by the decline in global travel.

With the FLT share price trading at $10.84 at the time of writing, Flight Centre is doing all it can to protect itself in these uncertain times.

Source:Optuma

What’s happening at Flight Centre?

From mid-January 2020 Flight Centre’s share price has plummeted over 73% to its current price.

Source:Optuma

The onset of the novel COVID-19 pandemic ceased traveling and holidaying, which is nothing short of a disaster for Flight Centre, who’s business is focused on these exact areas.

We discussed in an article back in May that the company sold their Melbourne headquarters for a much-needed cash injection.

Flight Centre acted again to sure up their future by announcing recently they have secured access to a debt facility of up to £65 million, which will be drawn as and when required to help offset the coronavirus’ impacts on its United Kingdom business.

With no end in sight for the global health pandemic, the entire travel industry is looking for ways to survive.

Qantas Airways Ltd [ASX:QAN] recently completed a $1.3 billion share purchase plan offer, along with Virgin Australia Holdings Ltd [ASX:VAH] going into administration then being sold to Bain Capital.

The pain is being felt across the sector.

Where to from here for Flight Centre

Right now, in Australia the state of Victoria is in lockdown as the COVID-19 virus spreads and it is looking more likely that New South Wales will follow suit.

This posses a problem for Flight Centre and co in the travel sector, as in normal operating conditions the route between Melbourne and Sydney is the second busiest in the world.

With out people booking flights, holidays and activities companies like Flight Centre may just be in for a rocky road to travel.

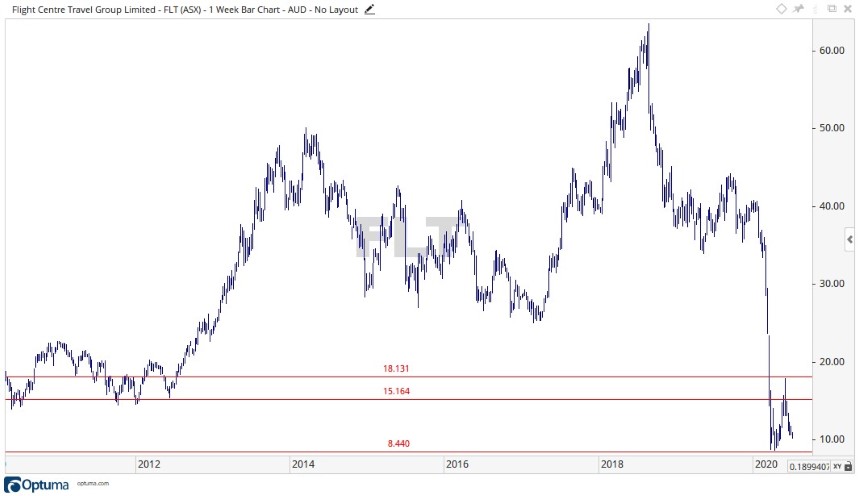

On a technical basis the price is currently at $10.84, getting down towards the $8.44 level, something not seen since February 2006 (blue rectangle).

Source:Optuma

If the price is to continue its move down, this level of $8.44 is an important one to watch.

On the upside if the price turns up, then levels of $15.16 and $18.13 may provide future resistance.

Source:Optuma

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.