At time of writing, shares of Douugh Ltd [ASX:DOU] are in a voluntary suspension.

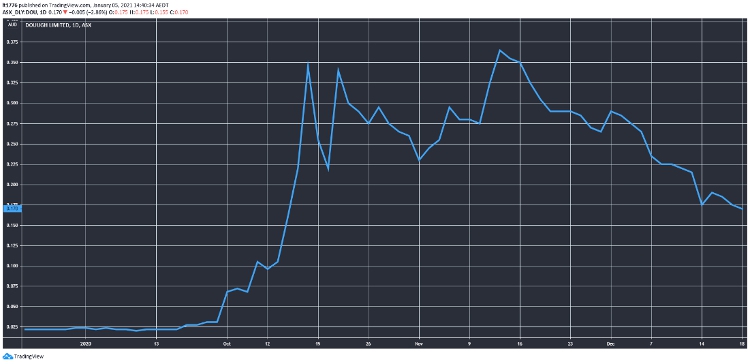

You can see the DOU share price took off at the start of October, and subsequently slid prior to the suspension:

Source: Tradingview.com

Shares are suspended prior to a ‘proposed acquisition of a millennial-focused investing company.’

Who could Douugh be after?

Completely unknown, to be perfectly honest.

Many fintechs have thrived in the current environment, with BNPL providers taking off as people shopped from home.

The DOU share price however, despite its early promise, has floundered since mid-November.

It could be a case of working out the kinks as the investor presentations are certainly slick.

The problem is, as of their 30 October Quarterly, there were no receipts from customers.

The acquisition may be well received however, so there is potential.

The company certainly took a period of time to get going and new investors may be frustrated.

The company is explicitly working under its current ‘Credit Jar’ approach as a point of difference from its current BNPL competitors, seeking to enhance credit scores from the inside out.

Outlook for DOU share price

It’s impossible to tell what the future holds, DOU needs to get its US-focused app running well.

The US market is certainly lucrative.

Should it be a wise move, expect the DOU share price to bounce, if only a muted move.

The company completed a $12 million placement and had over $16 million in cash as of 8 December.

It’s a healthy buffer against any difficulties they may face as they roll out their app, but time will tell.

If you are looking for more fintechs with potential that aren’t DOU, be sure to check out our three small-cap fintechs report.

It profiles three companies with determined growth ambitions.

Best of all, it’s free.

Regards,

Lachlann Tierney,

For Money Morning