Mobile marketplace provider Airtasker Ltd [ASX:ART] is soaring today.

The small-cap stock is up 15.62% at time of writing. A move that looks as though it may finally snap their downward momentum since late October.

As for whether the stock can hold onto this positive trend, only time will tell. But for now, let’s take a look at what’s driving the share price higher today…

Breakout growth

The catalyst for Airtasker’s decent move today is thanks to some great growth. Almost all of the company’s key metrics were up in their most recent quarter (December).

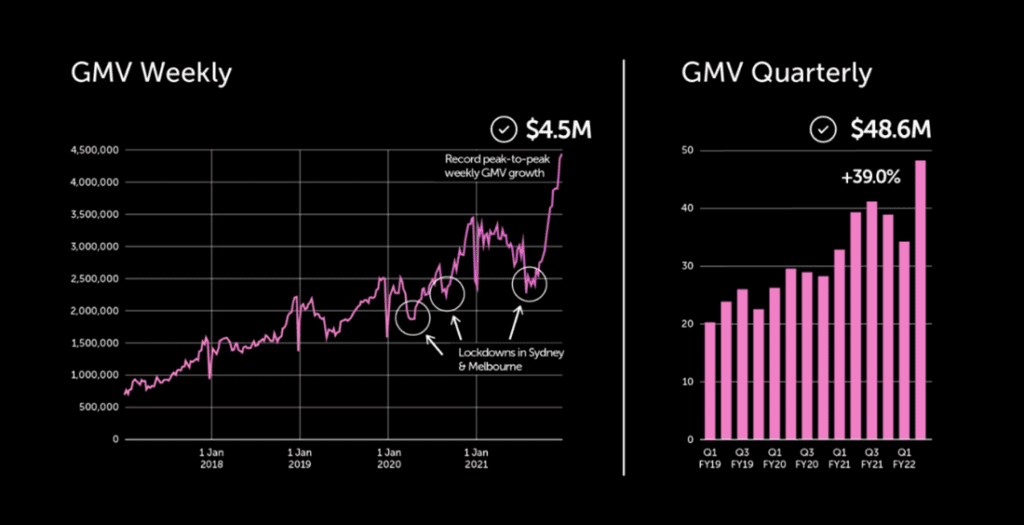

Gross Marketplace Volume (GMV), for instance, was up 39% quarter-on-quarter. Resulting in $48.6 million worth of transactions across the platform.

You can see just how big a breakout this was in the following graphs:

It has clearly been a bumper period for the business. A result that may be somewhat expected given it was in the lead up to the holiday season.

Nevertheless, it has helped lift revenues to $8.1 million, improving by 37.5% quarter-on-quarter. Including some great early traction from the UK and US — two markets that Airtasker is relatively new to.

Co-founder and CEO, Tim Fung, was rightfully pleased with the developments:

‘The strong performance this quarter demonstrates the robust and resilient underlying growth of the Airtasker marketplace. Based on our current growth trajectory, a clear outlook on no further lockdowns and an exciting product and marketing roadmap – we’re super pleased to be upgrading our H2 guidance for FY22.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

What’s next for Airtasker?

With today’s result proving a winner with investors, attention will now turn to the next half of FY22. After all, management will be looking to deliver an even better performance with the hopes of no further lockdowns.

It is for that reason that the company has elected to lift its guidance for the remainder of the financial year.

But this stock certainly still has a lot to prove. One good result isn’t enough to reverse what was a fairly unimpressive year for 2021.

Under the right circumstance, and with the right investment, Airtasker should thrive. They simply need to ensure that the growth will continue.

In the meantime, if you’re looking for other small-cap stocks building innovative digital platforms, then you should check out our fintech report. A comprehensive look at what the sector has to offer, and three of our top picks from this blossoming industry.

To get your free copy, simply click here.

Regards,

Ryan Clarkson-Ledward,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here