The PointsBet Holdings Ltd [ASX:PBH] entered an agreement with the Riverboat on the Potomac to provide online and retail sports wagering in the state of Maryland.

PBH shares oscillated on the news, with the market seemingly unsure how to digest the development.

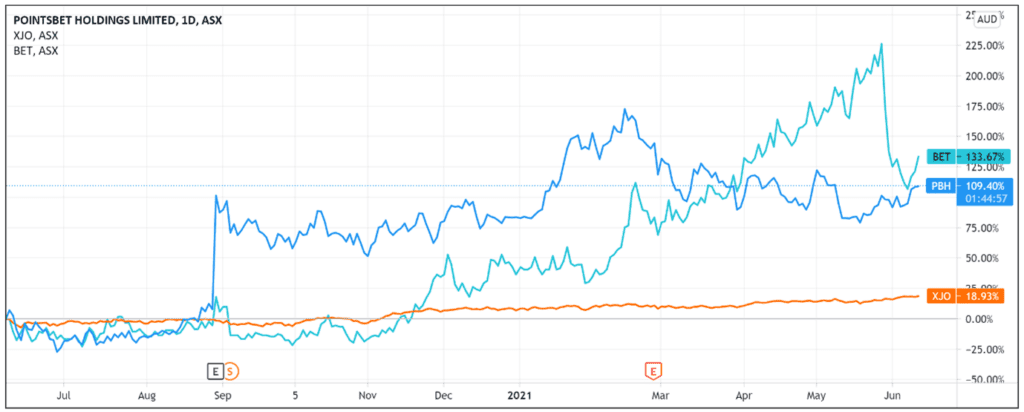

At the time of writing, the PointsBet Holdings Ltd [ASX:PBH] share price was slightly up by 0.2%, having traded as high as 2% earlier in the day.

Despite a turbulent May, PointsBet is still up 13% year-to-date and up 90% over the last 12 months.

PointsBet expands reach

PointsBet’s wholly-owned subsidiary PointsBet Maryland entered an agreement with the Riverboat Group to offer online and retail sports wagering in the state of Maryland.

This comes after the Maryland governor signed legislation permitting both online and retail sports betting in the state.

The agreement sees PBH partnering with the ‘revered’ Riverboat on the Potomac — a licensed satellite simulcast facility for horseracing.

PointsBet USA CEO Johnny Aitken said he was ‘thrilled to begin the process toward offering the passionate, sports-loving community of Maryland with the fastest and most differentiated sports betting product across every customer touchpoint.’

Equally optimistic, Co-Managing Member of the Riverboat Group Winston DeLattiboudere thought the partnership offers an ‘enormous opportunity.’

Key features of the agreement include:

- ‘The agreement involves PointsBet and the Riverboat Group partnering to launch online and retail sports wagering in the state of Maryland.

- ‘The initial term of the agreement is ten years.

- ‘PointsBet will pay to the Riverboat Group online and retail sportsbook market access fees as well as a portion of the Net Gaming Revenues derived from the online and retail sportsbook operations.

- ‘PointsBet will be responsible for the licensing and regulatory costs in connection with launching and operating the PointsBet services.

- ‘Neither party may terminate for convenience during the term.

- ‘Upon expiry or termination, PointsBet and the Riverboat Group have negotiated rights related to retention and utilization of client data acquired during the term, with PointsBet retaining the right to utilise client data it has directly acquired via the online channels.’

PointsBet Share Price ASX outlook

The lacklustre response to today’s news may have something to do with the agreement’s lack of financial detail.

Today’s update did not enumerate the revenue potential of this deal, and investors may have taken a wait-and-see approach as a result.

Some investors may also wonder how the deal stacks up for PBH if the wagering company is to pay the Riverboat Group market access fees and a chunk of its Net Gaming Revenues.

At what wagering volume would PBH make a profit under the deal?

It is not immediately apparent from today’s release.

For instance, when PointsBet gained approval to commence iGaming operations in Michigan, New Jersey, Pennsylvania, and West Virginia, it cited figures estimating iGaming revenues across these states exceeded US$770 million in the March quarter.

This at least provided the market with an indication of the addressable market.

It could be the case that PBH shares traded primarily sideways today as investors hold out for further potential details.

If you’re excited by technology, algorithms, and proprietary machine learning programs, then I think you may also enjoy reading our free report on new small-cap fintech stocks.

The report will go through three innovative Aussie fintech stocks with exciting growth potential.

Please have a read if you’re interested.

Regards,

Lachlann Tierney,

For Money Morning

PS: The Next Afterpay? Discover three promising Aussie fintechs that are currently trading below $1. Click here to learn more.