Seek Ltd [ASX:SEK] announced their FY20 earnings today and the market reacted.

The results ended up knocking the SEK share price down over 11%, to trade at $19.05 at the time of writing.

Source: Optuma

What’s been happening at Seek?

Seek now has a global presence with offices in parts of Latin America, Africa, the UK, and all over Oceania.

All of these regions are feeling the pain of the COVID-19 pandemic, with millions of people being forced to stay home.

This totally rearranged the normal work/hire process along with a sky-rocketing unemployment rate.

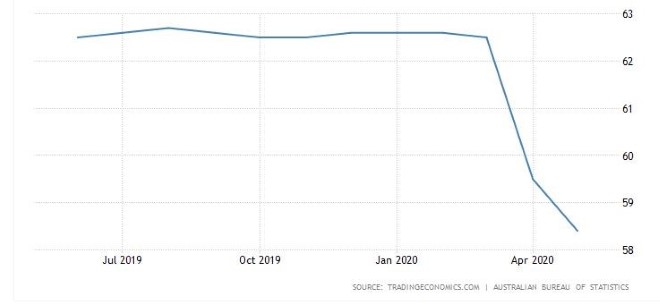

Here in Australia the unemployment rate currently sits at 7.4%. There were hopes this figure would drop as Australia’s job advertisements in newspapers and on the internet grew by 16.7% month-over-month to 104,916 in July 2020.

With the ‘second wave’ coming through Victoria and a complete lockdown underway, this will surely impact the growth in job figures.

ANZ senior economist Catherine Birch mentioned:

‘The second wave of virus cases and return to Stage 3 restrictions in Melbourne and the Mitchell Shire have undoubtedly weighed on the recovery in labour demand so far.’

On an annual basis, ads plunged 34%.

You can see the employment rate for Australia below:

Source: tradingeconomics.com

With the unemployment rate dramatically up, a lockdown in place, and COVID-19 still raging, it makes for very difficult business conditions for Seek.

In their FY20 announcement Seek reported revenue growth of only 3% and EBITDA decline of 9%.

Where to from here for the SEK share price?

Given its core business, the SEK share price is a bit of a proxy for job market sentiment.

Overall things are still not great for the job market here or abroad.

There is a long way to go before we are back at a 2019 level of advertised jobs. Over the next few weeks it will be interesting to see what numbers are reported from the job market and the unemployment rate.

Source: Optuma

As far as Seek goes, over the last couple of weeks the SEK share price plateaued out at around $22.50 on declining volume, before falling.

If this fall continues, then the levels of $18 and $16.60 may halt the fall.

Conversely, should it turn to the upside once again, then the levels of $21.25 and $22.50 may provide future resistance.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown mega-trends. Click here to learn more.