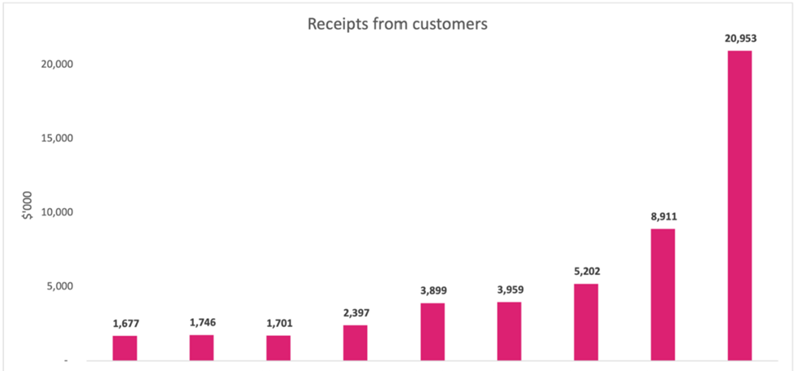

BetMakers’ cash receipts rise 135% on previous quarter

BetMakers Technology Group Ltd [ASX:BET] today released its September quarterly, registering $21 million in cash receipts in Q1 FY22, up 135% quarter on quarter.

Highlighting BET’s recent growth, the current quarter’s results were up a significant 437% on Q1 FY21.

The September quarter was BET’s strongest to date.

Source: BetMakers

Source: BetMakers

BET posted strong growth in its Australian platform and managed trading services operations. The company expects this growth to continue during the remainder of FY22.

BetMakers ended the quarter with $109 million in cash.

Raiz on track to hit $1 billion FUM target after another strong quarter

RAIZ Invest Ltd [ASX:RZI], a mobile-focused financial services platform, recorded growth across key metrics in the September quarter.

RZI’s normalised revenue rose 86% year-on-year to $4.2 million, aided by global active customers increasing 85% YoY to hit 533,755.

The fintech’s Australian funds under management shot up 94% YoY to $970.2 million.

Validating its strategy to broaden offerings, RZI’s superannuation FUM grew 159% YoY to reach $183.7 million.

The app’s annual recurring revenue (run rate) now sits at $13.7 million.

For more on ASX fintechs, click here.

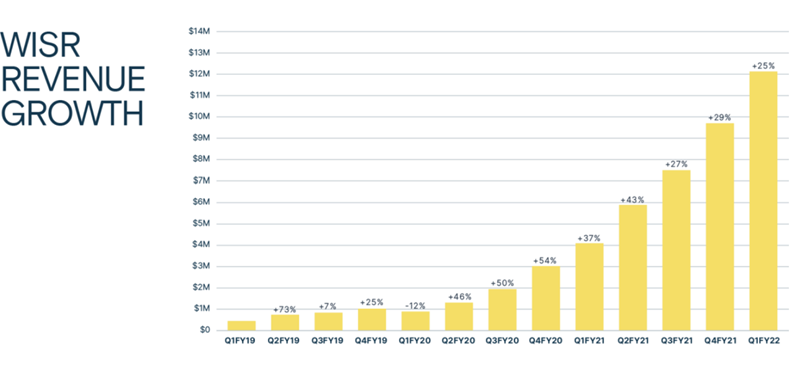

Wisr’s revenue grows 195% in September quarter

Wisr Ltd [ASX:WZR], Australia’s first neo-lender, released its September quarter results, delivering 195% revenue growth on the prior corresponding period and 25% revenue growth on the preceding quarter.

The September quarter marked a record quarter for WZR’s operating revenue, hitting $12.1 million.

The growth extends the fintech’s streak to 21 consecutive quarters of loan growth, with a record $132 million originations in the quarter, a 113% increase on Q1 FY21.

Secured vehicle loans are accelerating, contributing $47 million to the $132 million in originations, up 31% on Q4 FY21.

WZR’s total loan originations now stand at $743 million as of 30 September 2021, bringing WZR’s wholly-owned loan book to $475 million, up 247% on pcp.

Source:Wisr

Openpay goes live in the US

Openpay Group Ltd’s [ASX:OPY] consumer solution, OpyPay, is now live and transacting in the US healthcare market via a controlled rollout with ezyVet, who has access to 1,200 US veterinary clinics.

Unlike popular pay-in-four BNPL payment solutions, OPY’s OpyPay lets consumers spread payments out for up to 24 months.

OpyPay also sets a larger limit (up to $20,000).

Effective today, ezyVet is making OpyPay available to its 1,200 US veterinary hospitals and clinics via its practice management platform.

Brian Shniderman, CEO of OPY, said:

‘Our longer, larger, customized installment plans are built for life’s unexpected and important expenses, such as emergency dental surgery, sudden auto repair, and medical care for a beloved pet. In partnership with ezyVet, OpyPay will be made available to 1,200 US clinics as the rollout progresses — and we look forward to other partnerships to efficiently access our target verticals.’

For more on exciting small-caps, click here.

Life360 upgrades guidance as growth accelerates in the US

Life360 Inc [ASX:360], a family communications and safety platform, registered strong growth in the September quarter, with underlying revenue (excluding recent acquisition Jiobit) rising 45% year-on-year to US$29.3 million.

Annualised monthly revenue (again excluding Jiobit) for September 2021 stood at US$120.1 million, a 48% YoY increase.

The rise in revenue saw 360 record US$4.4 million in positive operating cash flow on the back of US$26.7 million in customer receipts.

Life360 ended the quarter with US$50.4 million in cash.

The quarter’s strong performance led 360 to bump up its annualised monthly revenue guidance.

It now expects AMR by December 2021 to be in the range of US$125–130 million. This compares with previous guidance of US$120–125 million.

Regards,

Kiryll Prakapenka,

For Money Morning