The Vulcan Energy Resources Ltd [ASX:VUL] share price is up 7% today after the lithium producer acquires geothermal engineering business.

VUL shares were up as much as 10.2% in early trade, before settling at $8.15 per share at time of writing.

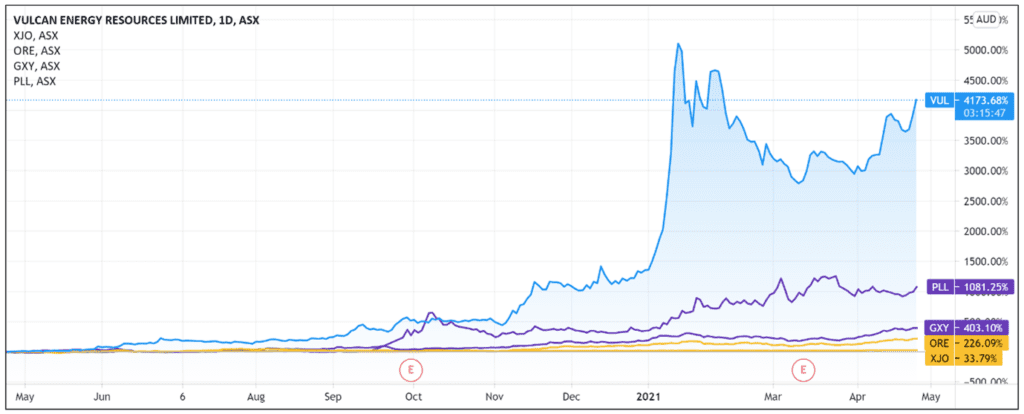

Vulcan has been at the forefront of this year’s lithium boom.

The lithium producer’s shares exchanged hands for 25 cents a share back in May last year, before a vertical spike saw VUL reach a high of $14.20 on 19 January 2021.

While VUL’s year-to-date gain of 190% is large, it pales in comparison to Vulcan gaining 4,000% over the last 12 months.

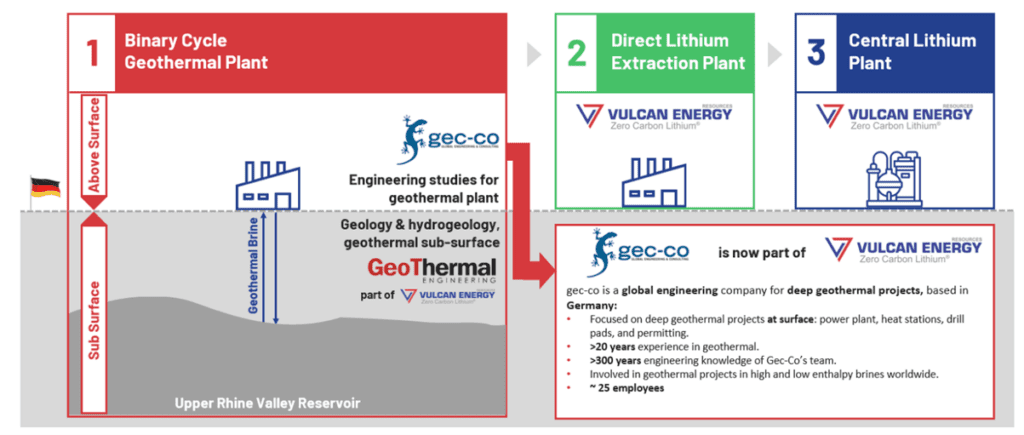

Vulcan acquires German geothermal engineering firm

Vulcan today reported that it signed a binding agreement to acquire 100% of geothermal surface consultancy company — Global Engineering and Consulting (gec-co).

Three Ways to Invest in the Renewable Energy Boom

The agreement is subject to shareholder approval.

VUL described gec-co as a ‘world-leading’ geothermal engineering company based in Germany.

It specialises in projects at surface: power plants, heat stations, drill pads, and permitting.

The company is also involved in high and low enthalpy brine projects worldwide.

Gec-co employees 25 staff and has over 20 years’ experience in the industry.

Today’s announcement follows Vulcan’s agreement this February to acquire the sub-surface development company GeoThermal.

GeoThermal is a scientific team in Germany focusing on sub-surface development of geothermal projects, including exploration and production drilling.

Source: Company presentation

How will Vulcan fund the acquisition?

Vulcan agreed to pay the following consideration to acquire gec-co:

- 325,000 fully paid Vulcan ordinary shares to be issued on completion of the acquisition.

- 216,667 (2/3) of these shares will be subject to 12 months’ voluntary escrow from the date of issue.

- Earnout of up to €1,190,000 linked to project development milestones for the Vulcan Zero Carbon Lithium Project.

How did VUL management respond?

Vulcan Managing Director Dr Francis Wedin believes the recent acquisitions help the firm in ‘accelerating the development of our globally unique project.’

In Dr Wedin’s view, the acquisitions will complement VUL’s existing crew and international partners.

In total, Dr Wedin believes the lithium producer is ‘very well positioned…to co-produce a world-first lithium hydroxide with net zero carbon footprint for the European electric vehicle market.’

VUL Share Price Outlook

The market’s expectations for VUL are high.

For instance, the lithium player is trading at a hefty market cap of $818.9 million on revenues of $371,997 and a net loss after tax of $5.2 million for the half-year ended 31 December 2020.

That contributes to VUL’s Price to Sales ratio (trailing 12 months) of 2,400.

In other words, investors are willing to spend $2,400 per dollar of Vulcan sales.

But markets are forward-looking, and what VUL’s valuation suggests is a market looking out very far indeed.

Bloomberg recently reported that supply of lithium hydroxide is expected to tighten this year and for ‘prices to rise along with battery consumption’.

It also cited figures from BloombergNEF indicating lithium demand may grow ‘almost eight-fold by 2030 from last year’s levels.’

The upgraded forecasts led lithium giant Albemarle to lift its demand forecast by 14%.

Albemarle now expects it to exceed 1.1 million tonnes produced by 2025, up from 300,000 tonnes currently.

However, with great expectations baked into VUL’s share price already, challenges may arise.

Can VUL live up to the market’s expectations?

I’m not the Oracle of Omaha so it’s difficult to say, but it’s likely the next 12 months will be telling for the trajectory of Vulcan’s stock.

Moving aside questions over which lithium stocks will flourish in 2021 and beyond, it is clear that we are in the midst of a green revolution.

Governments and private interests alike are converging on electric vehicles and renewable energy.

But what exactly does this trend mean for savvy private investors? Can they stand to benefit?

If you’re interested in answers to these questions, then I suggest reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you can capitalise on the $95 trillion renewable energy boom. Download your free report now.

Regards,

Lachlann Tierney,

For Money Morning