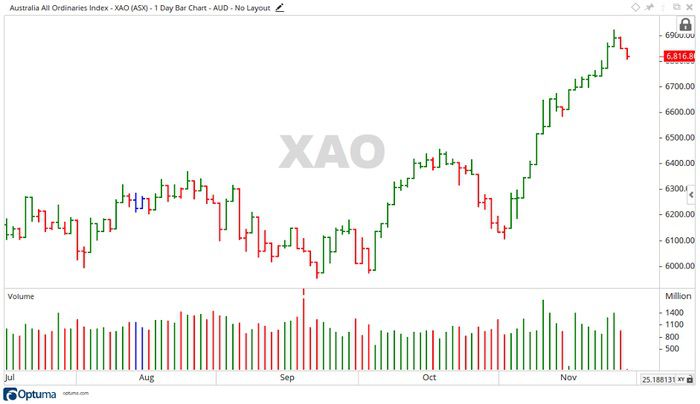

The week been saw another positive move up for the All Ords [ASX:XAO].

Gaining ground for the first three days of the week before falling back to close out the week.

Overall gaining 76 points for the week.

Source: Optuma

ASX outlook for the week ahead

The last two days of last week showed the first signs a pull back for the All Ords, after four weeks of moving up.

With Christmas around the corner and borders reopening around the country people are starting to spend again.

If the move up continues, then the level of 6,986 points may come into focus.

On the downside, if the market retraces, then 6,486 and 6,256 points may be the levels that halt the fall.

Source: Optuma

A closer look at the ASX

The week been saw Ampol Ltd [ASX:ALD] gain 7.74%. While Bendigo and Adelaide Bank Ltd [ASX:BEN] and Omni Bridgeway Ltd [ASX:OBL] moved up 7.29% and 10.97% respectively.

On the downside, Elders Ltd [ASX:ELD] fell back 6.62%. While Evolution Mining Ltd [ASX:EVN] and Northern Star Resources Ltd [ASX:NST] declined 6.59% and 8.41% respectively.

Moving into the sectors, Energy moved up 6.62% while Financials gained 1.74%. Healthcare fell back 2.83%.

A broader look at the ASX

The week been Elon Musk, CEO of Tesla Inc, moved up to become the second richest person in the world.

A lot of this is due to his 20% holding in the electric car company, Tesla.

The Tesla share price gained over 718% throughout 2020.

Source: Optuma

At the time of writing Tesla held a market cap of over US$500 billion.

On the back of this Tesla is joining the S&P 500. It all looks good, but have we seen this before?

Back in December 1999 Yahoo made its way into the S&P 500, just four months before the bust of the dotcom bubble.

While Tesla turned a profit of US$104 million in Q2 2020, it may not be enough to justify the mega market cap.

Source: Optuma

The last time the Dow Jones fell over from a dotcom bubble it took the All Ords with it. As seen above.

In a year like 2020 where tech stocks are all the rage, in the middle of a pandemic a fallout wouldn’t be the strangest thing to take place.

Regards,

Carl Wittkopp,

For Money Morning

PS: This expert reveals how you can make profitable trades more often…even during volatile markets. Download your free report now.