The Webjet Ltd [ASX:WEB] share price is trading flat after strategy update release and removal from All Technology Index.

Webjet Ltd [ASX:WEB] shares are trading largely flat this afternoon after releasing a strategy presentation for investors.

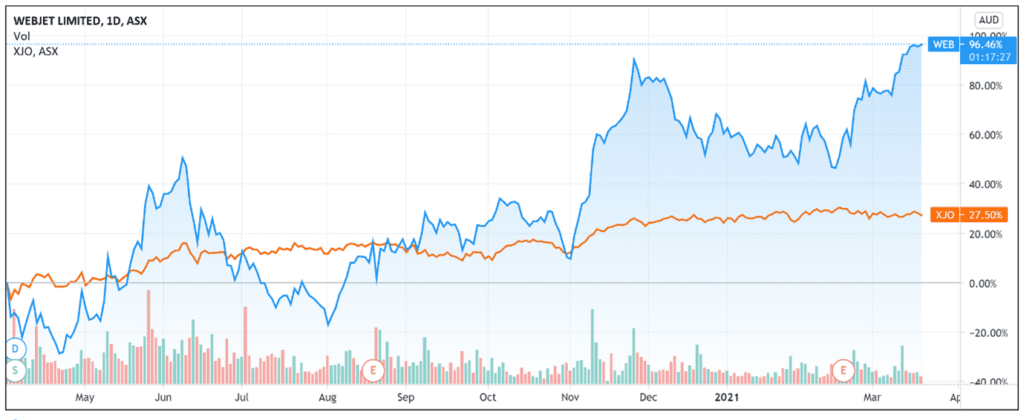

Investors may have largely priced in the strategic ambitions of the company, as investors have sent the WEB share price is soaring 127% over one year and up 22% YTD.

Source: Tradingview.com

Source: Tradingview.com

Webjet updates its strategy

Webjet’s strategy presentation focused on consolidating its WebBeds business post-COVID-19.

According to the release, WebBeds was already the second-largest global B2B provider, but Webjet’s strategic objective is to make WebBeds the number one global B2B provider.

To achieve the objective, Webjet stated that ‘initiatives are currently underway to be 20% more cost efficient at scale.’

The company revealed that it holds a 4% global market share in a $70 billion total transaction value B2B market.

According to Webjet, it can capture more of this market as there are ‘very few genuine global players.’

Webjet believes the severe financial pressure applied by COVID-19 will alter the B2B competitive landscape, as smaller competitors fall away and big players consolidate.

Webjet removed from S&P/ASX All Technology Index

Webjet also released an update attaching an index announcement from S&P Dow Jones Indices, a division of S&P Global.

Effective prior to the open of trading on 22 March, Webjet will no longer be listed on the S&P/ASX All Technology Index.

Webjet did not provide any commentary on this announcement.

It is unclear exactly what the impact of Webjet’s removal from the All Technology Index will have on WEB shares.

Index funds tracking the All Technology Index will sell their WEB shares to purchase shares of the stock taking Webjet’s place in the index.

The market hasn’t exactly priced in an anticipated fall.

The announcement came after markets closed on Friday, 12 March, and the WEB share price closed 1.6% up at Monday’s (15 March) close.

What next for Webjet and WEB shares?

WEB shares settled largely flat late this afternoon following the updates.

This may be because investors perceived the announcement more as a summation of what investors already anticipated Webjet to do and aim for.

What investors will really be looking for in the near term is how well Webjet can execute.

As I’ve covered last week, the analyst outlook for Webjet acknowledges that it’s a solid business that is nicely leveraged to capitalise on leisure travel resumption.

The bull case is that the wider market may underestimate the rebound in consumer response regarding leisure travel and activity.

The tempered Webjet outlook cautions that the recovery ahead may be bumpy and protracted, and points to Webjet’s dilutive equity raise last year.

If you are looking for undervalued stocks and seeking out real value in this environment, I’d recommend Greg Canavan’s Life at Zero event.

He outlines how persistent low rates will flush cash into the market and the ways in which you can invest based on this.

It’s an eye-opening look at a potential future ‘cash panic’ and you won’t regret listening to what he has to say.

Regards,

Lachlann Tierney,

For Money Morning

P.S: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here