The SelfWealth Ltd [ASX:SWF] entered a trading halt pending a proposed $12 million capital raise through the issue of 25.6 million new shares at 39 cents a share.

Trading platform SelfWealth hopes to raise $10 million in a non-underwritten placement and a further $2 million from a share purchase plan.

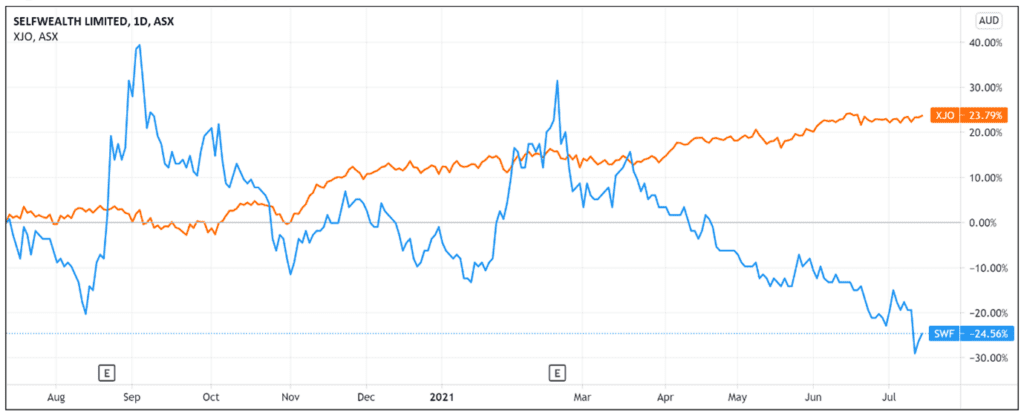

The capital raise follows a rocky period for the SWF share price. The stock is down 25% over the last 12 months, underperforming the ASX 200 benchmark by 55%.

SelfWealth set to raise $12 million

The $12 million capital raise will issue approximately 25.6 million new fully paid ordinary shares for 39 cents per new share.

The issue price represents a 9.3% discount to SWF’s last closing price and a 5.4% discount to its five-day volume-weighted average.

The new shares will rank equally with existing ordinary shares from the date of their issue.

Additionally, SelfWealth intends to tap its cash reserves for a further $3 million in funding.

Meaning the company aims to have $15 million at its disposal to ‘pursue investment in planned growth initiatives.’

Capital raise to fund growth initiatives

SWF told the market it undertook the placement to ‘accelerate investment in its growth strategy to deliver diversified revenue streams and increase market share.’

Importantly, SWF intends to broaden its product offering by including cryptocurrency and incorporating high-demand features such as instant payments.

The wish to accelerate its growth may have something to do with SelfWealth’s cash flows.

Although SWF’s latest quarterly — the quarter ended 30 June 2021 — showed a positive operating cash flow position, it was also a modest one.

In the June quarter, SelfWealth posted cash flows from operating activities of $140,000 from $5,109,000 in customer receipts.

Year-to-date (12 months), SelfWealth recorded positive cash flows from operating activities of $1,013,000.

The company ended the quarter with cash and cash equivalents worth $7,525,000.

SWF Share Price ASX outlook

It takes money to make money.

And SelfWealth probably thought the money it is currently making isn’t keeping up with its growth ambitions.

These ambitions are informed by SWF’s rapid increase in users and trades on its platform.

For instance, in 1H FY21 SelfWealth recorded a 208% increase in active traders and a 379% increase in total trades for the half.

So SWF is likely tapping the market for funds to capitalise on and accelerate that growth.

It will be interesting to see how the market reacts to the announced capital raise and whether the pending injection of cash will arrest SWF’s share price slump.

Now, SelfWealth choosing to broaden its product offering by including cryptocurrency also highlights the growing crypto uptake by fintechs and their customers.

Whether one thinks Bitcoin [BTC] is overpriced or under-priced, the world of crypto and the blockchain technology underpinning it is attracting more and more interest.

So it pays to keep up with trends potentially set to alter our lives.

That’s why I recommend checking out this special briefing by Ryan Dinse and Greg Canavan on what they are calling a ‘New Game’.

Traditional finance players like the big banks are moving quickly to adapt to it. But there’s a good chance they won’t be able to move fast enough.

You can watch the whole presentation right here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here