‘Mind-bending…’

That’s how CoinDesk’s Brady Dale recently described the revolution that’s happening with what we are calling ‘new-game income’.

Dale likens it, and DeFi in general, to the course the internet took as a publishing platform…

‘First, it recreated things from the analog world. Then it invented new things. Then new things were built on top of the new things. Finally, the internet colonized the analog world. We’re at phase 3 in DeFi: new things built on new things.’

You’ll get a feel for the ‘mind-bending’ potential of these new income tools in our just-released how-to guide, which you can read in full here.

One of the strategies we unwrap for you is a protocol called Yearn.

Yearn was formed in a blaze of glory early last year by a coding superstar of the DeFi world, Andre Cronje.

He basically created pre-programmed ‘vaults’ to automate the yield generation strategies he was doing manually.

Since then, these vaults have offered up totally stratospheric returns as high as 40%. Those massive returns, clearly, come with much higher risk.

The Yearn strategy we outline here is simpler. You likely won’t get an income as high as 40%. And, while it’s still riskier than having your money in the bank (we outline risks in your new guide), it offers a more stable yield with lower gas fees.

Some have called Yearn the ‘Black Rock of DeFi’. That’s because it’s very similar to how Black Rock made a plethora of managed funds available to anyone in the world in the ‘80s and ‘90s.

But that’s where the old game/new game similarity ends.

The difference between this and a managed fund with Black Rock is that in DeFi, you retain full control of your stablecoins.

At all times.

This is possible due to smart contracts built on blockchain protocol.

This is the brave new finance world.

One we’ll be introducing you to in full here.

There are multiple avenues opening up here. These range in risk, reward, and required crypto knowledge.

But what you’ll find in this brand-new report are three beginner strategies.

They’re based on generating income from stablecoins; cryptos that try to maintain a 1:1 peg with the US dollar.

We have how-to guides on other income methods (like using staking) in the works. But we wanted to fully explain the ‘anyone-can-do-it’, simpler option to you first.

These stablecoin income strategies are the best way to test the waters here.

Why?

Well, first check this out…

|

|

|

Source: Benzinga.com |

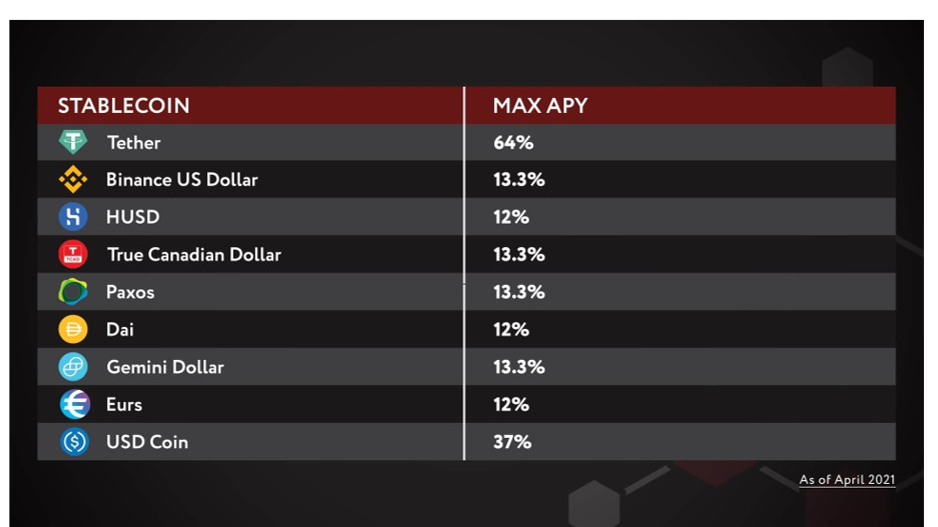

That’s a snapshot of the kind of income certain stablecoins offer.

‘APY’ is annual percentage yield.

As you can see, they’re impressive. They blow the banks out of the water.

But that’s because they come with added risks. It’s a very new financial instrument, no matter how ‘stable’ it is — this new income avenue is less than five years old. For that reason, if you want to start earning income this way, we suggest you start out simple and work your way up.

Even though it’s simple, you should still consider this three-part income strategy as ‘speculative savings’.

Regards,

|

Ryan Dinse,

Editor, New Money Investor

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here