The Zip Co Ltd [ASX:Z1P] recorded an FY21 net loss of $653 million as expenditure ballooned by more than 1,000%.

Zip Co Ltd [ASX:Z1P] share price dipped as much as 5.9% in early trade before recovering at noon. At time of writing, the BNPL stock was slightly up 0.5%.

After hitting a 52-week high of $14.53 in February, the ZIP stock has shed almost 50% since.

But Square’s interest in acquiring Zip’s biggest rival, Afterpay, has made the market look at Zip anew as another potential takeover target.

What will the market make of Zip’s widening losses but continued growth in underlying sales and customers?

Zip’s FY21 highlights and lowlights

Here is a summary of the key results from Zip’s results today:

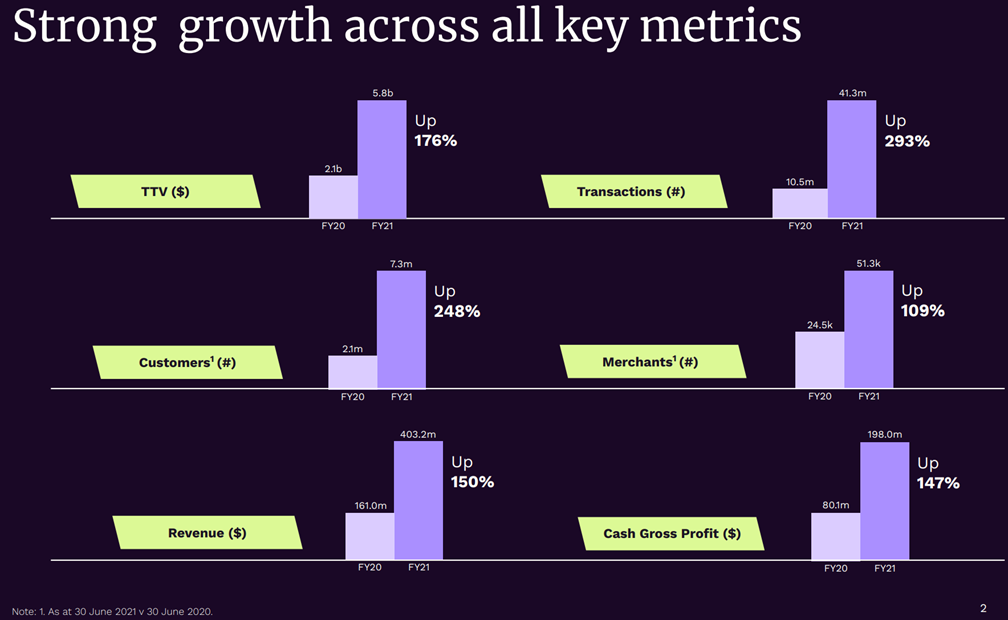

- Record revenue of $403.2 million, up 150% year-on-year (YoY)

- Record transaction volumes of $5.8 billion, up 176% YoY

- Customers reached 7.3 million, up 248% YoY

- Merchants reached 51,300, up 109% YoY

- Cash EBITDA loss of $22.9 million

- Net loss of $653.1 million

Z1P’s EBITDA FY21 loss missed consensus expectations for positive earnings of between $8 million and $9 million.

The EBITDA loss this financial year comes after a positive EBITDA of $3.5 million posted in FY20.

Z1P’s FY21 losses followed heavy investment in the company’s global expansion.

For the year ended 30 June, Zip recorded expenditure of a substantial $862.4 million, up 1,065% on FY20 expenditure of $73.9 million.

For one, Zip spent $71 million on marketing over the year.

This marketing outlay could persist into FY22 because the BNPL space isn’t getting any less competitive, with the likes of PayPal and Commonwealth Bank of Australia [ASX:CBA] entering the fray.

Two, salary and employee benefits expenses rose 120% to $97.7 million.

This, too, is likely to rise in FY22.

Z1P said it ‘has invested and will continue to invest in hiring and developing its employees to drive growth.’

Finally, expenditure ballooned partly due to an accounting adjustment to the firm’s acquisition price of US subsidiary QuadPay, worth $306 million.

The adjustment was deemed necessary to reflect a fall in Zip’s share price following the scrip deal and share-based payments to staff of $142 million.

Bad debts rise

Growing customer base and transaction volume inevitably raises bad debts.

Zip wrote off $74.5 million in bad debts during the 2021 financial year. This was up from $27.8 million in FY20.

The BNPL stock also provisioned $106.4 million for expected credit losses in FY21, compared to $52 million the year prior.

Zip reported that actual bad debts stand at 3.53% of closing receivables in FY21 compared to 2.35% in FY20.

These numbers raise several questions.

Is this an acceptable bad debt rate? Has Zip run the numbers on what it deems a satisfactory rate of bad debt?

And can Zip tighten its eligibility criteria to reduce bad debts without sacrificing its customer growth ambitions?

Z1P’s financial report did mention that its reported arrears rate and bad debt write-offs ‘remain well below management’s expectations of 2.5%, and market comparisons.’

This 2.5% threshold refers to bad debt write-offs net of recoveries (net amount written off as a percentage of closing receivables).

Zip outlook: Growth…but at what cost?

Z1P’s results today highlight the particularity of the BNPL growth model.

Despite more than doubling its revenue, transaction volumes, and merchants — and increasing its customers by 248% — Zip registered a net loss of $653 million.

At this stage of the business cycle, Z1P’s growth seems to be doggedly pursued by losses.

At what point will Zip reach critical mass where customer numbers and transaction volumes pay for themselves?

Today’s results suggest the BNPL firm isn’t nearing that critical mass yet.

For instance, having registered $44.2 million in cash flow from operating activities, Zip also paid $521.2 million in borrowing repayments.

In FY21, it also financed itself with proceeds from borrowings, convertible notes issues, and share issues totalling $1.72 billion.

Clearly, it is investing heavily in sustaining its fast growth. But investors will wonder how long Zip can grow this quicky and not post any profits.

When will the tide turn?

Now, whether or not one believes in the longevity of any particular BNPL business, it is hard to deny the global impact of Australian BNPL providers.

The proposed Square takeover of APT only reiterates the point.

Australia found itself as the incubator of firms offering a growingly popular payment method set to shake things up in the fintech sector.

Which only goes to show that the ASX is no backwater. It is home to companies that can disrupt old industries with new ideas.

Our market expert Murray Dawes has recently written a report outlining seven ASX small-caps that he thinks possess this disruptive potential.

If you want to read the report, you can access it here.

Well worth a look.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here