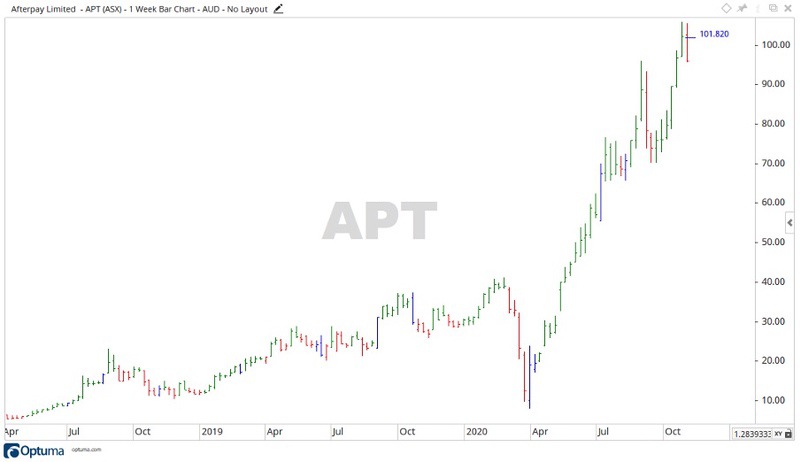

It’s been the year of the ‘buy now, pay later’ (BNPL) sector with Afterpay Ltd [ASX:APT] leading the way.

Trading at $101.82 at the time of writing, the Afterpay share price jumped up more than 5% on the announcement of Q1 FY21 results.

Source: Optuma

What’s happening at Afterpay?

The company’s growth throughout the year is well documented.

This growth is highlighted again in a recent announcement outlining the company’s Q1 FY21 results:

- ‘Strong performance in Q1 FY21 across all regions led to underlying sales increasing 115% to $4.1b, up from $1.9b Q1 FY20. This was 9% higher than the record underlying sales achieved in Q4 FY20.

- ‘Momentum towards the end of FY20 continued into Q1 FY21 with the run rate for Q1 FY21 now at $16.4b, up from $15.0b in Q4 FY20.

- ‘Merchant revenue margins (unaudited) remained firm in Q1 FY21 and continued to perform in line with what was achieved in FY20.

- ‘Active customers globally increased 98% to 11.2m (up from 5.7m in Q1 FY20), with the US reaching over 6.5m.’

Where to from here for the Afterpay share price?

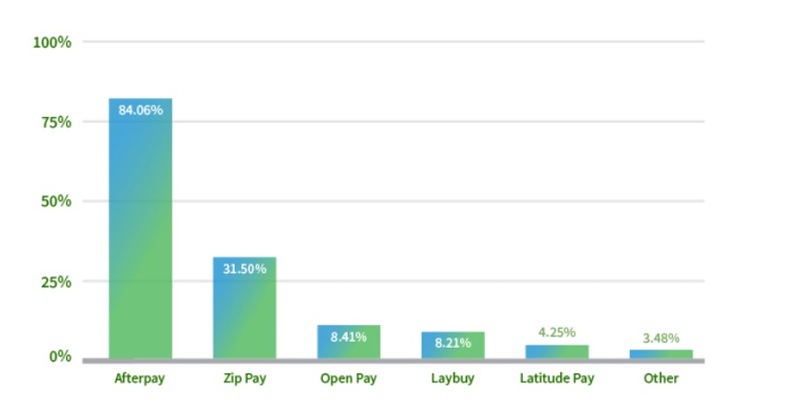

You can see APT remains the most popular of the BNPL providers by some margin.

Source: Mozo.com.au

As the nation opens back up after the lockdown, and people can go back to brick-and-mortar shops, will the growth continue?

Source: Optuma

The APT share price formed a small sideways move recently. From where the price sits at the time of writing, it would need to move up above the all-time high level of $105.80 for the chart to still be considered bullish.

On the downside, should the Afterpay share price start to fall back, then the levels of $96.21 and $82.14 may be enough to halt a further fall.

Looking for more fintechs?

Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

Regards,

Carl Wittkopp,

For Money Morning