In today’s Money Morning…data going exponential…two ways to invest in the exponential data trend…a final word of advice…and more…

Editor’s note: In this week’s video I discuss the limited impact of the antitrust lawsuit on the Google chart, the US election, and how the S&P 500 relates to the ASX 200. Click here or the thumbnail below to watch.

A toothless show trial for the ages and an election looming large.

After much umming and ahhing the US is finally having a crack at the Google monopoly.

Reuters called it:

‘The most momentous antitrust showdown since Washington took on Microsoft Corp more than two decades ago.’

You would think a massive sell-off would ensue.

But no, Alphabet Inc [NASDAQ:GOOG] registered a 1.39% gain overnight.

The market doesn’t think much of the trial, clearly.

That’s why I’m tempted to call the current US stock market run, the ‘anything’ rally.

Bad news? Buy more. Good news? Buy even more!

For the gamblers out there, stimulus is like one big bonus bet for the big funds.

With regards to Google, one commentator said, ‘What is there to break up? Everything is free.’

Define ‘free’ though — services in exchange for data-driven, highly-targeted marketing has been the modus operandi for years.

So instead of going out there and buying more Google shares, I suggest you look further ahead.

Try to understand what’s driving the Google machine and you may be able to snap up some exciting small-caps.

Who knows? One might even go on a Google-like run.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Data going exponential

Here’s the nub of the matter — the world is awash with data.

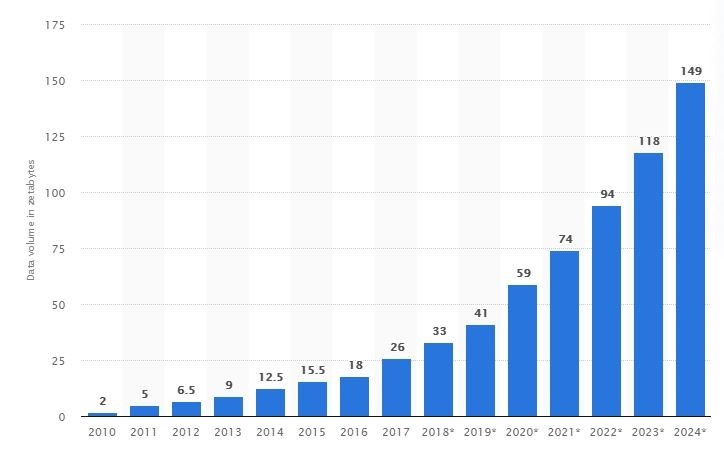

This year it’s projected that 59 zettabytes of data will be consumed or used worldwide.

That’s 5.9 raised to the 10th terabytes.

The computer you find at home has around one terabyte of data storage.

So, if you filled it up every day for a 161 million years, you would get the total data used in this year alone.

And by 2024?

A whopping 149 zettabytes at a compound annual growth rate of 26%.

Check it out for yourself:

Volume of data/information created worldwide from 2010 to 2024 (in zettabytes)

|

|

|

Source: Statista |

That’s a near exponential trend.

So, the companies leveraged to this trend should succeed in the coming years.

The large funds are waking up to this trend too.

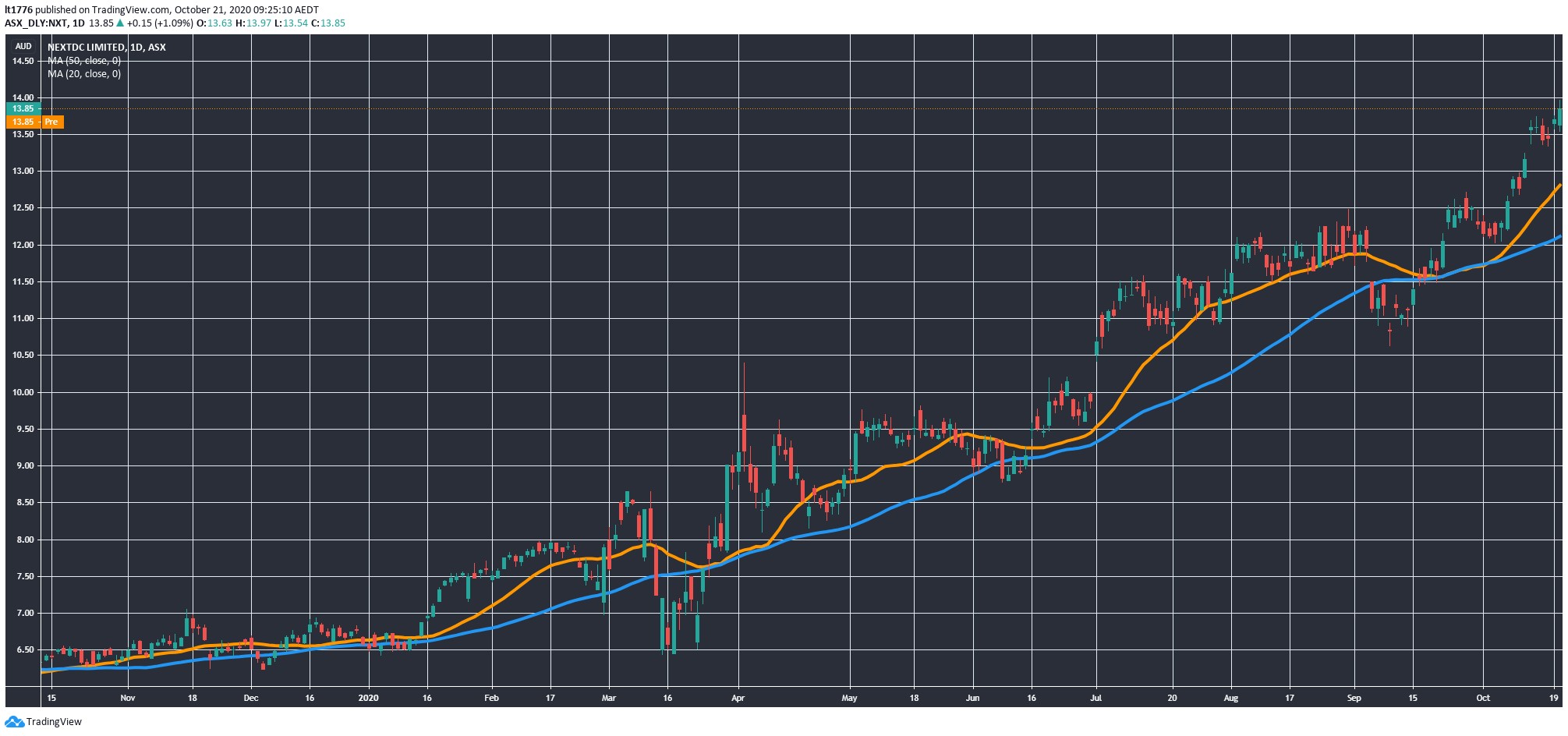

For evidence of this, just look at the immense run that NextDC Ltd [ASX:NXT] is on:

|

|

|

Source: Tradingview.com |

Now a $6 billion market-capped company, the big data centre operator isn’t even profitable yet.

But people think it will be profitable — and that’s all that matters.

This is Afterpay-like stuff, but instead of a ‘buy now, pay later’ (BNPL) service, what’s driving the NXT share price higher is the ability to store and transmit data in vast quantities.

Two ways to invest in the exponential data trend

I’d say there are two broad classes of stocks that could thrive on the exponential data trend.

These are data infrastructure stocks, and data service stocks.

Data infrastructure stocks could be anything from the aforementioned data centre operators to smaller telecommunications companies that offer super-fast speeds at competitive prices.

Data service stocks, however, are far more diverse.

Here you have companies that facilitate a shift to the cloud, companies that offer analytics and optimisation tools, and perhaps the most intriguing of all, AI services.

Artificial Intelligence feeds off enormous troves of data, this is how the machine ‘learns’.

Like coal in an old-fashioned steam engine — data is the fuel for the AI engine.

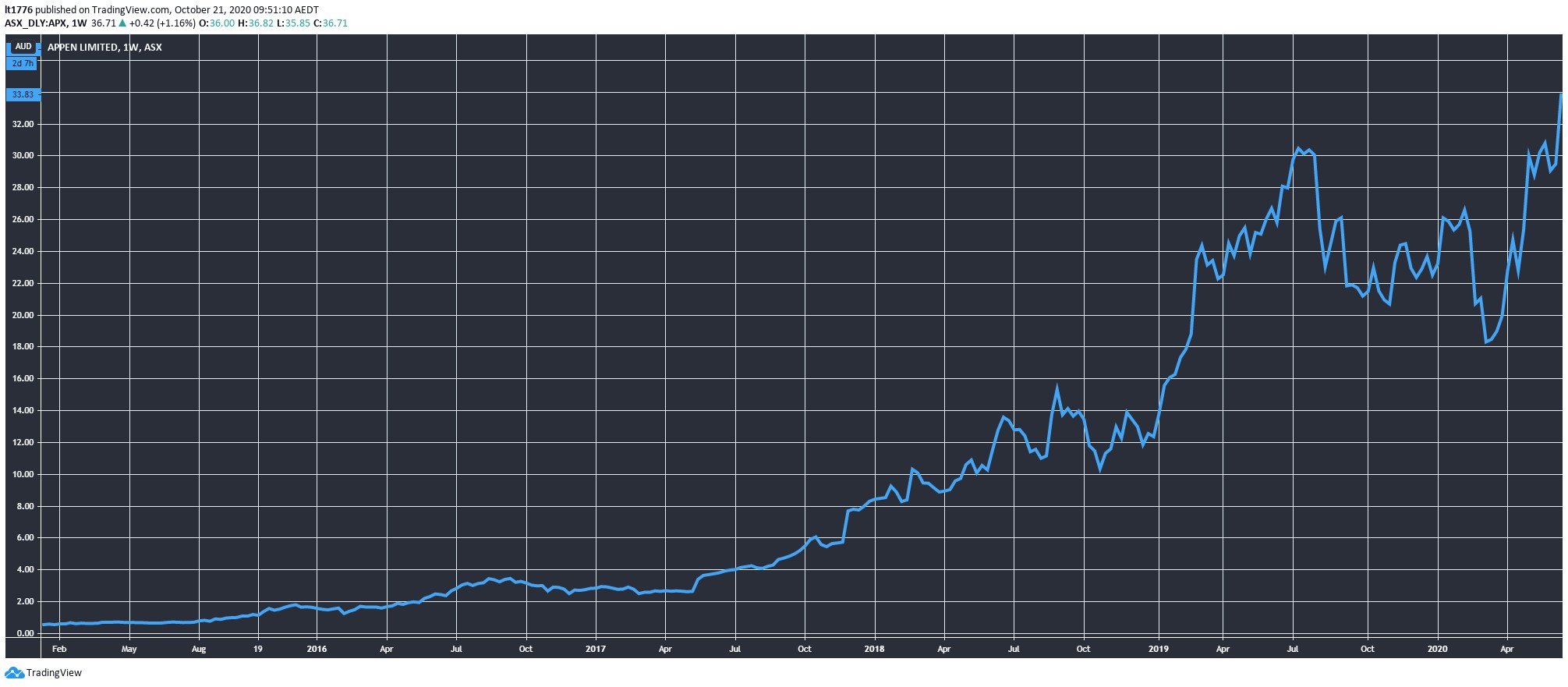

To see just how fast the AI industry is growing, take a look at the long-term chart for Appen Ltd [ASX:APX]:

|

|

|

Source: Tradingview.com |

The AI company listed in January 2015, at an IPO price of 50 cents.

Today? More than $36 dollars a share.

The combination of data ‘fuel’ with the AI ‘engine’ is a powerful one.

I count four AI stocks in our Exponential Stock Investor portfolio and at least four more that offer data infrastructure or data services.

Now, we may not get it exactly right on all of these.

But all it takes is one Appen-like or Google-like run and suddenly the portfolio returns are far more impressive.

A final word of advice

Ultimately, I think the Google antitrust lawsuit or the current US election will be of little significance to long-term investors.

What really matters is picking the exponential trends, identifying the sectors that will benefit from these trends, drilling down on specific companies — then sticking to your convictions.

Do this, and you give yourself a big leg up over the ‘short-termists’ that run our financial world.

Being able to drown out the noise created by headlines is a crucial first step too.

Headlines like the ones you are seeing today are just backward-looking hype pieces on yesterday’s history.

And what’s more valuable than hindsight?

Foresight.

Invest accordingly.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.