The Ioneer Ltd [ASX:INR] share price gained 5% in early trade following the release of INR’s June quarterly.

The emerging lithium-boron supplier ended the June quarter with $83.1 million in cash and cash equivalents on total outgoings of $7 million.

The quarter’s highlight was the signing of Ioneer’s first binding offtake agreement with EcoPro.

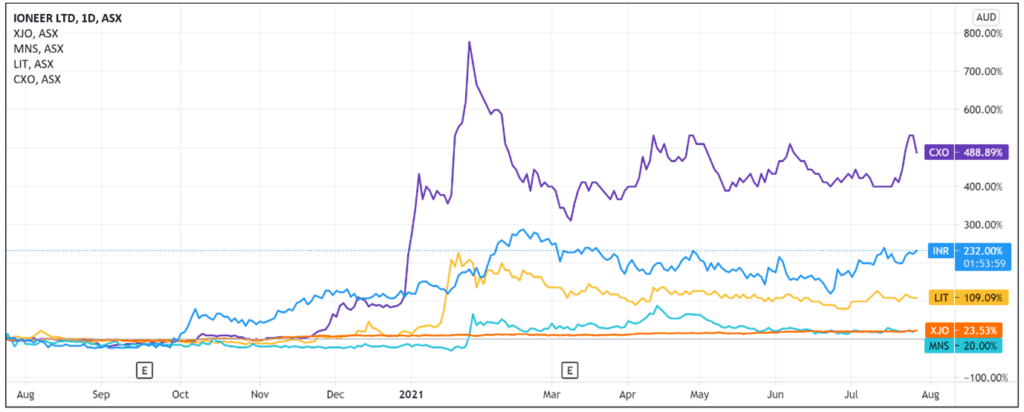

Today’s results come after the lithium-boron stock gained 215% over the last 12 months.

Milestone offtake agreement

The biggest highlight of the June quarter for Ioneer was the binding offtake agreement signed with Korean firm EcoPro Innovation.

INR described EcoPro as the world’s second-largest NCA cathode materials manufacturer, and a major player in the EV battery supply chain for US automakers.

INR Managing Director Bernard Rowe thought the signing was a ‘major milestone’ and demonstrates confidence in Ioneer’s Rhyolite Ridge project and the ‘quality of our lithium battery material products.’

The three-year offtake agreement includes INR supplying up to 7,000 tonnes per annum (tpa) of lithium carbonate.

This represents up to a third of Rhyolite Ridge’s annual lithium carbonate output for the first three years of its production.

There were some caveats.

The agreement will only go ahead if Ioneer reaches a final investment decision.

And the offtake’s 7,000 tpa stipulation comprises an ‘initial and firm 2,000 tpa’ and an additional and ‘optional’ 5,000 tpa subject to mutual agreement.

INR’s cash position

Expectedly, as an emerging lithium producer, INR did not record any receipts from customers for the quarter or year-to-date.

Meaning the lithium stock posted a net cash loss from operating activities of $2.04 million. Year-to-date (12 months), that net cash loss from operating activities came to $7.65 million.

Unsurprisingly, Ioneer’s biggest cash drag was exploration and evaluation.

The firm spent $4.99 million on exploration and evaluation for the quarter and $22.70 million year-to-date.

The expenses are noteworthy but were absorbed by INR issuing new shares and raising $80 million in March.

INR Share Price ASX Outlook

Ioneer’s Bernard Rowe was upbeat following today’s June quarter release.

Rowe described his company as the ‘most advanced lithium development project in the US.’

He also thinks INR is in a ‘strong position’ to capitalise on the rising demand for lithium products.

As we covered in March, Ioneer’s Rhyolite Ridge is a strategic location with a large ore reserve.

Given management’s optimistic stance, investors may now expect the company to continue securing high-profile offtake agreements in the medium term to shore up forward sales.

The interest in lithium stocks is likely to intensify as governments and legacy automakers shift their focus to electric vehicles.

Therefore, if you want more information on a sector enjoying a resurgence, then I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report