Kogan.com Ltd [ASX:KGN] has suspended its final dividend as net profit and EBITDA both fell, despite full-year revenue of $1.18 billion.

The steep drop in net profit precipitated a sell-off, with Kogan.com Ltd [ASX:KGN] share price currently down 14%. Kogan stock was exchanging hands for $11.30 a share.

As we’ve covered earlier, Kogan’s issues with inventory and rising warehouse costs this year have contributed to KGN shedding 45% over the last 12 months, well underperforming the overall market.

Kogan’s FY21 results

Here are the key FY21 results:

- Gross sales rose 52.7% to reach $1.18 billion

- Revenue rose 56.8%, totaling $780.7 million

- Net profit after tax down 86.6% to $3.5 million

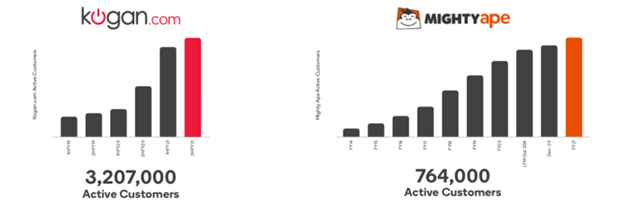

- Active customers up 46.9% to 3.21 million

- No final dividend declared

In FY21, Kogan managed to surpass $1 billion in gross sales for the first time in its history, while growing its active customer base to over three million.

However, the market zeroed in on the retailer’s significant drop in profits.

While Kogan boasted an adjusted NPAT growth of 43.2% to total $42.9 million, the non-adjusted FY21 NPAT was only $3.5 million, down nearly 90% from the previous year.

Why the large discrepancy between adjusted and non-adjusted NPAT?

Kogan said its net profit after tax was materially impacted by ‘one-off items’.

These one-offs included ‘significantly increased storage costs’ caused by excess inventory in 2H FY21, as well as logistics detention charges of $7.7 million incurred due to pandemic-related warehousing and supply chain interruptions.

The retailer had a Net Cash position of $12.8 million at the end of the financial year.

Finally, Kogan decided to preserve cash for ‘business investment and growth purposes and has paused dividends.’ Kogan will not declare a FY21 final dividend.

Founder and CEO, Ruslan Kogan, offered his thoughts:

‘Over the past 12 months, Kogan.com turned 15 years young, surpassed $1 billion in Gross Sales for the first time ever, surged past three million Active Customers, had record-breaking Black Friday sales, and made our largest ever acquisition to accelerate our expansion into New Zealand.’

Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

Successful acquisition of Mighty Ape

Kogan also reported that its newly acquired firm Mighty Ape is ‘progressively being integrated into the Kogan Group.’

For the seven months to 30 June 2021, Mighty Ape’s trading showed strong sales over the Christmas peak trading and the end of financial year sales periods.

Mighty Ape’s revenue and gross profit stood at $80.2 million and $19.9 million, respectively.

The subsidiary’s number of active consumers jumped to 764,000.

Source: Company’s Presentation

Source: Company’s Presentation

What’s next for the Kogan share price?

Kogan was one of the big winners during the peak of COVID-19 lockdowns last year, as consumers shifted to online shopping and working from home.

Kogan sought to capitalise on this trend and invested heavily in a warehouse network that saw facilities grow from 14 to 31.

However, you could argue Kogan’s sales growth forecasts were optimistic as mounting inventory led to discounting.

For context, KGN reported $34.74 million in warehouse expenses in FY21, compared to $13.57 in FY20.

And Kogan’s inventories, as registered on the retailer’s balance sheet, jumped from $112.88 million in FY20 to $227.87 million in FY21.

The profit losses reported today disappointed the market, but not everyone was rushing for the exits.

RBC Capital Markets analyst Chami Ratnapala thought KGN’s July and August gross sales and margins were positive signs, also noting that Kogan continues to slash inventory.

‘Our pricing analysis as of mid-August has seen largely reduced levels of discounting within Kogan’s key products categories and if these trends continue amidst supply shortages and ongoing lockdowns, we expect upside to Kogan’s gross margins at the next result.’

Kogan itself also remains optimistic and flagged its growth plans for FY22:

‘During FY22, Kogan.com expects to deliver strong growth in Kogan First memberships, ongoing growth in Exclusive Brands, further enhancement and development of Kogan Marketplace, and the benefits from the full integration of the Mighty Ape team and operations flowing through.’

Now, if you’re interested in overlooked small-caps that have the potential to disrupt traditional industries, I recommend reading the latest report from our market expert Murray Dawes.

He just put together a report profiling seven unheralded Aussie companies developing what he thinks are extraordinary new ideas.

Well worth a read.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here