|

In today’s Money Morning…a big risk…tech + resources = BOOM…what do you do now, though?…and more…

Dear Reader,

I’m certainly no panic merchant, but whenever I look at this table, I get slightly worried for our country’s future.

Check it out:

|

|

|

Source: World Stop Exports |

This table lists Australia’s top 10 exports by value.

I’m sure you can see the big problem here…

A big risk

It’s no secret that almost 70% of our total exports are from the mining sector.

Throw in a bit of agriculture and that’s three-quarters of our total exports by value.

But I suppose it’s always been like this.

From the gold rushes of the 1800s through to the great agriculture and wool industry booms of the 1900s; we’ve always been a commodity country.

So what’s the problem now?

The issue today is who is buying from us.

As you well know, China is our number one customer by far.

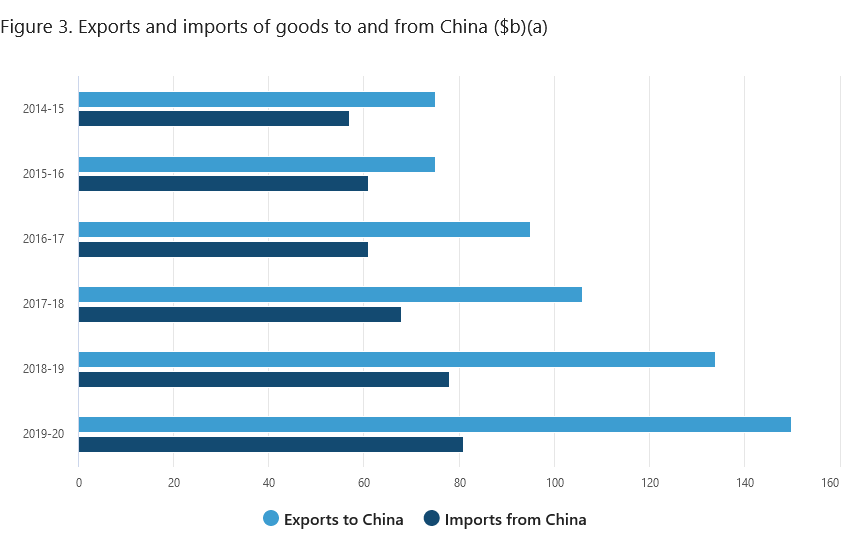

They buy close to 40% of our total exports and this has been growing every year, as you can see here (light blue line):

|

|

|

Source: ABS |

You mightn’t know, but in 2021 this actually kicked up a gear.

Despite the sabre rattling of late, China has ramped up the value of its purchases from us in 2021.

As reported in the AFR last week:

‘The value of Australia’s exports to China jumped almost 50 per cent in US dollar terms in the first nine months of this year, despite Beijing’s campaign to inflict economic pain on the Morrison government.

‘China’s latest trade data, released on Wednesday, showed exports hitting a record high in September despite power shortages. But they also showed that iron ore imports by volume fell 3 per cent in the first nine months of 2021 compared with the same period a year ago.’

It seems that China is just as bound to us providing these raw resources as we are in selling to them.

We’re stuck in an economic marriage of convenience.

But is this about to change?

Bitcoin vs Gold — Which Should You Buy in 2021? Download your free report now

Tech + resources = BOOM

It’s clear to see that the diplomatic relationship has shifted over the past year.

From our side and from theirs.

This is of course linked to the worsening of US-China ties, and it’s clear to see whose wagon we’ve hitched our future to.

While I don’t expect the doomsday scenarios to play out, the time is ripe to start thinking strategically about how Australia’s economy will look not just next year, but 10 years from now.

‘Dig it and ship it’ won’t cut it in a future Australia.

It’s time to plan our China exit or at least plan for the possibility.

In my opinion, we need to move our industries up the value chain.

The fact is, we’re seeing some tremendous new technologies emerging right now.

From battery technology, to quantum computing, to communications networks, to new use cases for nano materials.

The wonderful thing from an Australian point of view is that these new technologies need a secure, reliable supply of certain raw materials.

Take the battery tech trend, for example…

It’s been a boon for resources companies in areas like lithium, cobalt, graphite, vanadium, copper, nickel, and more.

And no doubt we can make money digging it up and shipping it off.

But if that’s all we do, we won’t reap the benefits we should.

As reported in Innovation Australia:

‘In Australia, it is estimated an additional 7.4 billion and 34,000 jobs could be added to the economy by 2030 with a more diversified approach to battery value chains. Some experts have also warned being too reliant on China for critical mineral refinement and production creates geopolitical risks.’

By adding value, not only do we add jobs, but we help grow out industries to compete in a high-tech world.

The strategy should be clear…

We take our natural advantage in resources and turbocharge it with tech know-how.

Do that and we’ll prepare our economy for the future, broaden our customer base, and reduce the single biggest risk factor — overreliance on China.

What do you do now, though?

Will we go down this route?

I’m not so sure…

I’ve been around the traps long enough to know you can’t rely on governments to be proactive about this.

If it happens, it’ll be due to brave Aussie entrepreneurs and forward-thinking private businesses.

But what happens if the China relationship goes south a lot faster than we can prepare for?

It’s clear that this risk is only growing.

And while so far things are holding up OK, the recent rapid fall in iron ore prices hint at some tougher conditions ahead.

Should you head for the metaphorical hills then?

Put everything in cash and see it out?

Or is there a better way to play this fast-evolving situation?

Well, my mate and our Editorial Director, Greg Canavan, has been thinking long and hard about this for a long time.

And he’s just put together a special report on how to play what he calls the ‘China divorce’.

The good news is, it’s not all bad.

It’s actually a much more nuanced situation than many realise, throwing up both immediate investment opportunities and looming risks in equal measure.

You really should give it a read ASAP.

Because it’s probably the single biggest story for all Australian investors with a super balance over the next 12 months.

You definitely don’t want to get this wrong!

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here