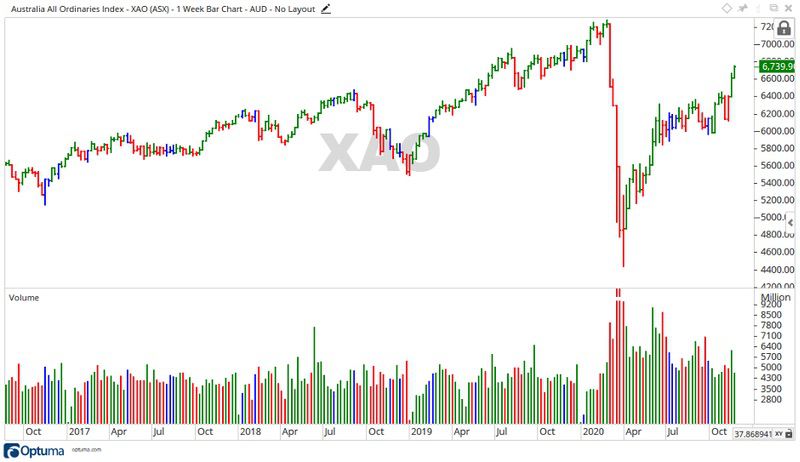

The All Ordinaries [XAO] pushed up again this last week been, gaining 152 points on declining volume.

A lot was made this last week again about a COVID-19 vaccine and at their latest meeting G20 leaders agreed to distribute the vaccine fairly around the world.

Source: Optuma

ASX outlook for the week ahead

There looks to be some positivity moving back into the market.

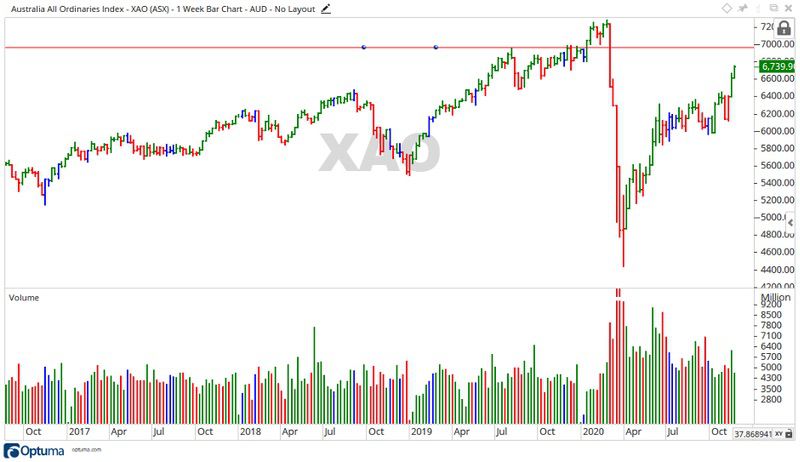

The last two weeks of trading moved the price up after a long sideways movement. This week could be more of the same.

Should the All Ords continue its upward move then the level of 6,965 points may come into focus.

Source: Optuma

A closer look at the ASX

Despite the rising tide, not all companies rose with it.

Australia and New Zealand Banking Group Ltd [ASX:ANZ] gained 8.55%, while Eagers Automotive Ltd [ASX:APE] and Alumina Ltd [ASX:AST] moved up 9.52% and 12.82% respectively.

On the downside, Ausnet Services Ltd [ASX:AST] fell back 6.50%, while Charter Hall Group [ASX:CHC] and Evolution Mining Ltd [ASX:EVN] declined 6.93% and 8.85% respectively.

Moving into the sectors, Energy and Financials gained 2.86% and 6.18% respectively, while Materials declined 0.64%.

A broader look at the ASX

Talk of a possible COVID-19 vaccine made global markets rally over the last couple of weeks.

It’s great that progress is being made but I think it may be a bit too early to claim victory.

Cases of the virus are surging in the US while in Europe the WHO is warning of a third wave.

South Korea is now in their third wave, closing bars and nightclubs.

Under it all, lie the devastating economic consequences.

Here in Australia is no different.

The All Ords gained ground the last few weeks coming into Christmas, but the nation is still propped up by JobKeeper and JobSeeker.

The move up in the market may be encouraging to trade but I remain cautious on a longer time frame.

We may be seeing a false dawn.

Regards,

Carl Wittkopp,

For Money Morning

PS: Make Profitable Trades, More Often — Trading expert Murray Dawes reveals his unique trading strategy designed to help you clock up steady gains in any market, while limiting your downside risks. Click here to learn more.