The Xero Ltd [ASX:XRO] share price is down 6% on the release of the tech firm’s latest half-yearly.

Xero registered H1 revenue of $506 million from 3 million subscribers.

XRO shares are currently trading at $138 a share.

Xero’s 1H22: the good news

Here are the highlights from Xero’s latest half-yearly:

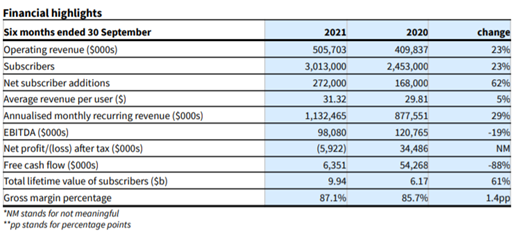

‘Operating revenue was up 23% to $505.7 million (26% in constant currency (CC))…

‘Total subscribers increased by 23% to 3.0 million…

‘Annualized monthly recurring revenue (AMRR) grew 29% to $1,132 million…

‘Total subscriber lifetime value (LTV) grew by 61% to $9.9 billion…

‘Gross margin increased by 1.4 percentage points to 87.1%…’

XRO’s annualised monthly recurring revenue surpassed $1 billion for the first time.

Xero’s total LTV rose to $9.9 billion.

Xero 1H22: the not-so-good news

If revenue rose by 23%, and total subscribers also rose by 23%, then why were XRO shares sold down?

While XRO managed to grow its top line, not all financial metrics were up.

Xero’s free cash flow fell drastically to $6.4 million, compared to $54.3 million.

And XRO’s EBITDA fell by 19% to $98.1 million from $120.8 million.

As Xero stated in its report:

‘EBITDA, net profit and free cash flow decreased versus H1 FY21 due to an increased level of investment spend across both sales and marketing and product development. The movement in these metrics reflects the heightened focus on cost management in response to the initial impacts of COVID-19 in the prior comparable period.’

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Xero provides outlook

Xero noted that total operating expenses (excluding acquisition integration costs) as a percentage of operating revenue for FY22 are expected to be in a range of 80–85%.

This figure is consistent with levels seen in the second half of FY21 and the pre-pandemic period.

Integration costs are expected to increase total operating expenses as a percentage of operating revenue by up to 2% for FY22.

Finally, Xero thinks its acquisition of Planday is expected to contribute about 3% of additional operating revenue growth in FY22.

If you’re thinking about fintech stocks, there are plenty of exciting options on the ASX right now.

A whole host of smaller and potentially more lucrative companies are awaiting the opportunity to explode.

We’ve put together a report on three of our top picks in the fintech scene right now.

You can check it out for yourself, for free, right here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here