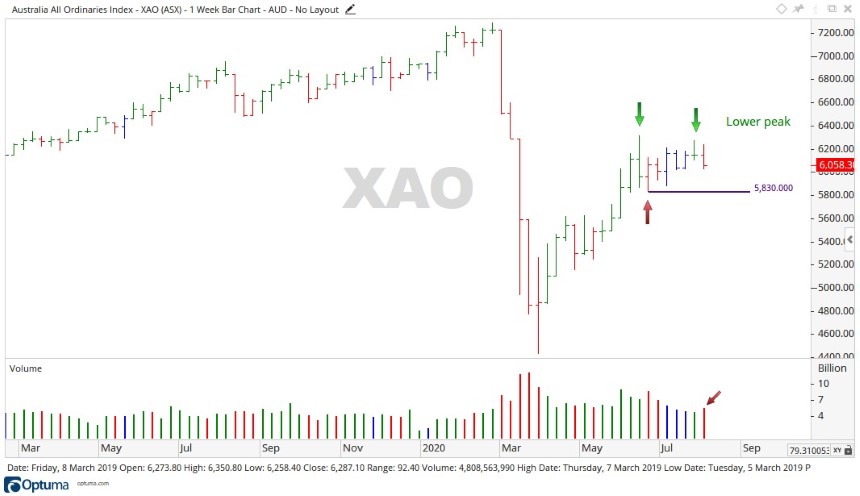

The past week, the All Ordinaries [XAO] may have blinked and given its first sign of a future direction. Opening at 6,148 points, it closed at 6,058 points — having an overall range of 218 points for the week.

After moving sideways for the last seven weeks, this may just be the first sign of things to come.

Source: Optuma

ASX outlook for the week ahead

The week ahead for the All Ords should give more of an indication on the medium-term direction of the market.

Last week recorded a lower close, with the price starting to push down after a period of indecision. I expect this week to record a further fall.

Should the price fall through the 6,018 points level, the next level to keep an eye on could be 5,853 points.

Source: Optuma

A closer look at the ASX

We saw a broad-based pullback in terms of sectors, with everything either moving down or recording a flat week.

Energy made the big movement down, of 5.39%, with Financials and Materials falling 2.68% and 2.35%, respectively.

Healthcare also pulled back 1.97%.

Looking into the stocks…

Fortescue Metals Group Ltd [ASX:FMG] gained 7.47%, while Credit Corp Group Ltd [ASX:CCP] and GWA Group Ltd [ASX:GWA] were up 11.25% and 10.89%, respectively.

On the downside, AMP Ltd [ASX:AMP] pulled back 14.32% on the back of some less than stellar profit projections.

While Alumina Ltd [ASX:AWC] and Qantas Airways Ltd [ASX:QAN] retraced 8.71% and 11.26%, respectively.

A broader outlook for the ASX

Right now, the All Ords doesn’t look too great, but in the much broader sense of global markets, it’s nothing new.

There’s nothing new under the sun, really…

Which brings me to Charles Dow (1851–1902).

Dow founded the Wall Street Journal; he invented the Dow Jones Industrial Average [DJI] along with a series of principles for understanding and analysing market behaviour which later became known as Dow theory, the groundwork for technical analysis.

A true pioneer for trading.

Dow defined the start of a downtrend as when a stock forms a lower peak than the previous peak, then proceeds to form a lower trough by breaking the low of the previous trough.

Dow also believed ‘volume matters’ — the stronger the volume the stronger the move.

With so much confusion in life and markets currently, these two simple yet powerful theories can be of enormous use to see the direction of the market.

Source: Optuma

The chart above shows these two rules playing out. A lower peak formed two weeks ago, while last week the All Ords started a push down, on higher trading volume.

While this may seem only small, it may also be part of the longer-term ‘wave b’ spoken about recently.

Right now, it’s time to keep an eye on the movements though this sideways period, should the price of the All Ords fall below 5,830 points, creating a lower trough — then we could have confirmation of the start of a bear movement.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four well-positioned small-cap stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown megatrends. Click here to learn more.