The Vulcan Energy Resources Ltd [ASX:VUL] and top European automaker Renault today announced a five-year partnership concerning the supply of battery-grade lithium chemicals.

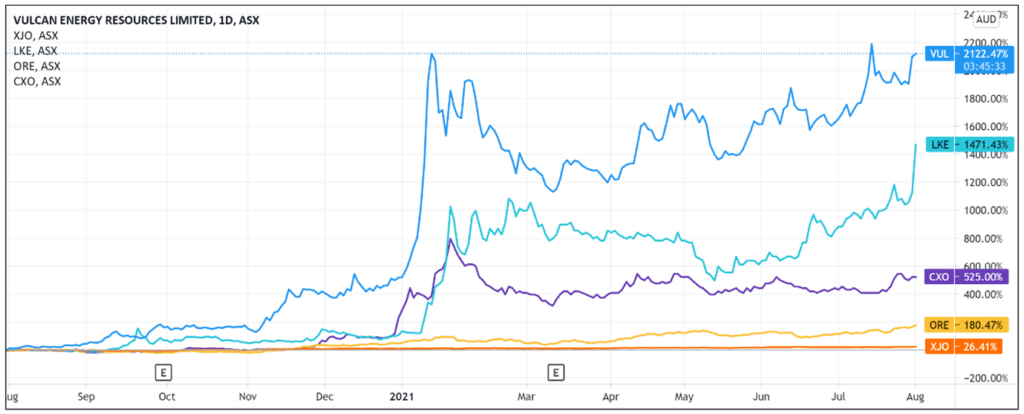

Vulcan Energy Resources Ltd [ASX:VUL] shares were up as much as 4.7% in early trade before pulling back at noon. The lithium stock was up 2% at time of writing.

The Renault partnership comes two weeks after Vulcan entered its first binding lithium offtake term sheet with LG Energy Solutions, the world’s largest producer of lithium-ion batteries.

Three Ways to Invest in the Renewable Energy Boom

‘Made in Europe’ — Vulcan partners with Renault

In its ambition to offer sustainable, ‘made in Europe’ electric vehicles, top automaker Renault has tapped Vulcan as a supply partner.

The parties signed a five-year lithium offtake term sheet that can be extended if mutually agreed.

The offtake’s commercial delivery is set for 2026.

Under the deal, Vulcan will supply Renault between 6,000 and 17,000 metric tonnes of battery-grade lithium chemicals per year.

Vulcan said the deal would help Renault avoid 300 to 700 kilograms of CO2 for a 50-kWh battery.

Why is this important?

As Managing Director of Alliance Purchasing at Renault explained:

‘Our environmental and social responsibility is at the heart of the Renaulution and this must apply to the providers we partner with if we want to … offer the most sustainable vehicles in the market.’

The Renaulution plan — which includes the commitment to a zero CO2 footprint in Europe by 2040 — gels with Vulcan’s Zero Carbon Lithium Project in the Upper Rhine Valley.

The announced offtake term sheet is conditional on the parties executing a Definitive Agreement on ‘materially similar’ terms by 20 November 2021.

VUL share price: What next?

VUL’s partnership with Renault makes sense.

Renault seeks to achieve carbon neutrality worldwide in 2050. And Vulcan wishes to become the world’s first lithium producer with net-zero greenhouse gas emissions.

By 2030, Renault hopes to have 90% of its sales mix comprise battery electric vehicles, four years after the first anticipated commercial delivery of the offtake with Vulcan.

In its Pre-Feasibility Study (PFS) released early this year, Vulcan cited estimates from Canaccord and Fastmarkets suggesting the average annual price for lithium hydroxide will ‘remain above $15,000/t long term.’

The PFS also noted Vulcan’s lithium project has an estimated production capacity of 39,400 tonnes a year.

This means the proposed agreement with Renault represents — at minimum — about 15% of VUL’s annual production capacity and — at maximum — about 43% of VUL’s production capacity.

If we also take the price estimates cited by Vulcan, we get a rough approximation of this agreement’s potential revenue ramifications.

The Renault offtake agreement could bring in between $90 million and $255 million a year for Vulcan.

If you’re researching lithium stock investments and want more information or ideas, then I’d recommend reading Money Morning’s free 2021 lithium report.

If you’re keen for more reading, this report on energy disruption is also a great resource. It goes through finding promising energy stocks and discusses why the energy market is ripe for massive disruption.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report