Editor’s note: In today’s video update I discuss four ways you can become a better investor. I also look at the performance of some of Australia’s biggest equity funds in comparison to investing in certain small-cap stocks covered in a recent report. Click the thumbnail below to view.

Dear retail investor:

You aren’t dumb.

I mean, you can be if you are investing based on rocket emojis on a forum.

But I think you’ve been unfairly maligned by the mainstream financial press.

In May there was much talk by regulators and fundies about retail investors flooding into the market.

The number of retail accounts more than tripled during the period between late February and early April.

The bigwigs were aghast! How dare you manage your own money or investments, they say.

Now, I must say at the start here, that all investments carry risk…and don’t even get me started on the murky world of CFDs…

What’s more, pulling out your super to take punts in the market when you are a novice is poorly considered, to say the least.

However, if you do your own research, hone your skills, and have a sound risk management strategy — there is no reason you can’t be successful.

Many will also be unsuccessful, and that’s part of the learning process as an investor.

The point I am trying to make though, is that a lot of the patronising language, down talking, and put-downs emanating from the hallowed pages of some of our major mastheads are poorly justified.

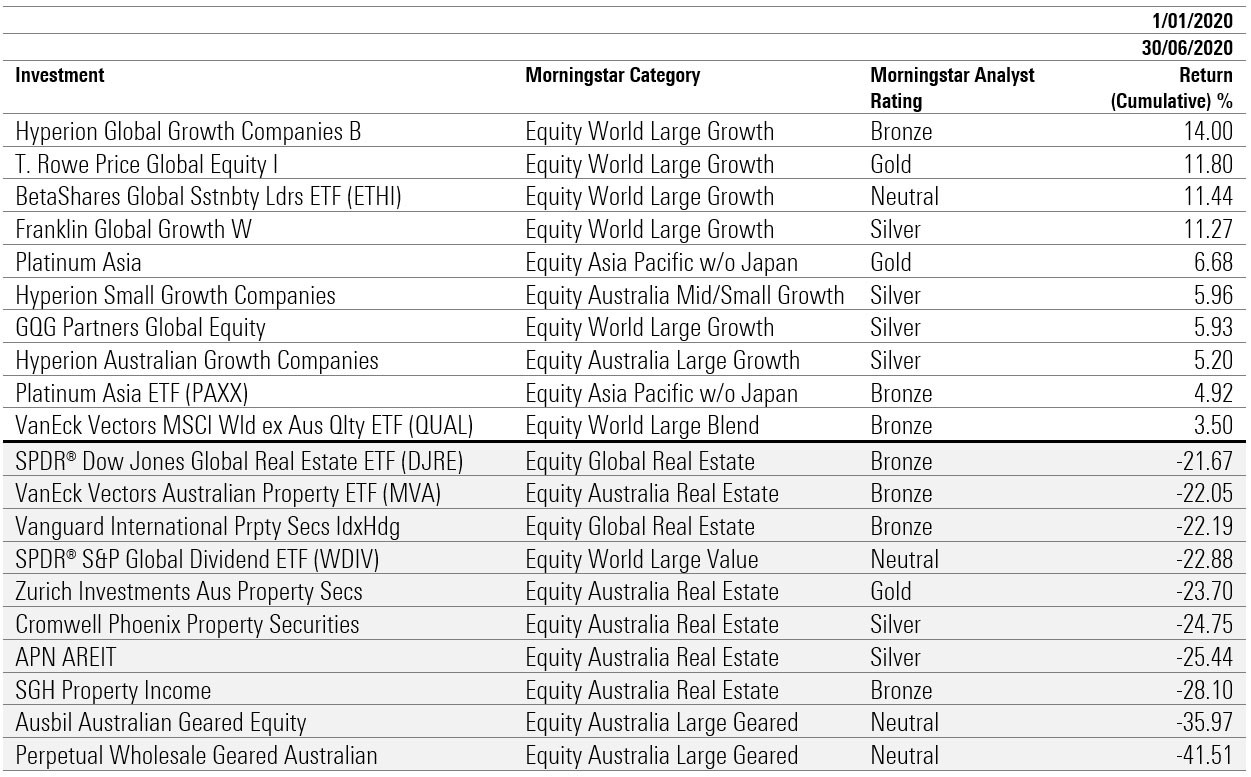

To make my point, I present to you the performance of the best and worst Australian equities funds as compiled by Morningstar:

All categories

|

|

|

Source: Morningstar |

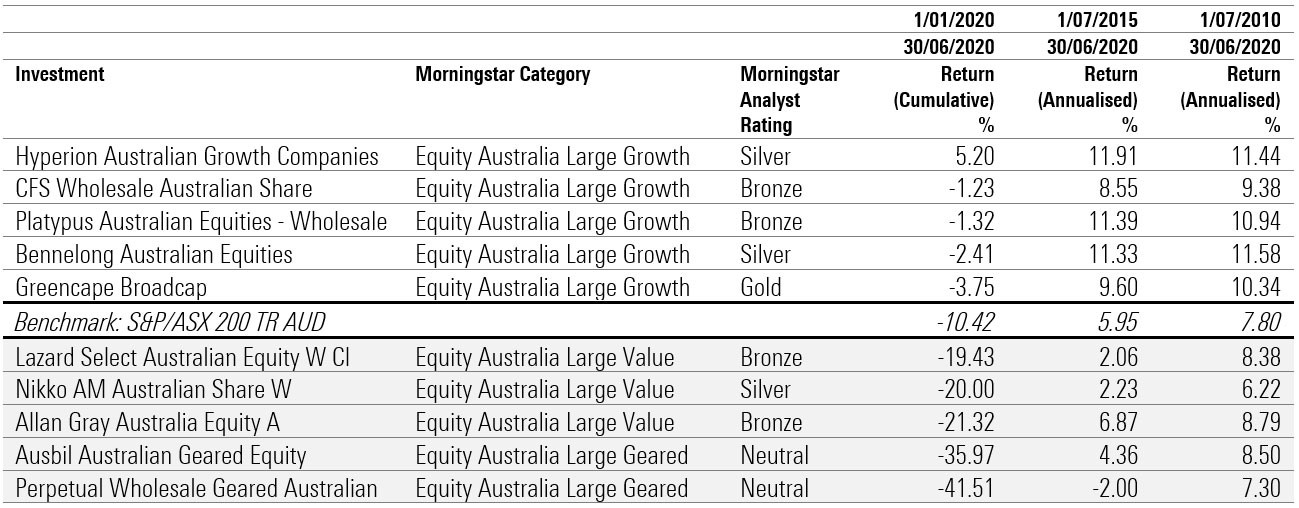

Best-performing large equities funds

|

|

|

Source: Morningstar |

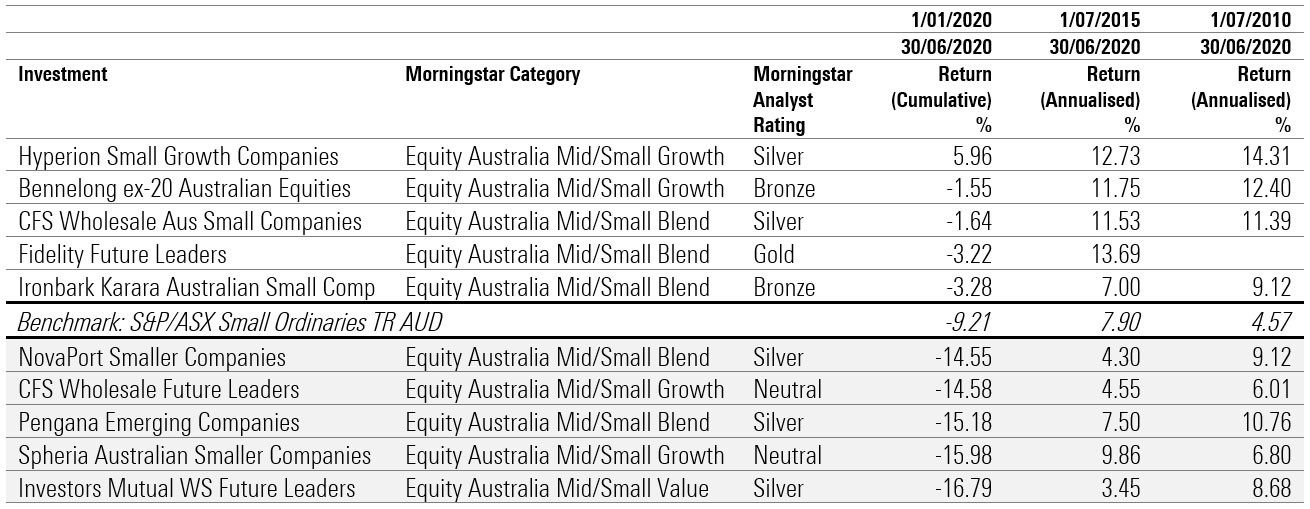

Best-performing small equities funds

|

|

|

Source: Morningstar |

So, across all categories, Hyperion did the best pulling in 14% in a six-month window between 1 January and 30 June.

How Hyperion did it, was a bet on growth and particularly tech.

But what of the others?

In the large equities funds the best performing was again Hyperion — and the next best!?

CFS Wholesale Australian Share, with a whopping negative 1.2% return.

In the small equities funds it’s Hyperion again, followed by Bennelong with another negative 1.5%.

I’ll put it bluntly — if all you can do is pull in negative numbers do you really have a better insight into the market than a retail punter?

The hubris is immense here — and I don’t think I’m being unfair.

They wear suits, they talk down to retail investors in the paper, and then they have the gall to do all this knowing they are producing paltry or negative returns.

So, you aren’t dumb if you’ve done well in the recent rally despite what the bigwigs say.

Anyway, here are four advantages you have as a retail investor…

Reason #1: Retail investors can stick to convictions

A longer investment horizon is crucial.

If you think a company is going to do well then you can hang onto your investment longer.

No 12-month window can hold you back.

No shareholder breathing down your neck to grind out a quick return.

Reason #2: Retail investors can take bigger risks

Now, it doesn’t mean you should take greater risks — always keep one eye on what you can afford to lose.

But your capacity to take greater risks is clearly an advantage.

Reason #3: Retail investors can be more flexible

If you own 10% of a company it can be hard offloading shares.

With a smaller position, you can exit quicker if it all heads south.

Reason #4: Retail investors can invest in the change they believe in

Look at Tesla Inc [NASDAQ:TSLA], value investors turn their nose up while everyone else laughs all the way to the bank.

The point is, if you see change in the world and have a good grip of mega-trends, you can invest accordingly.

You don’t need to punt on a big oil company or any other potentially ethically dubious venture just to please shareholders.

You can invest how you want, based on what you think the world will look like down the track.

Here’s a resource if you want to be a better retail investor

I promise this isn’t a shameless plug.

I genuinely believe our Exponential Stock Investor is a great resource for those investors looking to get better.

We don’t always get it right, which is important to acknowledge.

But we have had some solid success, and ultimately we are committed to doing our best for our subscribers.

We aren’t a fund — which means we can call it the way we see it.

And ultimately the decision is yours as to whether you invest or not.

You can completely disagree with our reasoning too!

But you will always get an in-depth explanation and clear instructions.

We hope you join us.

Regards,

|

Lachlann Tierney,

For Money Weekend

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.