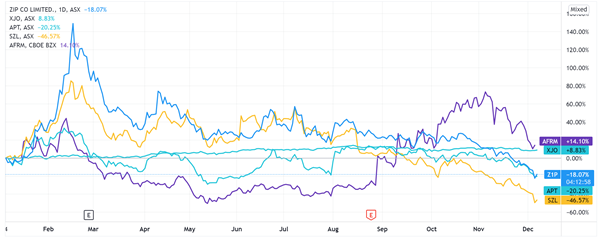

November’s metrics indicate Zip Co Ltd [ASX:Z1P] is processing around $10 billion transactions a year, which raises the question: is Zip undervalued relative to Afterpay Ltd [ASX:APT]?

As we covered yesterday, jittery markets sent ASX buy now, pay later (BNPL) and lithium stocks tumbling on Monday. Zip was one of the hardest hit, with share price closing 10% down.

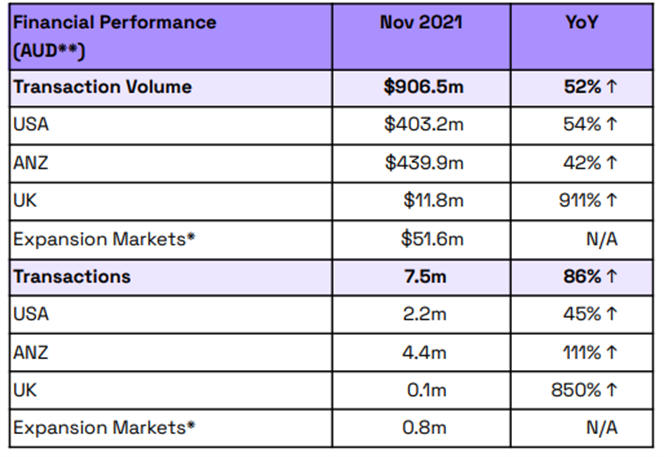

But the market was more upbeat today, especially after Zip reported a record monthly total transaction volume (TTV) of $906.5 million, pushing the share price up 8% in afternoon trade.

Zip’s November transaction volume nearly tops $1 billion

Zip found a good time to assuage some of the market’s concerns over the long-term outlook for the BNPL sector.

Today, the second-largest ASX-listed BNPL stock reported a record monthly transaction volume of $906.5 million.

That’s up $310.5 million or 52% year-on-year.

Based on November’s volume, Zip’s TTV is now annualising at just over $10 billion.

For comparison, in FY21, Afterpay processed $21.1 billion worth of sales.

US BNPL stock Affirm Holdings Inc [NASDAQ:AFRM] processed US$8.3 billion in gross merchandise volume in FY21.

By segment, the US market is edging closer to surpassing Australia and New Zealand as Zip’s largest TTV contributor.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The ANZ segment registered $439.9 million in TTV, while the US segment registered $403.2 million.

There was something else I noticed in Zip’s results today…

Consider the following segment breakdown:

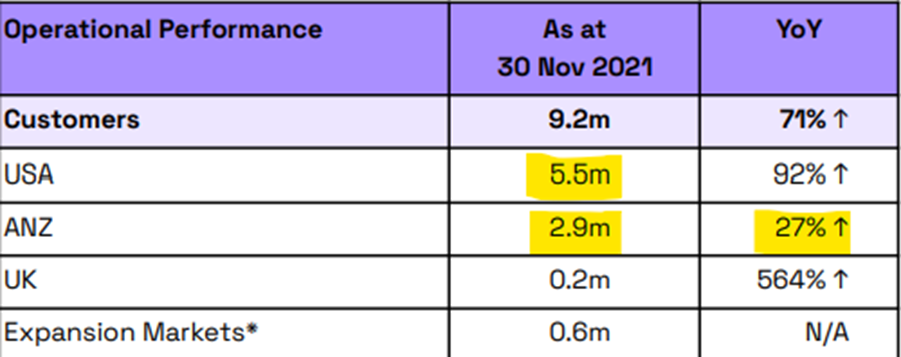

While the US segment is catching up in total transaction volume, it is doing so on much higher customer numbers.

Zip’s American users nearly double that of Zip’s ANZ users, but the Australian and New Zealand segment still delivered more transaction volume.

That’s not surprising as ANZ is a mature BNPL market. We’ve been exposed to BNPL for longer than the US, and we are using BNPL more.

Zip’s ANZ segment made 4.4 million transactions in November, while the US segment made only 2.2 million.

That also means the US users spent about $183 per transaction, while ANZ users spent about $100.

That may suggest American users are still using Zip for one-off, high-value purchases, while ANZ users are using it more regularly for all sorts of purchases.

Are Zip shares undervalued compared to APT shares?

A week after Affirm listed on the Nasdaq this year, Zip co-founder Peter Gray broke with managerial tradition and publicly bemoaned what he believed was Zip’s grossly undervalued share price relative to its higher-flying peers.

In an interview with the Australian Financial Review, Gray said:

‘Our view would be that on the revenue multiples we are significantly undervalued when directly compared to Afterpay and obviously Affirm.’

Is Zip still undervalued to its peers today?

Since neither Afterpay nor Zip are profitable, a good metric to use in comparing the pair is the price-to-sales (P/S) ratio.

APT has a P/S of 28.

Z1P has a P/S of 5.6.

Afterpay and Zip are also gearing heavily to the US market, where most of their growth resides.

So we can also compare Zip to the US’ homegrown BNPL fintech, Affirm.

Affirm has a P/S of 30.

Today’s spike in Zip’s share price may indicate the entry of bargain hunters who think Zip presents an undervalued play on the BNPL theme.

Now, if you are interested in fintechs and want to read more, I suggest reading through our latest fintech report for 2022.

It profiles three promising fintechs. Coincidentally, one of them is the only profitable BNPL stock in Australia.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here