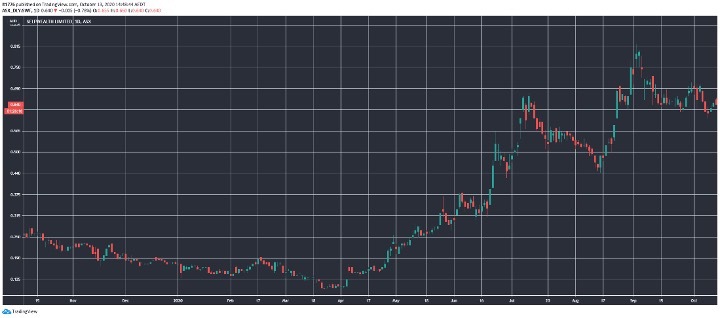

A quick look at the SelfWealth Ltd [ASX:SWF] share price.

After an immense run fuelled by a flood of new retail investors in lockdown, the SWF share price is starting to cool:

Source: Tradingview.com

We take a look at the metrics the company shared in their latest investor presentation.

Investor presentation doesn’t move SWF share price

On a day when the ASX logged a strong day in the green following the budget, the SWF share price is shedding .78%, trading at 64 cents.

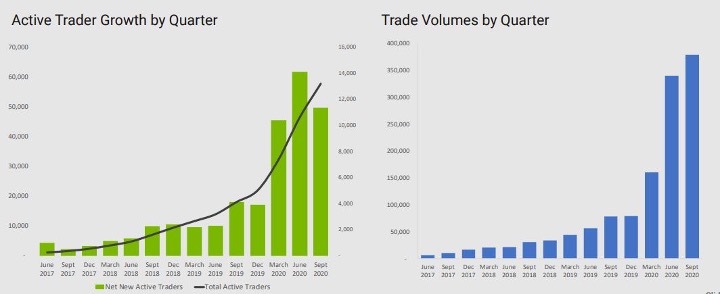

The investor presentation showed strong growth across these two metrics:

Source: Company Presentation

Staggering trade volume on their platform in the last three quarters.

Interesting to note though, growth in active traders slowed in the latest quarter.

Maybe the retail feeding frenzy is cooling?

Also complicating matters, and potentially driving the slowdown in the SWF share price rise is the potential for greater competition.

New entrant to the broker game, Superhero, could be a factor — offering trades for $5.

The big banks will surely be watching these developments closely and may eventually cut their fees.

It’s starting to look like a race to $0 trades at the moment.

Outlook for SWF share price

SelfWealth has done very well to capitalise on the sharp uptick in retail investors.

But it’s a legitimate question to ask how their business model will cope if the big banks alter their fee structure.

New product offerings may be the ticket.

Opening up the US market could be key going forward.

If you are excited by what’s happening in the Australian fintech space, be sure to read this brand-new report I authored on the topic.

Get the names of three well placed fintechs, and the details on their business models and finances.

It’s a great read, and these companies are the wave of the future.

Regards,

Lachlann Tierney,

For Money Morning