The QuickFee Ltd [ASX:QFE] share price rocketed today on the back of strong Australian lending numbers and a record month for US PayNow transactions.

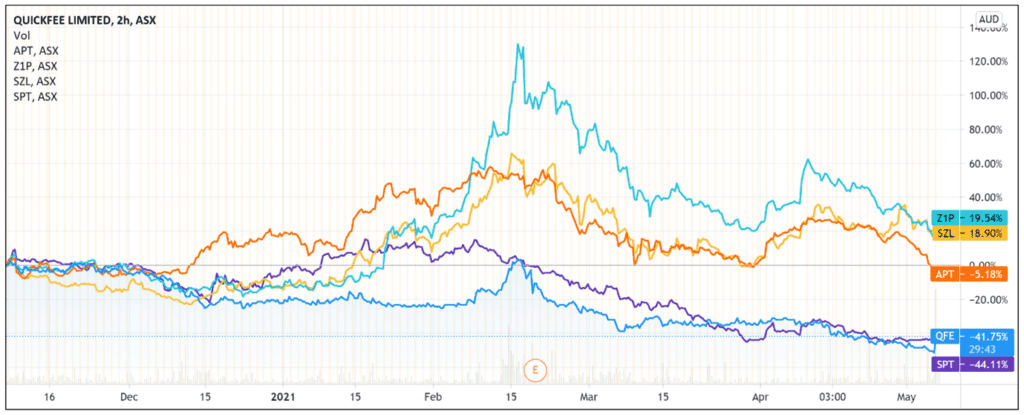

QFE shares were up as much as 42% in early trade before retracing somewhat to exchange hands for 29 cents a share. Source: Tradingview.com

Source: Tradingview.com

QuickFee posts strong numbers

Here are the highlights from QFE’s update.

‘April lending in Australia hit a new high for FY21 at A$3.5 million, up 30% on the previous highest month in FY21, signalling encouraging signs for a recovery in the local business following the end of the JobKeeper stimulus.

‘QuickFee processed US$76.4 million in US PayNow volume in April 2021, another record month, equating to a run rate of over US$900 million.

‘QuickFee Instalments are starting to gain strong traction in the US, with volumes in April at US$180k, 600% up on the previous month; 445 and 191 merchants now signed up in the US and Australia, respectively.

‘US investment bank, D.A. Davidson appointed to secure expanded funding lines to support the expected growth in QuickFee’s loan book. The company has entered into a term sheet with a leading global finance company.’

QuickFee did acknowledge that traditional financing in the US remains in line with its previous quarter’s run-rate, stating that the US government stimulus continues to weigh on lending growth.

QFE compared to its BNPL peers

QFE’s rise today contrasted with the downcast fortunes of its bigger BNPL peers.

Yesterday, Afterpay Ltd [ASX:APT] shares fell below $100 and the BNPL darling continued its slump today, down 4.5% at the time of writing.

Both APT and Zip Co Ltd [ASX:Z1P] are down 21% and 12% respectively over the past week.

Some analysts attributed the recent BNPL mood change to PayPal’s looming Australian entry in Q2 2021.

Others theorised that growth stocks in general could be nearing a market top where already priced in expectations blunt any ‘good news’ announcements.

For instance, Chief Investment Strategist at HighTower told CNBC that ‘high multiple stocks in tech are very crowded.’

‘You have very tough comparisons going forward. But also the valuations. High valuations don’t do well when you see better GDP growth, a little bit more inflation.’

It is also interesting to compare QuickFee’s metrics with its rivals when trying to explain its outlier performance today.

Let’s consider the Price to Sales ratios for APT, Zip, Sezzle Inc [ASX:SZL], and Splitit Ltd [ASX:SPT].

Afterpay has a P/S ratio of 41 based on trailing 12 months revenue of $670.93 million.

Zip has a P/S of 16.

Sezzle has a P/S of 28.

Splitit has a P/S of 49.

And what about QuickFee?

Out of this cohort, QFE has the lowest P/S ratio of 8.

Investors bullish on the BNPL sector but nonetheless wary of high valuations may be shifting to junior BNPL players with both growth potential and modest valuations.

If you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, then definitely read our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning