US lithium miner/producer Piedmont Lithium [ASX:PLL] is staging a rebound today. The share price is up 2.92% at time of writing, making up some of the losses from yesterday’s trading session.

As for what’s driving the move, well, a lot of it has to do with the overall market.

Oil prices, for example, are coming back down to reality. It’s a sign that last week’s frenzy was an outlier rather than a trend. For a business that is directly linked to the adoption of EVs, that is a good sign. One that may suggest that while the world’s reliance on oil is still vital, it may be waning.

Let’s take a closer look at what Piedmont’s management team had to share…

Costs down, demand up

Whether by design or a stroke of luck, Piedmont has put out a fresh corporate presentation. In it, investors can find a concise overview of the company’s recent endeavours as well as a market snapshot.

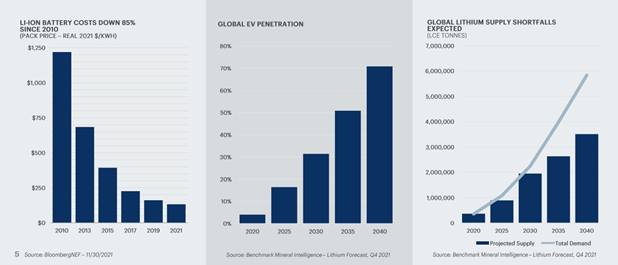

Effectively, it underscores what many are already seeing: costs are coming down, and demand is going up. You can see this for yourself in the following infographics:

For an established producer like Piedmont, this set up is obviously enviable. They’re looking poised to be able to profit nicely from the boom in the coming years.

Especially as they’re a US-based operation that has plenty of political appeal. Because while most people have already dismissed the US’s trade war with China, its lasting effects are still being felt, and critical minerals — like lithium — will need to retain suppliers and supply chains outside this influence.

And that’s exactly what Piedmont is doing, as their CEO, Keith Phillips made clear:

‘The planned 2023 restart of North American Lithium in conjunction with our partner, Sayona Mining, and the potential for spodumene production at Ewoyaa in partnership with Atlantic Lithium as early as 2024, creates an attractive timeline for potential revenue generation that could precede output at our proposed Carolina Lithium project.

‘The steady drumbeat of expansion announcements from OEM’s and battery makers alike, continues to drive the need for additional lithium hydroxide supply to support the U.S. market.’

What’s next for Piedmont?

Looking ahead, it’s clear that Piedmont has laid out a detailed roadmap for its future.

These plans should provide comfort for investors. It seems like the management team is determined in what their goals and objectives need to be.

All we need to see now is Piedmont achieve them!

That will be revealed in due course, though.

Because like any commodity market, no matter how much you plan, unexpected outcomes are always possible. Sometimes, like Piedmont is seeing at the moment, they can be favourable. And other times, not so much.

Either way, though, investors are clearly anticipating this business to make the most of their opportunity.

But Piedmont certainly isn’t the only promising lithium play on the ASX. There’s a whole host of exciting and speculative stocks to choose from. In our view, though, there are three in particular that you need to know about right now!

To find out more and get the name of these three stocks for free, click here.

Regards,

Ryan Clarkson-Ledward,

For Money Morning