The BetMakers Technology Group Ltd [ASX:BET] shares fell despite an early rally after BET’s Q4 FY21 quarterly release.

BET shares were down 1.6% at time of writing. But at one stage, the BetMakers share price was up as much as 5.9% in early trade.

It appears investors are unsure how to interpret the company’s quarterly results. Or it could indicate some investors took this quarterly release as an exit sign and took profits.

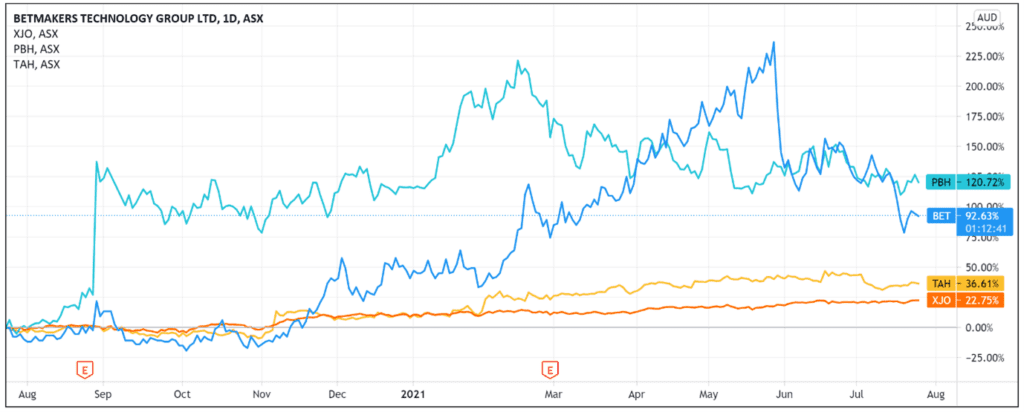

While up a handsome 90% over the last 12 months, the BET stock is in a recent slump, shedding 40% off its 52-week high.

The slump coincided with BetMaker’s $4 billion cash-and-scrip offer for Tabcorp.

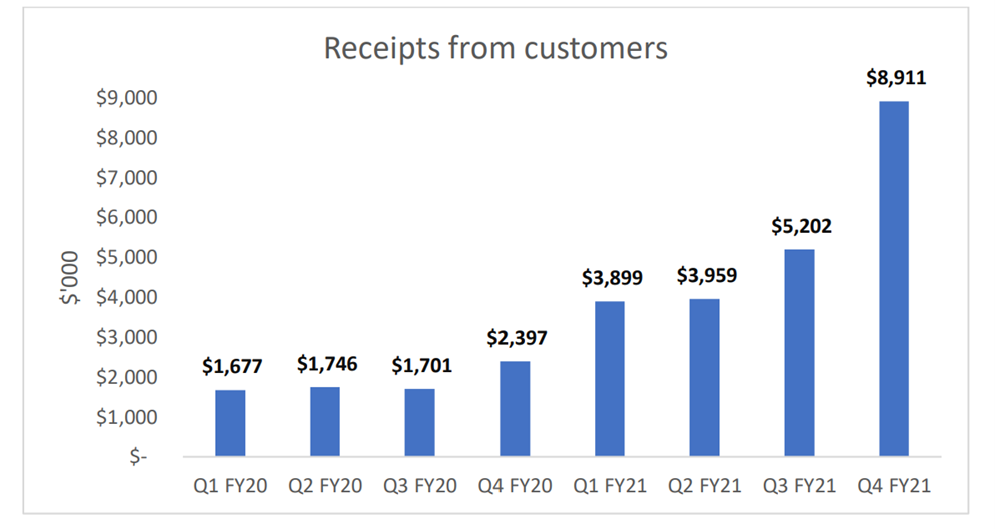

BET’s customer receipts grow 71%

Here are the key highlights from BetMakers’ latest quarterly:

- ‘$8.9mil in cash receipts from customers in Q4 FY21

- ‘71% increase versus Q3 FY21 and 272% increase versus Q4 FY20

- ‘Completion of acquisition of Sportech racing, tote and digital business

- ‘Fixed Odds Bill passed unanimously in Senate and General Assembly in New Jersey

- ‘Acquisition of Form Cruncher and Swopstakes assets

- ‘Placement shares issued to wagering industry leader Matt Tripp

- ‘Closing cash balance of $120mil.’

While the $8.9 million was a significant increase on past corresponding periods, the associated operating costs led BET to register a modest net cash position of $648,000 in the quarter.

Year-to-date (12 months), BET posted a net cash loss from operating activities worth an even $1,000.

BET share price — what’s the outlook?

As we covered earlier this month, BET’s recent rescinding of its Tabcorp takeover bid means BetMakers is seeking new avenues to grow.

Will the company look for other takeover targets or double down on its existing operations to drive organic growth?

BetMakers has already acquired Sportech and the assets of Form Cruncher and Swopstakes this quarter.

It pays here to note what BET CEO Todd Buckingham said regarding the acquisitions:

‘I am especially pleased that we have completed the acquisition of Sportech’s racing, tote and digital assets during Q4 FY21.

‘This material acquisition is a cornerstone of our future plans and we are delighted to have welcomed staff within these businesses into the BetMakers’ team.’

The weight given to the acquisition may suggest BetMakers will target other acquisitions in the upcoming quarters in its pursuit of growth.

BetMakers has quickly made a name for itself and has been a solid performer in the small-cap sector.

If you’re looking to read about other exciting small-cap opportunities, Money Morning’s got you covered. Our latest report goes over four overlooked companies that are looking primed for future gains. Just check out this free report, right here, for more info.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here