At time of writing, the share price of Sezzle Inc [ASX:SZL] is down 2.19%, trading at $6.26.

You can see what’s happening with the SZL share price below:

Source: Tradingview.com

We take a quick look at their recent quarterly and the outlook for the SZL share price.

Quarterly was relatively strong, but investors may be seeing things differently

Here are the key points from Sezzle’s quarterly released on 30 October:

Source: Sezzle Inc

Now generally speaking this would be a strong set of numbers.

Good quarter-on-quarter growth across the board.

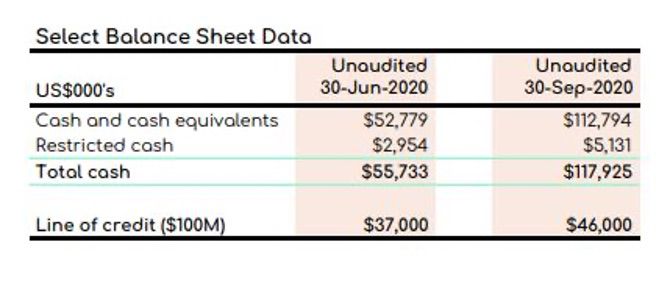

This is underpinned by details on their balance sheet below:

Source: Sezzle Inc

So, potentially plenty of wiggle room there.

Cash to market cap ratio is a good place to start for a growing company, I might add.

But, and this is a big but, there are a few factors to consider here.

For instance, we know that Sezzle is very much focused on the US market, and particularly online shopping.

In addition, we know that as of the most recent quarter they were cash flow negative.

As the quarterly explains:

‘Operating cash flows for the third quarter were a negative US$4.7 million. YTD cash flows from operating activities totaled a negative US$2.2 million. Cash receipts from customers rose 23.4% QoQ to US$209.0 million from US$169.3 million in 2Q20. Cash payments to merchants rose 29.4% QoQ to US$199.7 million from US$154.3 million in 2Q20. Payments from customers and to merchants are driven by UMS volume, with the difference in payment flows between merchants and customers driven by the timing of payments as well as seasonality.’

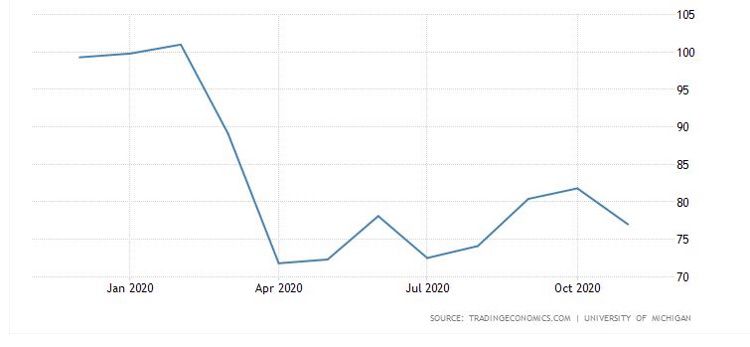

With the holiday season about to start in the US, consumer confidence could be key going forward.

Outlook for SZL share price

I’d be watching US consumer confidence closely, which you can see below:

Source: Tradingeconomics.com

Not looking the best there.

Stimulus has yet to pass too, which will flow directly into the prospects of the US’ ability to go on a holiday season shopping binge.

As such, despite whopping growth previously, Sezzle may struggle to break this downtrend immediately.

I talked about stop-losses and risk management in the context of the BNPL sector previously, which you can watch below:

And if you are looking for three fintechs which could prove more resilient in the current environment, you can read our brand-new report, right here.

They are all small-cap fintechs, each with their own unique properties.

It’s well worth a read if you are thinking of what comes after the BNPL hype.

Regards,

Lachlann Tierney,

For Money Morning