In 2017, Mark McVeigh — a Uni student from Brisbane — got in touch with his super fund.

He wanted to know what Retail Employee Superannuation Trust (Rest) were doing to manage climate change risks and what were their plans for the future, but he couldn’t find much info on it.

What concerned him was that this could really affect his long-term investment.

In his own words:

‘There’s inherent risks to investing in companies that aren’t sustainable and contribute to climate change, which will be phased out the next couple of decades.’

He didn’t get much of a response from them, so he decided to sue.

This past Monday the matter resolved.

While the case got settled out of court, the results included a few milestones.

Rest issued a press release admitting that climate change is a financial risk that ‘could lead to catastrophic economic and social consequences’ they need to manage. Rest has also agreed to bring the fund’s portfolio to net zero carbon emissions by 2050. They’ve also agreed to disclose how they evaluate their investments against three scenarios: business as usual, Paris targets agreements, and a third where there’s a faster transition.

David Barnden, McVeigh’s lawyer, had this to say:

‘This outcome should represent a significant shift in the market’s willingness to tackle climate risk — a shift which should set a clear precedent for the industry in Australia, and also pension funds around the world.’

Wherever you sit at on the climate change debate, things are starting to change.

[conversion type=”in_post”]

Super Funds Part of the Shift to Renewables

Super funds are starting to ditch fossil fuels to diminish risks and they are also getting pressure from their own members to change.

Earlier this year we heard the chief investment officer for Australian Super, Australia’s largest superfund, say that the market was already penalising ‘climate laggards’.

And, First State Super (now Aware Super) have said earlier this year they were looking to get rid of their thermal coal investments and a 30% reduction in emissions on their investment portfolio by 2023.

First State’s chief executive Deanne Stewart told The Sydney Morning Herald:

‘Climate change posed the single biggest risk to Australians’ retirement savings, and superannuation investors must “take bold and decisive action now” to safeguard members’ long-term interests.’

In fact, I recently interviewed Liza McDonald — head of responsible investment at First State Super — to get her insights on this exact topic. You can watch this interview here.

A recent report from ClimateWorks Australia on the superannuation sector also agreed. As they noted:

‘There are indications this sector is starting to transition. Conscious of the commercial implications of climate risks and of regulatory, legislative and policy requirements for action, institutional investors are acting to address the likely impacts of global warming. […]

‘Superannuation funds are themselves making commitments to reduce emissions funded through their investment portfolios, a further sign of gathering momentum for change.’

The report looked at 20 of the largest Australian superfunds by value assets under management and found that even with the pandemic, funds are ‘accelerating’ their efforts to tackle climate change risks.

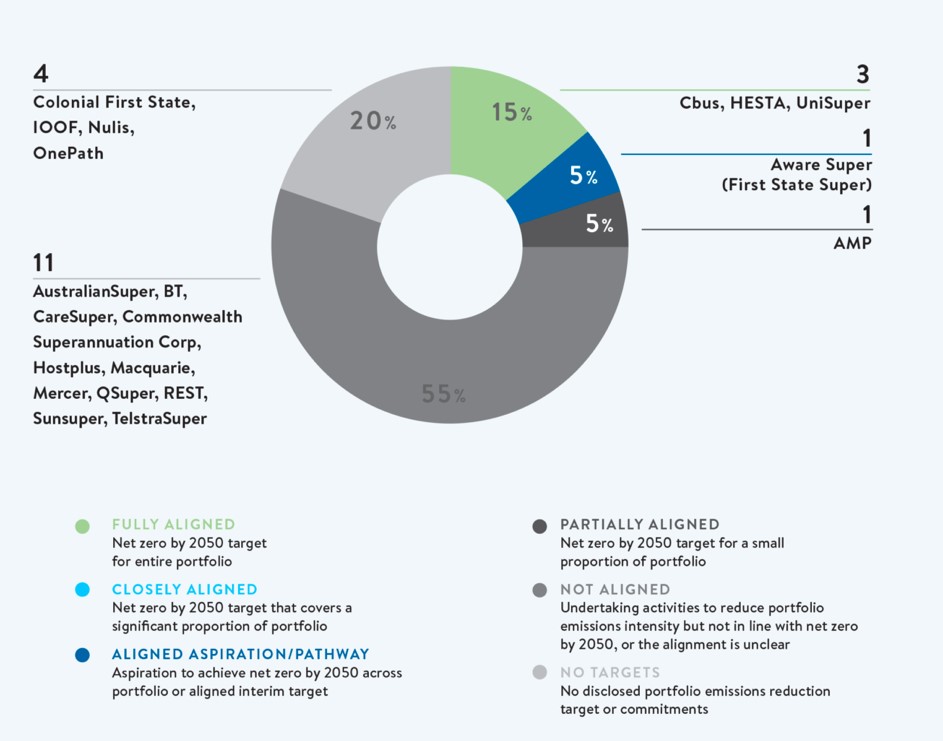

As you can see below, 20% of the 20 superfunds either already have 2050 as a target to get to net zero emissions or are closely aligned, and 60% are involved in some activity of reducing emissions.

Only four out of the 20 don’t have any emission targets.

|

|

|

Source: ClimateWorks Australia |

Australian superfunds make up a big chunk of the ASX.

In fact, in 2019 superfund investments made up 35% of all ASX investments, and that’s only set to increase. Deloitte forecasts their share could increase to 60% by 2038.

Investment is switching away from fossil fuels, but also some governments are too. Three of our largest trading partners — Japan, South Korea, and China — said they would commit to net zero emissions by either 2050 or 2060. Some of our biggest coal and gas customers are starting to shift towards a low-carbon economy, so expect those markets to get smaller.

The pandemic has accelerated things, oil demand has collapsed from the lockdowns during the pandemic and hasn’t recovered yet.

But the key takeaway here is that this switch not only represents a threat, but an opportunity to capitalise from renewables. With technology improving, cheap debt, and the fact that they themselves are getting cheaper, the case for renewables is becoming more attractive.

As I said, things are starting to shift.

Best,

Selva Freigedo,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.