Today, we continue with our top trends for 2022 as part of our ongoing series, “Our Top Nine Investment Trends to Watch in 2022”

In this series we are going to cover our top 9 investment ideas:

1. The great lithium disconnect

2. Decarbonisation — green switch activated

3. The future of payments

4. Quantum computing and Moore’s Law on steroids

5. Connected devices and memory

6. Decentralised finance — an ‘Amazon-in-1994’ moment

7. The influential ‘I’s

8. Watch out for gold

9. Stocks – Mind the lofty valuations

And this time, we’re talking about…

Trend #3 Future of payments

Tokens, digital wallets, and central bank digital currencies

On 10 December 2021, Reserve Bank Governor Philip Lowe addressed the Australian Payments Network Summit with the aptly titled speech, ‘Payments: the future?’.

Lowe identified five trends emerging in the payments system he expects to endure.

- Declining use of banknotes.

- Greater use of digital wallets.

- Growing involvement of ‘big tech’ in payments.

- Rising specialisation within the payments value chain and the emergence of new business models.

- Growing community and political interest in the security, reliability, and cost of payments.

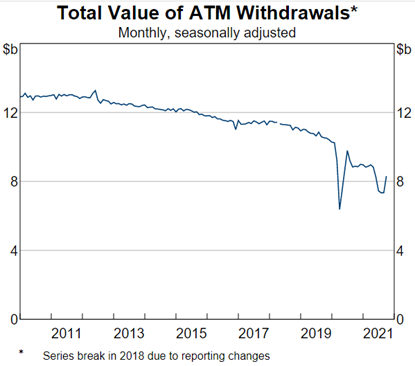

While the use of cash was declining even before the pandemic, the cashless transition has accelerated in the past two years.

The value of ATM withdrawals over the six months to December 2021 was around 30% lower than the comparable period three years ago.

Source: Reserve Bank of Australia

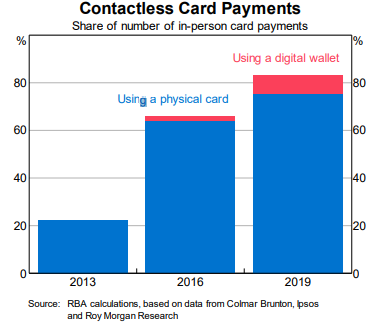

While cash is trending down, electronic payments are trending up. Debit payments, especially, are the preferred option to credit.

The increasing sophistication of mobile technology and the shift to electronic payments is also leading to a rise in digital wallets.

Source: RBA

Use of digital wallets is only set to rise in 2022 and beyond.

Just consider research from Deloitte:

‘In 2021, the use of mobile digital wallets that allow users to store their debit or credit cards digitally on their phone has increased substantially in Australia. In 2019, 42% of respondents indicated they had not used a smartphone to make an in-store payment, in 2021 this number has reduced to only 15%.’

As Lowe said in his speech, it’s

highly likely that digital wallets will become more important’.

Central bank digital currencies and an eAUD

But the accelerated adoption of electronic payments and the abandonment of cash has implications beyond how we pay for our coffee.

As Lowe noted in his speech:

‘Many people are now choosing to make payments through their digital wallet rather than through their bank card.

‘They could contain tokens that could be used to make payments and these tokens could be issued by the central bank, a private bank or another entity.

‘One possibility is that tokens are issued by and backed by the Reserve Bank just as we issue and back Australian dollar banknotes.

‘This would be a form of retail central bank digital currency (CBDC) — or an eAUD.

‘How far we go in this direction and what form these take are yet to be determined.’

Lowe is reserved and cautious. He would not bring up the potential of an RBA-backed digital currency lightly.

But atop his Martin Place office in Sydney, Lowe is seeing change on the horizon.

Lowe said the RBA is

‘open to the possibility’ of an eAUD but is yet to see a ‘strong public policy case to move in this direction’.

But Lowe may have to move faster than he’d like.

In a December 2021 governmental dispatch, Federal Treasurer Josh Frydenberg had this to say:

‘The Government will commence consultation on the feasibility of a retail Central Bank Digital Currency in Australia, with advice to be provided by the end of 2022.’

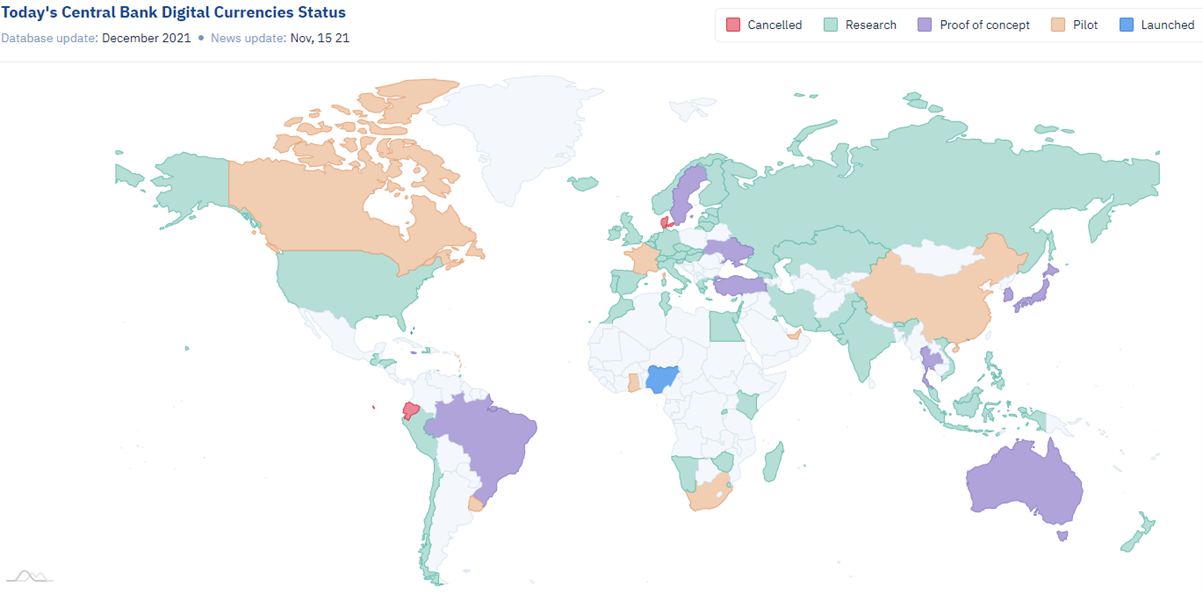

But other countries are already starting to move in the direction of central bank digital currencies.

As you can see below, plenty of countries worldwide are researching and piloting central bank digital currencies:

Source: CBDC Tracker

Two countries have already gone a step further.

On 25 October 2021, the Central Bank of Nigeria launched the eNaira. The eNaira is the world’s second CBDC fully open to the public after the Bahamas.

Nigeria is Africa’s largest economy but has suffered from fuel and consumer goods shortages and frequent double-digit inflation levels.

So economists — and investors tracking developments in CBDCs — will monitor how the eNaira will fare in tackling Nigeria’s economic woes.

A country inching closer to joining Nigeria and the Bahamas is China, who is patiently testing and piloting the rollout of its digital yuan, or eCNY.

China’s digital yuan is already being piloted in big cities like Shenzhen, Shanghai, and Beijing.

As The New York Times reported, no other major power is ‘as far along with a homegrown digital currency’.

While our own reserve bank hasn’t seen a pressing case for a CBDC just yet, RBA Governor Lowe flagged that the rapidly changing nature of payments may sway the bank to act.

‘It is possible, however, that the public policy case could emerge quite quickly as technology evolves and consumer preferences change. It is also possible that these tokens could offer a lower-cost solution for some types of payments than provided by the existing technologies.

‘All this means we have been continuing to examine closely the case for a retail CBDC and working with other central banks on this issue.’

With the world’s central banks watching the CBDC space, it pays for us to monitor it too.

A bit about us — Fat Tail Investment Research

While themes and trends can come and go, one thing that doesn’t go out of fashion in the investing world is insightful analysis.

Information is the crucial ingredient in markets.

But information alone isn’t enough.

It’s the rational analysis of the information that separates a sound idea from a weak one.

Here at Fat Tail, our editors pride themselves on providing valuable insight by applying their industry experience and knowledge.

At Fat Tail, we value differences.

Disagreement isn’t censured but encouraged.

And we find our readers appreciate the range of thought and ideas of our editors.

At Fat Tail, we have bulls, we have bears, we have crypto advocates, and gold bugs.

At the heart of it, though, we have a team dedicated to the free exchange of ideas. Reason trumps agenda here.