At time of writing, Cann Global Ltd’s [ASX:CGB] share price is up 20%, trading at 0.6 cents.

While 20% sounds like a big jump, it’s a small blip in what is a long-standing slide for the CGB share price:

Source: TradingView.com

We look at the details of their new product announcement.

Canntab product for Australian market

Here’s a quick summary of today’s announcement:

- Medical cannabis tablets via its JV partnership with Canadian company Canntab Therapeutics

- Import permit in place

- Six formulations, two THC, two CBD and two blends

- Complemented by large observational study or CMOS

So, an initial step in the right direction for CGB.

It helps to have products to sell.

CGB’s Managing Director Sholom Feldman highlighted the potential competitive advantages of the tablets given Australia’s tightly regulated market:

‘…we expect [the product] will be very sought-after by Doctors who are looking to prescribe pharmaceutical grade medicinal Cannabis products to their patients. It is our understanding from discussions with medical professionals that it is easier for them to prescribe a uniform dosage tablet.’

Outlook for CGB share price

Given the long-standing slide and the current sub-$20 million market cap CGB has, I’d be hesitant to say this is the beginning of a major trend reversal.

That being said, I’ve noticed a significant uptick in interest in ASX-listed cannabis stocks.

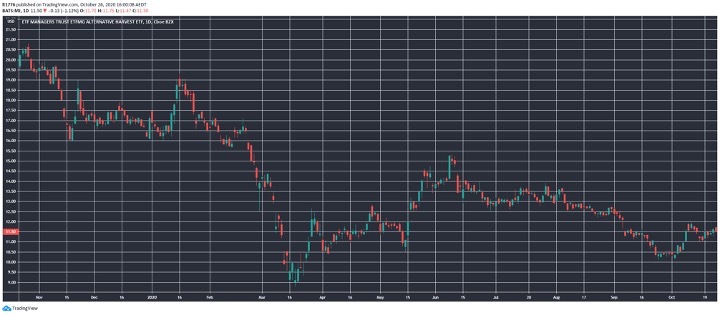

You can see how the ETFMG Alternative Harvest ETF [MJ] is tracking below:

Source: tradingview.com

A small bounce recently, but still a long way to go before it claws back its losses made over the course of the last 12 months.

It will be interesting to see how many of these beaten-down stocks get runs and revenue on the board after the hype drastically faded.

Regards,

Lachlann Tierney

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.