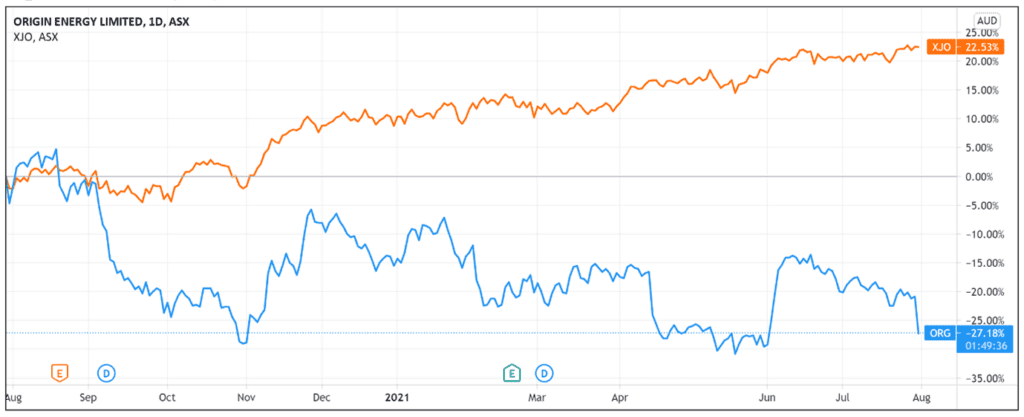

Origin Energy Ltd [ASX:ORG] share price floundered this morning after the company’s latest quarterly update revealed some leaky spots.

At time of writing, the energy leader’s shares are down over 8% to $4.10.

The energy leader anticipates it will log non-cash impairment charges of almost $2.25 billion after tax.

These charges comprise $1,578 million (post-tax) expected for Energy Markets goodwill and generation assets, and a tax expense of $669 million relating to a deferred tax liability.

Why is the Origin share price falling?

If hefty charges stall Origin’s momentum into FY22, it’s understandable that investors may feel deterred at this stage.

Management pointed to a decrease in wholesale electricity prices and were quick to acknowledge additional contributing factors.

It was noted that a reduction in gas earnings (caused by higher procurement costs and poor business customer demand) were also influential in the charge.

As the cost is non-cash, the company’s FY21 Energy Markets underlying EBITDA guidance of $940 million to $1020 should remain unaffected.

Yet FY22 looks like another story, and this is likely what’s sending investors running.

In another bleak point in the report, Origin stated it expects the FY22 underlying EBITDA for Energy Markets to drop $450 million to $600 million.

How does this bode for Origin’s outlook?

Strong CEO sentiment despite low gas sales

Origin CEO Frank Calabria took an optimistic stance in the report, stating:

‘The strong performance of Integrated Gas continues, with full-year production at Australia Pacific LNG stable even as we significantly reduced development activity and costs, reflecting the performance of the gas fields.’

Calabria also highlighted the fact that higher realised commodity prices and domestic volumes had driven a strong increase in Australia Pacific LNG revenue during the past quarter.

Although FY2021 gas sales volumes decreased overall by 11%, the CEO underlined that the tide seemed to be turning.

‘Wholesale electricity prices recovered strongly during the quarter,’ Calabria commented, ‘due to a number of unplanned baseload plant outages in the National Electricity Market and a winter cold snap, which also drove higher demand for gas.’

The development of a new and more efficient retail operating model continues to progress smoothly as the company migrates to the Kraken platform — with 250,000 customers already said to be on board.

The goal is to have all Origin customers on the upgraded platform by 2022’s year-end.

How to get ahead in the energy game

Although Origin could remain an established, strong energy leader, our energy expert James Allen believes renewable energy firms could be the way of the future.

In his latest report, he reveals how to find clean energy and renewables stocks with explosive potential in the next decade and why an industry-wide disruption could result in certain superstar stocks for investors.

Interested in finding out about what could potentially be the most exciting up-and-comers in energy?

You can access James Allen’s latest research You’ll also get a free subscription to Money Morning – a daily investment e-letter that shares with you the kinds of investment ideas most mainstream sources haven’t even heard about yet.

Simply click

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is an easy way to start finding investment opportunities — in energy and beyond. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.