As markets continue to churn, even (seemingly) good news is finding it hard to dent market sentiment.

Case in point, Australian Strategic Materials Ltd [ASX:ASM]. A rare earths miner who has signed what could be their breakthrough deal.

And yet, the ASM share price is down 0.84% at time of writing. Failing to win over investors amidst widespread pessimism.

Despite today’s muted reception though, this could be a big win for ASM. Especially when looking ahead to the long term…

Korean government commits to metals plant

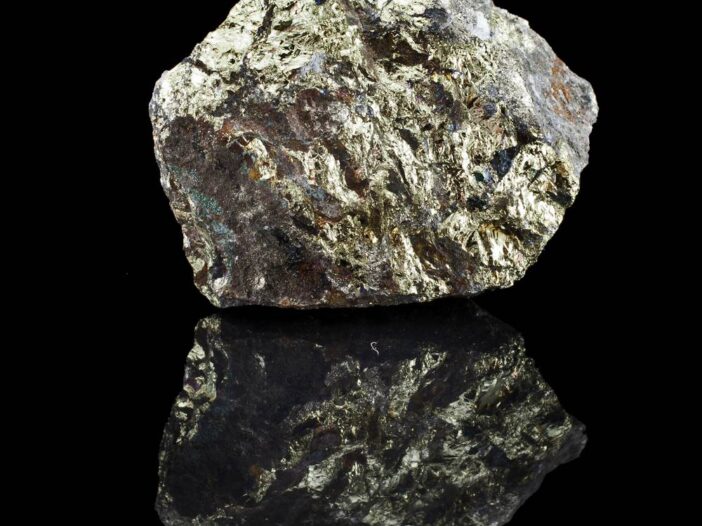

As you may or may not be aware, the ongoing supply of rare earths is still a deeply concerning topic. With China the undisputed king of supplying said minerals.

Estimates of Chinese rare earths supply ranges from 70–95%. Making them the clear leader in this rather niche but important market.

However, with trade tensions between the Middle Kingdom and Western nations flaring, this stranglehold over the market has come under fire. Prompting nations like Australia and the US to put in place plans to create rare earths supply chains outside of China’s grasp.

As today’s deal between ASM and the Korean government shows, it is fast becoming a global issue.

Which is precisely why this supply arrangement and new metals plant will help provide key resources to the local economy. As well as ASM’s own bottom line.

Here is what Managing Director David Woodall had to say on the matter:

‘This MoU, along with the strong support from the Korean Ministry of Trade, Industry and Energy (MOTIE) and the Chungbuk Provincial Government, provides ASM with confidence to build the metals plant in the Ochang Foreign Investment Zone.

‘With key Korean manufacturing companies like LG Chemical, Samsung SDI, SK Hynix, and Hyundai Mobis within close proximity, we are confident that building our first metal plant in this well established industrial area will provide significant benefits.’

What’s next for ASM?

For investors this is fantastic news. Giving ASM its entry point into the Korean market, and hopefully the beginnings of a long-lasting relationship.

As for when the plant will be built, or up and running for that matter, there was no update. Meaning that the timeline to actual production is still yet unknown.

However, I’m sure both ASM and the Korean government are looking to get the ball rolling as soon as possible. Meaning that it is simply a matter of getting all the checks and balances sorted before going ahead.

Needless to say, the sooner the better — for all involved.

And if you’re looking for more resource-based stock recommendations, then we can help.

Our latest report on copper and nickel miners is a must-read for any commodity investor. Detailing what is going on right now, and how to potentially make the most of the recent boom.

Check out the full report, including some of our top stock picks, right here.

Regards,

Ryan Clarkson-Ledward,

For Money Morning