The Vulcan Energy Resources Ltd [ASX:VUL] posted a net loss of $10.8 million in FY21, as the lithium stock ended the fiscal year with $114.7 million in cash.

Vulcan Energy Resources Ltd [ASX:VUL] shares are currently trading at $14.23 per share, up 5.96% at time of writing.

Despite the reported net loss, Vulcan was able to raise $120 million from ESG investors to accelerate its Zero Carbon Lithium project development.

VUL shares have gained a substantial 1,900% over the last 12 months, highlighting the hot interest in the ASX lithium sector.

Let’s examine Vulcan’s highlights from its 2021 fiscal year.

VUL FY21 performance

As a junior lithium developer, it was unsurprising that VUL delivered modest revenue of $0.6 million, up from only $95,342 in FY2020.

Unable to offset expenses with big revenues, Vulcan reported a net loss after tax $10.7 million in FY21, up on the $3.5 million loss in FY2020.

However, the company ended the year with a strong cash position, totalling $114 million.

This is up from $6.4 million in FY20.

So Vulcan is now operating with a much larger cash cushion.

The increase in VUL’s cash stockpile came largely from the $120 million lithium stock raised via a strongly supported placement at $6.50 per share to a suite of ESG-focused institutions, including Hancock Prospecting Pty Ltd.

The company will use the cash for its investments at the Zero Carbon Lithium Project.

Looking at Vulcan’s cash flows, and we see that the biggest outflows were payments to suppliers and employees ($3.4 million) and payments for exploration and evaluation costs ($5.8 million):

Market expert reveals why every Aussie investor should pay attention to this trillion-dollar opportunity. Click here to discover more.

VUL share price outlook

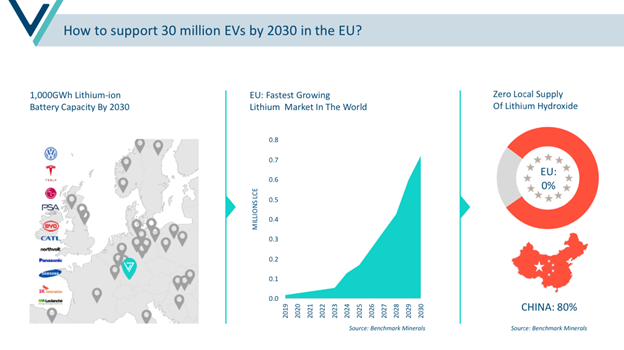

The Australian lithium sector has been one of the better performers on the ASX this year as the switch to green energy and electric vehicles sees demand for lithium ramp-up.

The current lithium market led Macquarie’s equity desk to upgrade its demand outlook:

‘We have materially upgraded our demand outlook for energy storage system demand and marginally increased EV demand.

‘This has translated to a material upgrade in forecast demand for lithium over the short and medium-term.

‘In the longer term, we believe the lithium market is likely to be in perpetual deficit.

‘As a result, lithium prices are expected to continue to rise, moving to an incentive price by CY24. Some new supply additions temporarily tighten the market in CY26, but beyond CY27 the supply deficit widens significantly.’

The recent spike in VUL’s share price can likely be attributed to the market thinking Vulcan is well-placed to capitalise on tight supply and rising demand in the coming years.

Moreover, the company is aware of the market dynamics and is investing in its growth.

For instance, Vulcan signed a binding agreement to acquire 100% of a geothermal sub-surface engineering firm as well as a geothermal surface consultancy company.

Apart from this, VUL has designed, built, commissioned, and is now operating a Direct Lithium Extraction (DLE) Pilot Plant to demonstrate lithium extraction from live geothermal brine.

VUL is focused on demonstrating pre-treatment and DLE processes, as well as the durability of the process over hundreds of cycles, which will feed into its Definitive Feasibility Study (DFS).

Now, if the potential of lithium-ion batteries to accelerate the clean energy revolution interests you, then you may enjoy reading the latest report from Murray Dawes and Ryan Clarkson-Ledward, our small-cap market experts.

They just released a report sharing their research on companies that seek to chemically ‘crack’ fossil fuel and transform it into clean energy.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.