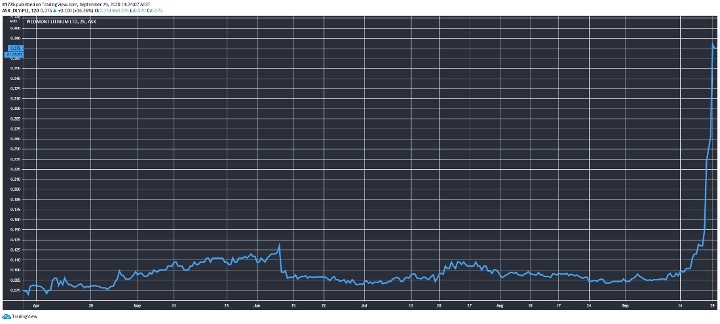

At time of writing, the share price of Piedmont Lithium Ltd [ASX:PLL] is up a further 36.36%, trading at 37.5 cents.

There was a bit of a kerfuffle around the announcement that triggered the meteoric rise in the PLL share price.

In a nutshell, a sales agreement with Tesla Inc [NASDAQ:TSLA] was reported early by accident.

You can see the PLL share price take off below:

Source: Tradingview.com

Naturally, a deal with Tesla will generate hype. We pull out the key passage from a recent announcement you should be aware of.

PLL share price responds to two factors

As the company apologised for the disorderly release of information, they noted two factors behind the mammoth volume of PLL shares trading hands.

This included the Tesla Battery Day event, which given PLL’s North American operations, drove excitement in lithium stocks with the right geography.

Here’s perhaps the most intriguing passage of one of PLL’s announcements yesterday though:

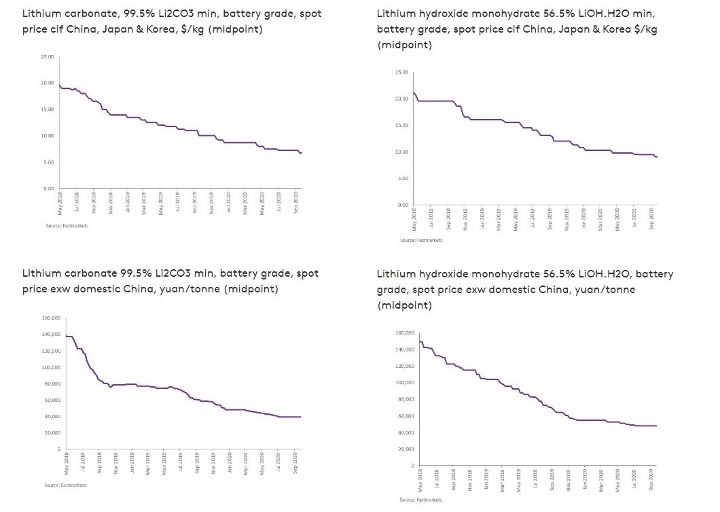

‘The increase in the Company’s share price and volume during the week ending Friday, 18 September 2020, was not unique to the Company. The stock prices of a number of other ASX and North American lithium companies increased significantly during that week. Further, on 15 September 2020, Canaccord Genuity (Australia) Ltd (“Canaccord”), who has a current “Buy” rating on Piedmont, released an industry research report which called the “bottom” of lithium prices.’

So, Canaccord thinks the bottom is in.

On its long-term price slide, many have called a false bottom on lithium prices.

And to a degree this has made lithium stocks a young person’s game.

I’d note that stockpiled lithium may mean that the bottom could involve a bout of sideways movement for a period of months. And the price may not explode until later.

This is what’s happening for the prices of a variety of different forms of lithium:

Source: Fastmarkets.com

The pace of declines is slowing or levelling out.

Fascinating.

For the names of three well-placed lithium companies and a great explanation of lithium’s potential in 2020, read this report.

Regards,

Lachlann Tierney,

For Money Morning