The Splitit Ltd [ASX:SPT] share price is up on news Splitit is now available in Japan’s Google Store.

The SPT share price is up as much as 4% in morning trade, with the stock trading up 2.7% at the time of writing.

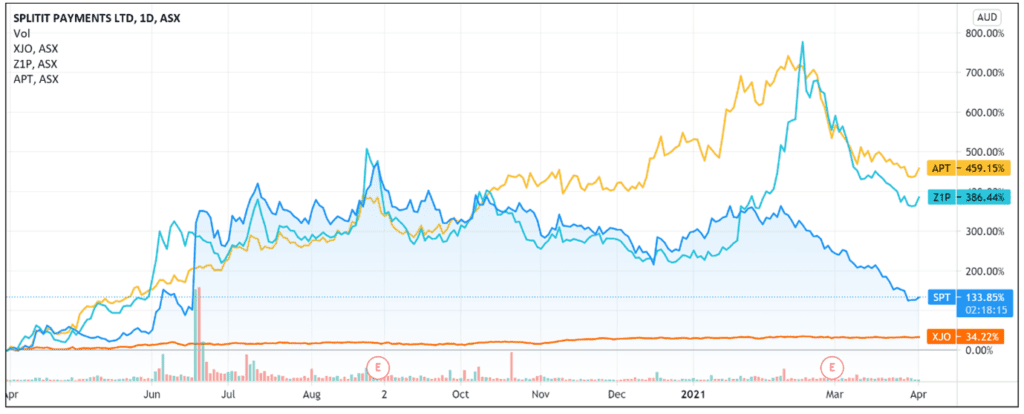

The wider tech sell-off in recent months impacted Splitit along with its major rivals Afterpay Ltd [ASX:APT] and Zip Co Ltd [ASX:Z1P].

Year-to-date, the SPT shares are down 40% and down 30% over the last month.

Nonetheless, investor interest in the emerging BNPL sector still boosted Splitit stock up 115% over the last 12 months.

Splitit now available on Japan’s Google Store

Splitit announced today that Japanese customers can now use its instalment plans to make purchases on Japan’s Google Store.

As of 31 March, Japanese customers can use Splitit’s monthly instalments option on their credit cards when purchasing Google’s new 5G phone, the Pixel 5, or any Nest devices.

Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

According to Splitit CEO Brad Paterson, the ‘seamless integration of Splitit in the Google platform means shoppers never have to mavigate away from the Google site to complete their transaction when using Splitit.‘

Mr Paterson added that customers using Splitit on the Google Store can ‘make instalment payments on their existing credit cards without incurring additional debt or fees.’

Afterpay announces JB Hi-Fi partnership

Splitit’s announcement follows Afterpay’s reveal that it is partnering with electronics retailer JB Hi-Fi Ltd [ASX:JBH].

On Tuesday, Afterpay announced that JB Hi-Fi and The Good Guys would be available to Afterpay customers in the ‘next few weeks‘.

Customers will be able to shop in-store, via Afterpay’s recently launched Afterpay Card, and online.

Customers can spend up to $1,000 at all affiliate stores.

Zip follows Afterpay

Not to be outdone, Zip followed suit.

Or, rather, maybe JBH decided that it’s better to have both APT and Zip as payment options since one of the most common payment help support questions on its site is, ‘Do you accept Afterpay and ZipPay?’

Zip announced that it will provide a ‘fully integrated payments solution‘ for both JB Hi-Fi and The Good Guys.

The partnership will allow customers to use Zip’s services in-store and online.

Splitit outlook

One thing stood out from Splitit’s announcement.

The company ended its release by pointing out that the ‘economic materiality‘ of Splitit’s integration with Japan’s Google Store is ‘unknown‘ at this point in time.

Splitit explained that this is due to the ‘variable nature of revenues which are dependent on customer uptake of specific products.’

This is a far cry from BNPL’s early days, when partnerships with big brands were emphasised and highlighted.

Afterpay didn’t even think its JBH announcement warranted an ASX update, instead revealing the partnership as a media release on its Newsroom webpage.

It may be that new partnerships are not as ground-breaking as they once were for BNPL providers.

The buy now, pay later payment is becoming a more mainstream way to manage one’s purchases in Australia and worldwide.

It is major news when PayPayl launches a cryptocurrency checkout service or when Tesla says it’ll accept bitcoin as payment.

But were we really that surprised when JB Hi-Fi announced it will allow customers to pay with Zip and Afterpay?

It may be the case that BNPL partnership announcements are more of an expectation for investors rather than a novelty.

And if that is true, then it will likely take more than partnership announcements for Splitit’s share price to return to its peak.

If you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, then definitely read our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning

Comments