Crown Resorts Ltd [ASX:CWN] shares spiked in morning trade by over 8% after the casino group received an improved takeover offer from persistent US investment titan Blackstone.

In an ASX announcement today, Crown revealed the American asset manager had proposed an $8.87 billion bid at a price of $13.10 cash per Crown share.

At time of writing, Crown shares are up 8.6%.

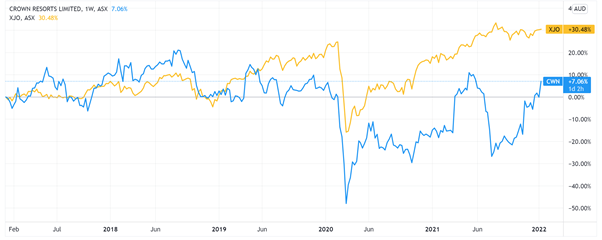

Crown has had a turbulent year.

CWN dealt with prolonged lockdowns, misconduct enquiries in every state, and bad press all the while batting away offers from Blackstone it considered too low.

But today’s upped bid from Blackstone has swayed Crown’s board.

Crown intends to recommend that the takeover go ahead should Blackstone make a binding offer at a price no less than $13.10 cash per share.

All this raises a question — how much is Crown worth — regulatory warts and all?

Let’s look at Crown’s release in more detail.

Crown board intends to enter binding agreement after Blackstone’s revised bid

As it now stands, Blackstone is offering Crown shareholders $13.10 per share — an amount 60 cents per share higher than their previous bid of $12.50 per share.

Crown says the revised offer came after Blackstone considered ‘non-public information provided by Crown during initial due diligence.’

The upped offer is still subject to conditions standard for these matters: the completion of an Independent Export’s report, confirmation that no superior proposal lands on the company’s desk in the coming weeks, and unanimous support and recommendation by the Crown board.

Regarding the latter, the Crown board noted it considers it’s ‘in the interests of Crown shareholders to engage further with Blackstone on a non-exclusive basis in relation to the revised proposal.’

The conciliatory stance was corroborated further by Crown’s board permitting Blackstone to finalise its due diligence inquiries so that Blackstone can lodge a binding offer.

Crucially, Crown noted that should Blackstone make a binding offer at a price of no less than $13.10 per share, then it is the Crown board’s ‘current unanimous intention to recommend that shareholders vote in favour of the proposal’ in the absence of a superior one.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

What’s next for Crown shares?

Blackstone first approached Crown in April 2020, with an offer worth $11.85 per share.

But Crown kept lobbing Blackstone’s offers back — until today, in a sign CWN’s board is nearly ready to sign off on the acquisition.

James Packer — who owns 37% of Crown — today commented he’s ‘encouraged’ by the proposal.

As the Sydney Morning Herald reported, Blackstone’s offer of $13.10 a share is higher than the $13 a share price at which Packer agreed to sell a 19.9% stake in Crown to Hong Kong’s Melco Resorts in 2019.

While Crown’s board strongly indicated it is ready to approve Blackstone’s latest offer, the dotted line has not been signed yet.

In the meantime, there’s a free workshop I highly urge you to attend today.

It’s designed to help you make clearer decisions about which stocks to target in a world where the markets are moving faster than ever.

The workshop will discuss how to build a portfolio of high-potential shares while also explaining why investing in ASX stocks is a golden opportunity right now.

You can also get your hands on our simple blueprint on how to get started — even if you’re new to this.

Click here to attend the free workshop now.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here