The Galaxy Resources Ltd [ASX:GXY] upgraded its full-year production guidance due to a higher-than-expected production rate at its lithium site.

The Galaxy share price stock rose as much as 2.8% in early trade before retracing somewhat to exchange hands for $4.01 per share at the time of writing.

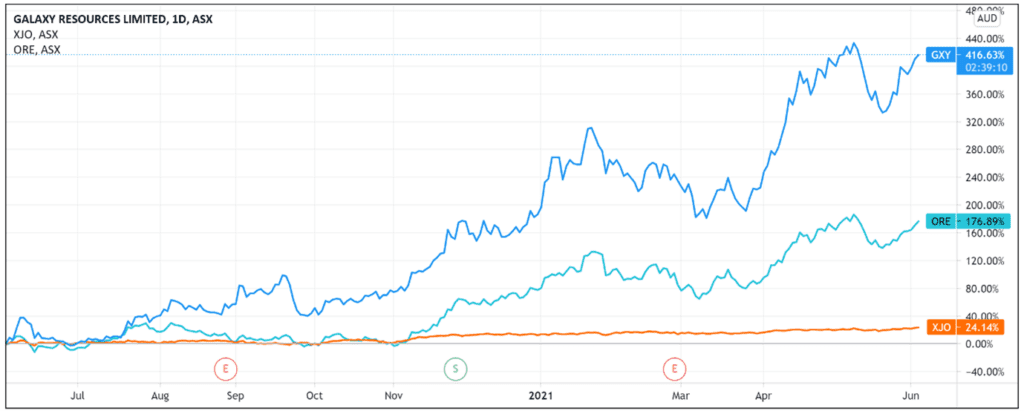

The last time we covered GXY news was when the lithium producer announced a merger with Orocobre Ltd [ASX:ORE] to create the fifth-largest lithium chemicals company in the world.

Since that announcement in April, Galaxy shares are up 4.6% and ORE shares are up 5.6%.

Looking further out, GXY is up a significant 370% over the last 12 months, highlighting the optimistic mood prevailing in the ASX lithium sector.

GXY lithium production upgraded

Galaxy Resources updated the market today on the production rate of its Mt Cattlin lithium project.

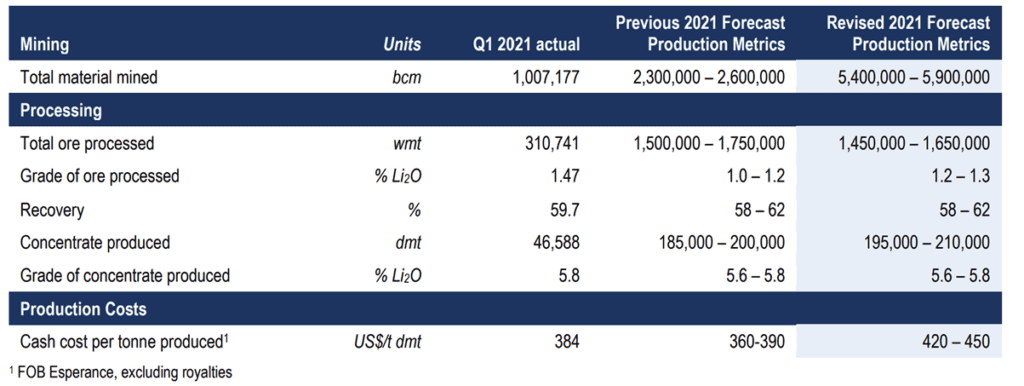

GXY reported that Mt Cattlin is producing at full rate with over 40,000 dry metric tonnes (dmt) of spodumene concentrate produced in Q2 to the end of May.

Shipped spodumene grade was in line with customer requirements at 5.77% Li2O.

The sustained high production rate led Galaxy to increase full-year guidance to 195,000–210,000 dmt.

This guidance is higher than the previous range of 185,000–200,000 dmt.

The producer also noted that 2021 expected sales volumes ‘continue to be in line with production’.

ASX GXY outlook

In commentary tucked away in the appendix to today’s ASX release, Galaxy provided an assessment of the lithium market.

At current sales prices, GXY forecasts Mt Cattlin to make a profit, with ‘sales prices expected to meet or exceed current prices.’

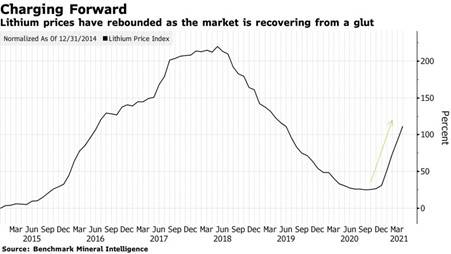

Lithium prices have rebounded from the lows of early 2020, and are currently enjoying a sustained upward trend.

Bullish investors may argue the oversupply that sent lithium prices plummeting in 2018 is less likely today, with a more concerted effort from governments and legacy automakers to go electric.

In the bullish scenario, lithium prices are likely to maintain their current prices and could rise further.

It’s also interesting to look at the lithium sector as a whole.

One way to do that is via the Solactive Global Lithium Index, which tracks the performance of the largest and most liquid listed companies active in producing the white metal itself or lithium batteries.

Source: Solactive.com

Source: Solactive.com

Since June 2020, the index is up 130%.

Although it’s currently down 5.8% from its January 2021 peak, potentially showing that some of the initial frenzy is tempering.

If Galaxy’s Mt Cattlin continues to operate at full rate, it could stand to benefit from favourable market conditions.

Lithium stocks are riding a strong wave of interest recently.

Governments are eyeing off a greener future while enterprises are eyeing off profitable ways to accelerate this future.

Lithium is at the core of this as the white metal is a key part in the global EV supply chain.

Therefore, if you want more information on a sector enjoying a resurgence, I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.