At time of writing, the share price of RPM Automotive Group Ltd [ASX:RPM] is up more than 20% to trade at 23.5 cents.

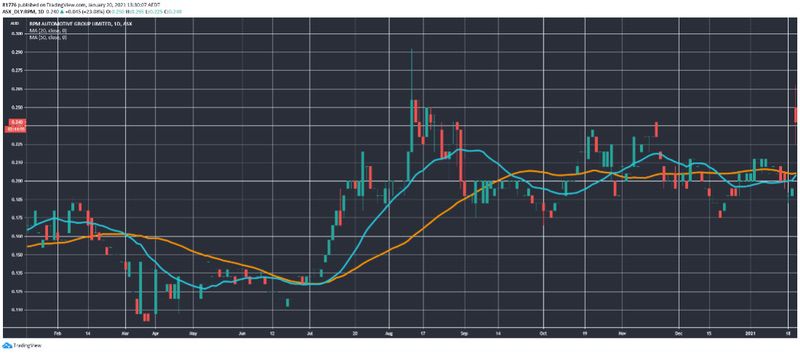

After a bout of sideways trading, the RPM share price spiked today:

Source: Tradingview.com

We take a look at why the RPM share price is up today and the outlook for the company going forward.

RPM share price moves on impressive results

Here are the punchlines from the company’s latest results, causing the share price to spike on open:

- ‘FY2021 full-year revenue forecast to increase by 44% to $49.2M (FY2020: $34.1M) o Annualised forecast based on current position is $55.3M

- ‘FY2021 full-year EBITDA forecast to increase by 37.6% to $4.7M (FY2020: $3.4M)

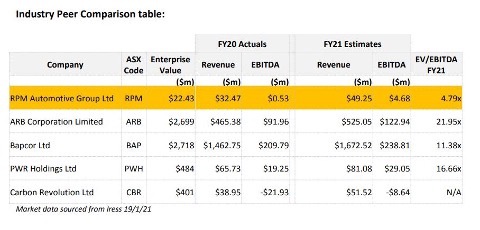

- ‘RPM currently trading at only 4.8x FY21 forecast earnings, significantly below that of industry peers

- ‘Record quarterly revenue of $10.9m, up 16% from $9.4m in the prior quarter, with YTD revenue of $20.3m in line with our budgeted forecast (including RPM Autoparts)

- ‘YoY Revenue increase of 32.4%

- ‘Quarterly EBITDA of $840k (un-audited) significantly exceeding our budgeted forecast of $584k – an increase of 43.7% (net of capital raise expenses of ~$180k)

- ‘YTD EBITDA of $2.32m is a YOY EBITDA increase of 116%

- ‘Successful completion of oversubscribed capital raising of $5.1M in January 2021 provides RPM with a strong Balance Sheet, with $7.3M cash at bank as at 31 Dec 2020’

I’ll tell you what I think of these numbers.

They’re strong. Meaning today’s movement in the RPM share price could be justified/rational.

You’ve got a small company that has what I see as sufficient cash and strong sales momentum.

The announcement also has a handy chart in it:

‘Source: RPM Automotive Group Ltd

The Outlook for RPM Automotive Group

In intraday trading it was interesting to see the price settle lower, to where it is at time of writing.

And small-caps can be risky and volatile, to be sure.

But the multiple in the top right-hand corner of the table above makes a strong case for the company.

It’s important to stress that these are just my opinions and not recommendations.

If that’s what you are after though — I highly recommend you check out my colleague Ryan Clarkson-Ledward’s excellent Australian Small-Cap Investigator service.

As explained here, we are in a very frothy ‘stock picker’s market’ where there is a very high level of value dispersion.

If you want to find out about this, click the link above to learn more.

I’d also note that, RPM is riding a mini-trend at the moment with the difficulties with air travel in Australia.

Humans are nomadic creatures and are increasingly interested in exploring regional areas, especially with certain voucher programs in place.

Being able to spot flow-on effects from certain government policies and sector-specific stars is Ryan’s specialty.

I’d encourage you to check out his work.

Regards,

Lachlann Tierney,

For Money Morning