The Humm Group Ltd [ASX:HUM] share price up nearly 10% as market digests its 3Q21 business update.

At the time of writing, Humm’s share price was up 9.5%, exchanging hands for 94.7 cents per share.

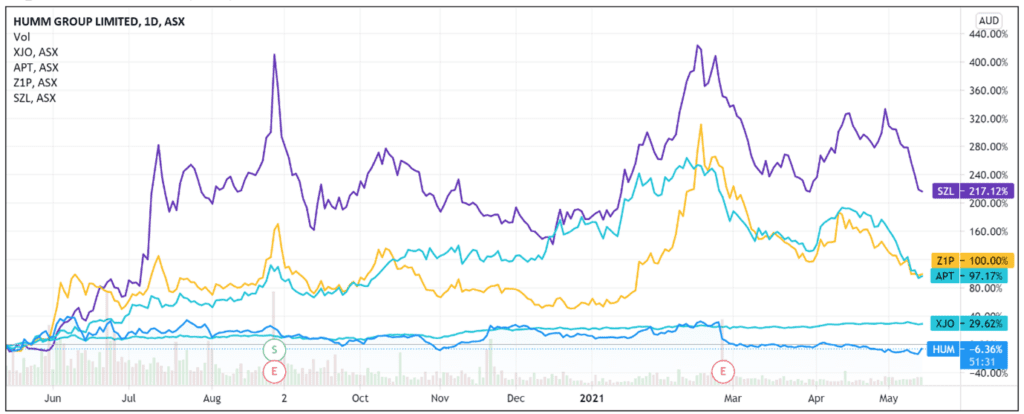

Today’s spike contrasts with Humm’s recent performance, which mirrored the downturn for BNPL players generally.

For instance, having dropped below $100 last week, Afterpay Ltd [ASX:APT] shares continue to tumble, losing 31% over the last month.

Humm itself has traded largely sideways since March, with the stock down 15% year-to-date.

Let’s examine what led to Humm reversing its recent momentum.

Humm records growing transaction volume

Here are the key highlights from Humm’s latest business update.

- ‘Record transaction volume for BNPL segment in March 2021 of $100.8m, with 3Q21 volume of $255.3m, up 33.0% on pcp.

- ‘Cards (Australia and New Zealand) volume of $264.8m, down 26.5% on pcp although spend returning to key volume categories.

- ‘Commercial and Leasing volume of $142.2m, up 61.7% on pcp.

- ‘Total hummgroup customers of 2.7m as at 31 March 2021, up 40.0% on pcp.

- ‘Greater digital penetration with 303.9k app downloads in 3Q21 (3Q20: 215.4k).

- ‘Improved net loss (gross write offs net of recoveries) of $18.7m, down 31.4% on pcp.

- ‘1,111 merchants integrated in 3Q21 including strong growth in key verticals of health, luxury retail, home improvement, and automotive.

- ‘Market launch into the United Kingdom on track for this financial year.

- ‘Appointment of Canada Country Head, Mr Tim Moulton, and launch in 1H22.’

Can Humm sustain today’s momentum?

BNPL players are experiencing a sell-off recently as a value rotation takes hold and inflation fears in the US percolate to the ASX.

Stronger-than-expected US inflation data for April sent Wall Street lower yesterday on concerns of a tighter monetary policy.

Such a macroeconomic context doesn’t favour growth and tech stocks.

Australian tech stocks for instance, followed their NASDAQ counterparts and fell more than 5% yesterday, their lowest since 5 October last year.

So how can one interpret Humm’s share price jump?

Does today’s price action indicate that Humm could be building momentum?

Or will today’s result become an outlier to the recent downward trend for Humm and its BNPL peers?

As I’ve covered recently in regards to QuickFee Ltd [ASX:QFE], it could be the case that smaller BNPL players are attracting investors more in today’s climate as they present a better entry price on fairer valuations.

For instance, QFE has a price-to-sales ratio of about 8.

This compares to Afterpay’s 37.

Humm itself has a P/S of 2, a large discrepancy.

As I’ve noted last week, it could be the case that the hype around BNPL hasn’t died down.

Instead, investors could be selling stakes in BNPL players they think are stretching valuations and turning to the likes of Humm, with its P/S of 2 and a trailing P/E of 15.

If you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, then definitely read our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.