At time of writing the Appen Ltd [ASX:APX] share price trades at $26.35, down 12.27%.

Appen announced lower then expected revenue for Q3.

Source: Optuma

What’s gotten Appen off track?

The company specialise in the development of machine learning and artificial intelligence.

Focusing on human annotated datasets.

The company operates in 130 countries.

Usually, international business is seen as a great thing.

But in the times of COVID-19 it is proving to be a problem.

Back in April the company advised that its 2020 performance would be impacted by the virus.

A slowdown in digital ad spending, a reduction in IT spending, and cancellation of services from Appen’s smallest customers would likely take place.

Q3 revenue for the company came in lower than expected.

While Q4 has improved on Q3, the usual ramp up Appen traditionally sees at this time of year is not there.

Appen’s largest customers are in California.

Right now, California is at breaking point, under the weight of COVID-19.

To the point that some counties are running out of ICU capacity.

The state reported 30,851 new daily COVID-19 infections on Wednesday.

The company is picking up new customers in areas less affected by COVID-19 such as shipping, healthcare, and education.

Taking all the above into account, Appen projects FY20 underlying EBITDA results in the range of $106–109 million.

How will this impact the Appen share price?

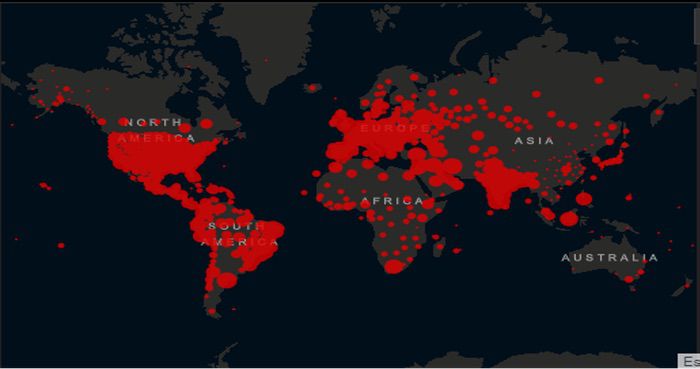

The COVID-19 virus is having a severe impact on Appen.

With their largest customer base in California and the US being close to overrun by the pandemic, earnings for the company are down.

Source: coronavirus.jhu.edu.

The containment of the virus in the US may be critical for the future earnings of Appen.

Looking at the chart, you can see the share price has fallen for last eight weeks:

Source: Optuma

Long term, the way the price unfolded, APX looks to be in a potential ‘Wave C’ of the Elliott Wave sequence.

Historically, a ‘Wave C’ can fall in price up to 162% of the previous range.

With the share price sitting at $26.25 at time of writing, if it continues to fall at this rate then the levels of $21.54 and $15.70 may become the focus.

On the upside, the price would need to break the level of $30.78 and $37.13 to be considered bullish again.

There is an old saying in trading, ‘never try to catch a falling knife’.

It looks that Appen is the falling knife right now.

The share price is on the fall and the pandemic conditions in the US, where their largest customers are based, don’t look to be getting better.

I’d leave this one alone for now.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Regards,

Carl Wittkopp

For Money Morning