In today’s Money Morning…it’s no secret that Thomas Edison was a big fan of electric cars…the future of lithium is now…the race for 2022 and beyond…and more…

‘I believe that ultimately the electric motor will be universally used for trucking in all large cities, and that the electric automobile will be the family carriage of the future. All trucking must come to electricity. I am convinced that it will not be long before all the trucking in New York City will be electric.’

Thomas Edison, 1914

It’s no secret that Thomas Edison was a big fan of electric cars. He thought their technology was superior to petrol cars.

In fact, in 1914, he started working with Henry Ford to develop a low-priced electric car.

Ford had been an employee at Edison’s Illuminating Company. The pair had met at a company conference and had become fast friends.

Truth is, electric cars were pretty popular during their time. In the early 1900s, 38% of cars in the US ran on electric energy while only 22% ran on petrol.

People liked electric cars back then. They didn’t make noise and were cheaper to drive since they ran on cheap electricity. Gasoline cars polluted the air, required gas, and needed a crank to start up.

But the electric car failed to take off.

Nobody really knows exactly what happened.

It could have been because the technology wasn’t ready.

The Edison-Ford car, for example, never made it to market, even though the pair built at least one experimental car together.

In his book Friends, Families & Forays: Scenes from the Life and Times of Henry Ford, Ford R Bryan says Ford refused to use any other battery than Edison’s nickel-iron battery. Yet Edison’s battery couldn’t power electric cars consistently.

A recent study by Lund University published by Nature gives another explanation: lack of infrastructure.

As Review Geek wrote:

‘According to Hana Neilsen [from Lund University] “the electricity market for households was not profitable for private electricity producers,” so electric infrastructure wasn’t widespread in the early 20th century. By the time that the U.S. government made a strong commitment to electric infrastructure as part of the New Deal, “the industry had already become locked into a technology choice that was difficult to change.” It chose gas cars.’

But whatever the reason, electric cars failed, and petrol-powered cars took off instead.

The future of lithium is now

In the 1970s, interest for electric cars sparked again because of high oil prices.

But while there had been some technological advancements, electric cars still had trouble performing as well as petrol.

In the last few years, interest in electric cars has been rising. In particular, since the pandemic, EV sales have been growing quick.

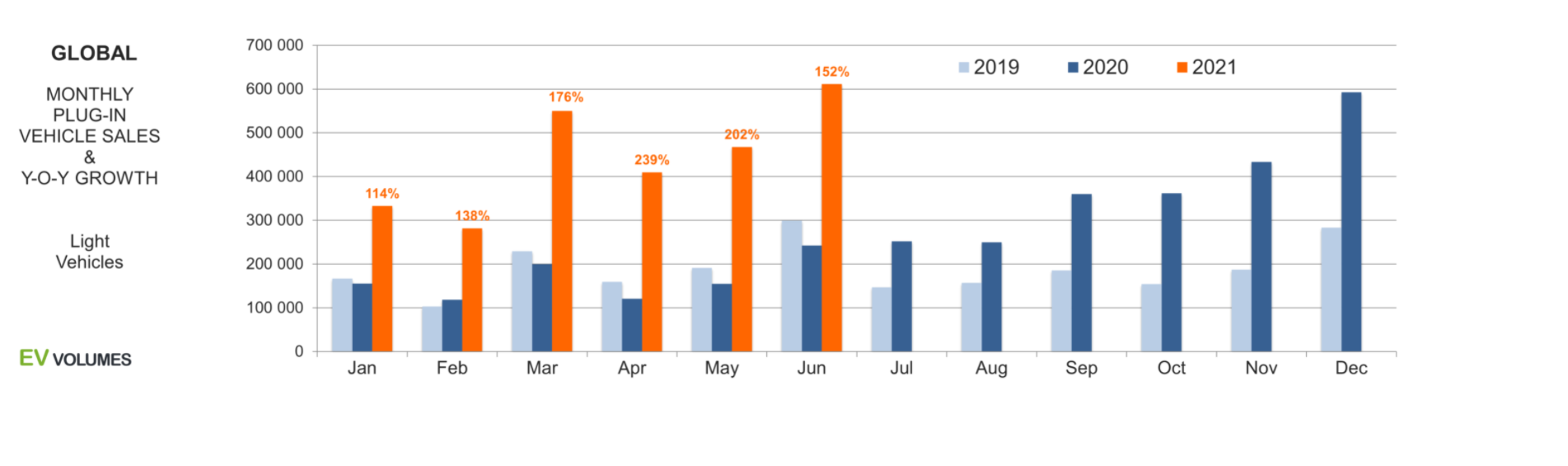

Take a look at the chart below. It compares monthly electric vehicle sales between 2019 and 2021. Things have really taken off this year.

|

|

|

Source: Ev-volumes.com |

The technology is getting cheaper. The cost of lithium-ion batteries has dropped by 97% since 1991, according to a study by MIT.

Governments are pushing for banning petrol vehicles in the next decades and we are seeing investment in EV infrastructure.

In fact, the US recently passed a US$7.5 billion bill to build half a million new EV chargers across the country.

The rebirth of the electric car is turning lithium into one of the most strategic commodities.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The race for 2022 and beyond

Lithium, the lightest solid element on Earth, is emerging as the key material in electric car batteries. It offers a lightweight storage solution, and it is becoming integral to the electric car future.

Until 2015, four major producers dominated lithium supply, holding 90% of the market. These were Tianqi Lithium, Albemarle, SQM in Chile, and FMC Lithium in the US.

In recent times, though, with a lithium supply crunch on the horizon and higher lithium prices, more players have entered the sector.

And it’s not just mining companies that are pouring in.

Big automakers like Mitsubishi, Toyota, and Volkswagen are also joining the lithium race to secure supply.

And it’s not just EVs that will need lithium, we will also need lithium for stationary batteries.

The International Energy Agency sees lithium demand growing by over 40 times to 2040.

So make sure you have some exposure to lithium in 2022.

That’s it from me until January. Wishing you and your family happy holidays and the best for the new year.

Until next week,

|

Selva Freigedo,

For Money Morning

PS: Selva is also the Editor of New Energy Investor, a newsletter that looks for opportunities in the energy transition. For information on how to subscribe, click here.