In a week where markets have been buoyed by vaccine news, Kazia Therapeutics Ltd [ASX:KZA] is following a similar trend.

While this small-cap biotech may not be trying to treat COVID, they are trying to treat an equally sinister disease: glioblastoma. And, in the midst of their phase II trial, Kazia was lucky enough to share some updates on their progress…

Suffice to say, the data provided was very promising. Reinforcing the fantastic results the company has shown to date. Results that helped them secure a ‘nod’ from the FDA, as we’ve previously covered.

Today though, shares are surging higher once more. As of time of writing, the stock is up 32.35% for the day. A welcoming sign of the market’s expectations for Kazia’s ongoing endeavour.

A superior alternative

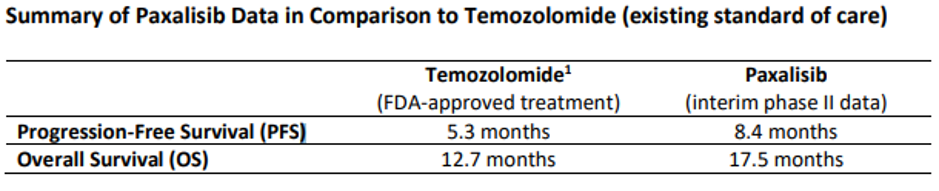

The big takeaway from Kazia’s update is their incredible survival endpoints.

In treating such an aggressive type of cancer, the company has been trying to give patients as much time as possible. Providing a few extra, but extremely valuable months to these victims.

Here are their latest figures compared to the current leading drug:

Source: Kazia Therapeutics

As you can see, Paxalisib (Kazia’s drug) outshines Temozolomide completely. Providing longer survival rates for patients regardless of their cancer progression.

So, if this data holds true throughout the trials, Kazia may have a huge breakthrough. And Kazia’s CEO, Dr James Garner, is extremely optimistic about their chances:

‘This is very reassuring data from the glioblastoma study, confirming our earlier results with the data now much more mature. In studies such as this, volatility is the enemy of dependability.

‘From the very first efficacy data we reported from this study, in November 2019, through the ASCO and AACR presentations in June 2020, to today’s latest analysis, the PFS and OS figures have remained extremely stable as the study has progressed.

‘This gives us a great deal of confidence that what we are seeing is representative and reliable.’

That confidence is certainly shared by the market today. Indeed, it has been shared for much of November, with the stock flying higher on momentum.

They’re a biotech worth keeping an eye on.

What’s next for the Kazia Therapeutics share price?

Naturally, the ongoing trial is still the major focus for Kazia, with the study set to wrap up sometime in the first-half of next year.

From there, a Phase III trial will likely follow if the final results stay true to past findings. Meaning that it will still likely be years before Paxalisib makes it to market.

Nevertheless, as long as the results remain promising, Kazia should flourish.

For investors that should be the key takeaway. Though, I would remind you that biotechs are notoriously volatile — so don’t take these findings as ‘guaranteed’.

Trials exist for a reason, and there is still a chance that Paxalisib doesn’t pan out as hoped.

Because of this, you may be interested in learning how to manage volatility in your trading. Learning technical tools that can help you achieve profits even in volatile stocks or markets.

For more information, learn all about these techniques in our latest report, right here.

Regards,

Ryan Clarkson-Ledward,

For Money Morning