In today’s Money Morning…there is a bit of panic in the room…the level to watch…valuations will fall…and more…

Well, it was a wild night in the US stock market. A big move that ended late in the session with a big reversal.

It’s a deleveraging.

Interest rates are going up, and there is a bit of panic in the room.

The S&P 500 — which is an index of the top 500 companies in the US — is, as always, the most important market to pay attention to. It sets the broad theme for equities globally.

We’ve seen the recent break of a short-term low at 4,492. This brings the S&P 500 just through the lower end of its price channel that started forming in April last year.

The level to watch

The level to watch now is 4,260. The low that gives us this support was a bigger pullback from the prior high than the recent level that just broke at 4,492. This gives it a bit more significance.

The level had a false break last night, but it was a trap for the bears. In the end, the market closed higher on the session. 4,260 is still the level to watch.

|

|

|

Source: TradingView.com |

Just a word on these channels, support lines, and other technical drawings like this: They’re completely subjective.

You can easily draw this channel in a way that recent prices are resting on the lower bound. The question to always ask yourself is: ‘How is the market looking at it?’

So we’ve got a pretty picture, but what does it mean?

Well, coming out of the channel really just tells us that momentum is slowing. We’re no longer climbing at the same steady pace.

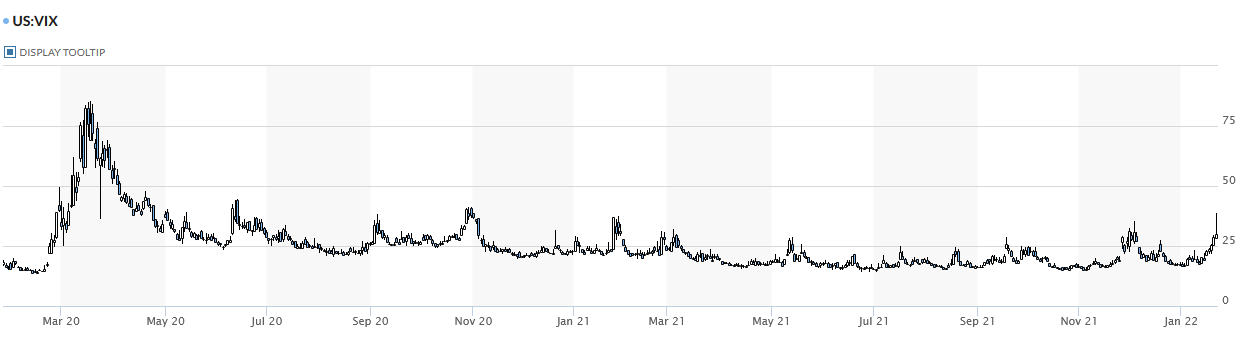

The first thing I would expect with technical levels and channels breaking is increased volatility. Interestingly, the VIX — which is commonly used as an indicator of stock market volatility — is only slightly elevated. See the following chart:

|

|

|

Source: Marketwatch.com |

This suggests that the market is currently not expecting a major crash, just some choppiness.

If we take a wider view of the S&P 500, we can see that this recent upwards channel has been extreme. It’s been a cheap-money-fuelled buying frenzy.

A bit of a pullback, and some sideways action would be reasonable, especially in the context of rising interest rates.As I wrote about yesterday, however, Biden has a big spending agenda.

He’s been handing out COVID cash as the first phase of his ‘Build Back Better Plan’.He calls this first phase the ‘The American Rescue Plan’, but I prefer COVID cash.

There’s more to come in this massive wealth redistribution scheme.Now, I wouldn’t expect too much of that money to go into buying shares. Of course, some of it will.

I expect it to go mostly into consumer purchases. Groceries, TVs, cars, etc.While this won’t pump up share prices in the short term, it will be good for company earnings.

This brings us to every share market doomsayer’s favourite topic.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Valuations will fall

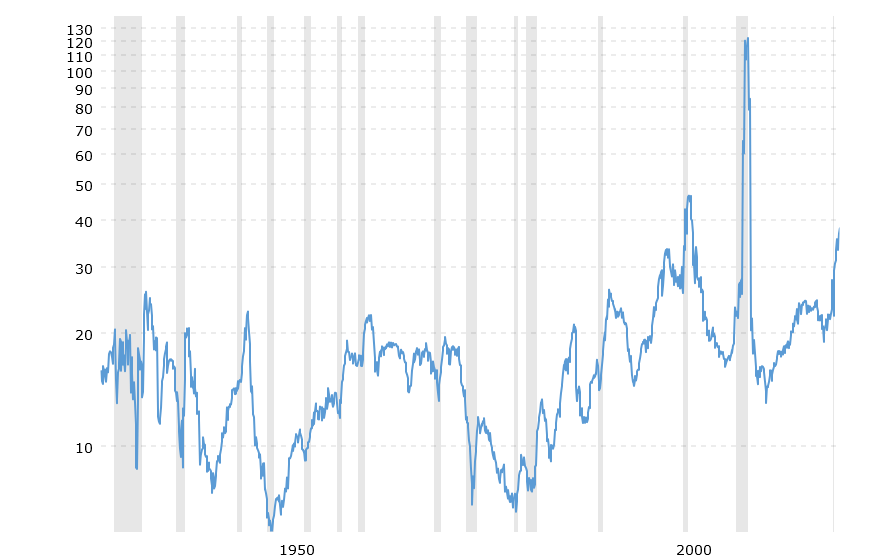

Last year, there was lots of talk of how crazy market valuations had gotten. The free money parade from central banks had propped up speculative markets to dizzying heights. The following chart shows the price-to-earnings ratio of the S&P 500:

Source: Macrotrends.net

[Click to open in a new window]

While it’s been quite high recently, that is in the context of extremely low interest rates and central banks’ asset purchases.

Now, interest rates are going up, and central bank support for the markets is being removed.

So a pullback right now shouldn’t really surprise anyone — especially in the more hyped-up markets such as tech and crypto.

In terms of tech stocks, the Nasdaq 100 is sitting right on the low from 4 October of 14,367. That’s the equivalent of the 4,260 level I’m watching in the S&P 500.

Source: TradingView.com

[Click to open in a new window]

The thing is, though, it’s important to remember that interest rates were low because we were going through a tough time.

Interest rates are going to increase this year because the economy is looking much stronger, and things are starting to heat up fast.So while some leverage needs to come out of the market, we can expect the economy to be quite strong.

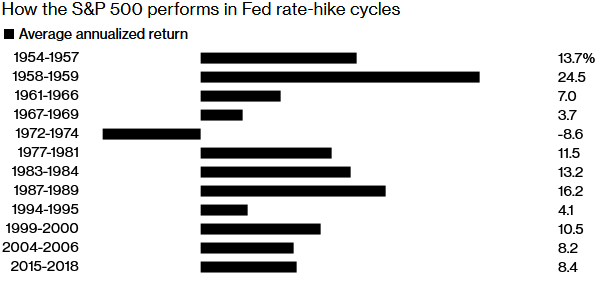

In fact, as interest rates go up, the share market usually goes up as well — by 9% per year during rate hikes on average since the 1950s. The following chart shows how the S&P 500 has performed in the last 12 interest rate hiking cycles:

Source: Bloomberg.com

[Click to open in a new window]

The central banks are (for now) exiting their asset purchasing programs. This will allow more speculation to come into the markets. The one thing I’m expecting this year is increased volatility.

That means more opportunity. I also expect those crazy-high market valuations to be lower at the end of this year compared to 2021. That will happen largely through rising company profits. All those TVs and hamburgers that Biden is paying for!

It’s easy to focus too much on the short-term market moves, like this recent dip we’re seeing. This kind of volatility creates great opportunity, and there could be a lot more of that volatility to come this year. But if we look forward to the end of the year, strong economic growth and a Biden spending spree bode well for a strong share market.

Until next week,

Izaac Ronay,

Editor, Money Morning

PS: Izaac is also the editor at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Izaac’s telling subscribers right now, please click here.